UK Labor Market: Further Signs of Resilient Wage Pressure But Soggier Activity More Notable

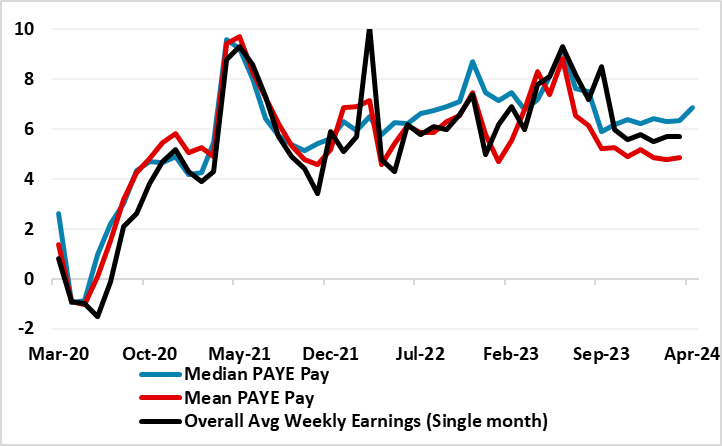

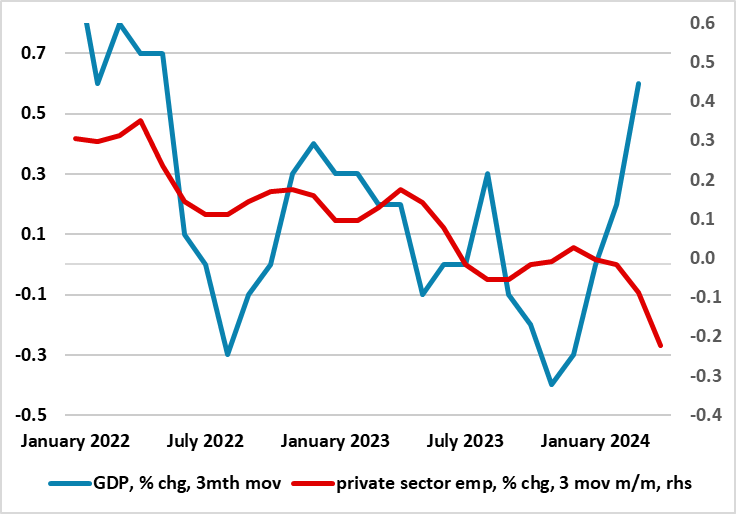

As we have underscored repeatedly, the BoE has come to regard the official ONS average earnings data with some suspicion given response rates to the surveys that have fallen towards just 10%. But the BoE will not be able to dismiss the latest earnings data given that alternative (and more authoritative) wage data from the HMRC (the UK tax authority) are also showing similarly resilient growth in mean and median pay as you earn (PAYE) growth (Figure 1). But this PAYE data also chimes with weaker activity backdrop highlighted by the ONS which showed a marked fall in vacancies alongside increased signs of employment contracting and not just in terms of self-employment. Notably, the jobs data conflict with the headline pick-up in Q1 GDP growth (Figure 2), albeit more in line with the soggy domestic demand picture those national account data nevertheless highlighted. As a result, it can be argued that weaker jobs may take a toll on wage growth in due course, this coming alongside the marked base effects that would curb such growth in coming months including the next set of labor market numbers that arrive a full week ahead of the June 20 MPC decision.

Figure 1: Wage Resilience Evident Across Range of Measures

Source: ONS, HMRC, % chg y/y

Wage Resilience – For Now?

Resilient wage data may take center stage in any assessment of the latest UK labor market report. Headline earnings stayed at a higher-than expected 5.7% y/y in March with regular earnings ticking higher to 6.2%, albeit with the Q1 reading largely in line with the 6% BoE projection. More recently, the ONS data, (handicapped by severe reservations about their authenticity due to poor survey take-up) have contrasted with PAYE data which have shown softer and slower growth in wages. This no longer seems to be the case (Figure 1) where median pay data actually hinting at some pick-up. The question is whether this is a fresh trend or more noise, possibly accentuated by the looming rise in the minimum wage.

Labor Market Loosening Clearly

Admittedly, rising in activity may hint at still tight labor market conditions, although this is being offset by still rising average working hours, thereby stabilizing effective labor supply. Probably more notable is whether wage pressures will succumb to what seems to be weaker labor market overall given the further drop in vacancies (down a third in the last two years) now being accompanied by weaker recorded employment and rise in the jobless rate. Admittedly, question marks about this data’s authority should also be highlighted as they are subject to similarly low response rates to the ONS earnings data. However, the HMRC number also provide data on employment and on a more topical and broader industry basis. In particular, they have been showing a weaker trend recently in terms of private sector employment, this notable as the public sector has been instrumental in supporting actual employment and GDP growth in recent months. In this regard, it is notable how private sector employment has weakened of late according to the HMRC PAYE numbers. Indeed, they have actually having turned negative on a 3-mth moving average basis, this measure chiming better with quarterly GDP growth data. Notably, the employment data do not chime with the marked and surprise pic-up in GDP growth seen through Q1, the very opposite, more in sympathy to the ex-import national account figures which have been negative of late, where imports weakness has actually boosted recorded GDP growth by some 1.5 ppt in the last three quarters.

Figure 2: Weaker Jobs Picture Conflicts with GDP Surge

Source: ONS, HMRC

As a result, rather than evidence of a clear recovery in activity as framed by GDP data, it seems that the economy continues to move nothing more than sideways and remains fragile, this feeding through ever more clearly into jobs and the labor market generally. Indeed, it could be argued that some of the rise in in activity may also be a rise in discouraged workers. Moreover, it can also be argued that weaker jobs may take a toll on wage growth in due course, this coming alongside the marked base effects that would curb such growth in coming months - NB media PAYE pay rise by a cumulative 3.5% between March and June last year alone. Some of these base effects will appear in the next set of labor market numbers that arrive a full week ahead of the June 20 MPC decision, the question being however, whether the weaker thrust evident in the labor market data as a whole will now start to overtake BoE hawk worries about wage resilience!