USD flows: USD softer after FOMC and BoJ raid

USD falls back with US yields with BoJ amplifying JPY strength

The USD is weaker overnight after US yields dropped following the FOMC meeting. While there was nothing particularly surprising in the statement or Powell’s press conference, it was slightly on the dovish side of expectations after the big hawkish move in the market in the last few months. While noting recent inflation disappointment, neither the statement nor Powell’s press conference delivered a strong pivot in tone. The Fed is still waiting for data to allow easing to take place, but still expects inflation to slow, and looks ready to respond once data allows. We do not expect easing until September, but stick with a view for two more moves in Q4, assuming that by then data has slowed significantly. While 2 year yields did drop and the market priced in a little more easing for this year, the first hike is only priced as around a 65% chance to come by September, and is still marginally short of fully priced at the November meeting. While there are 35bps of easing priced by December, it looks to us like there is still scope for further yield declines.

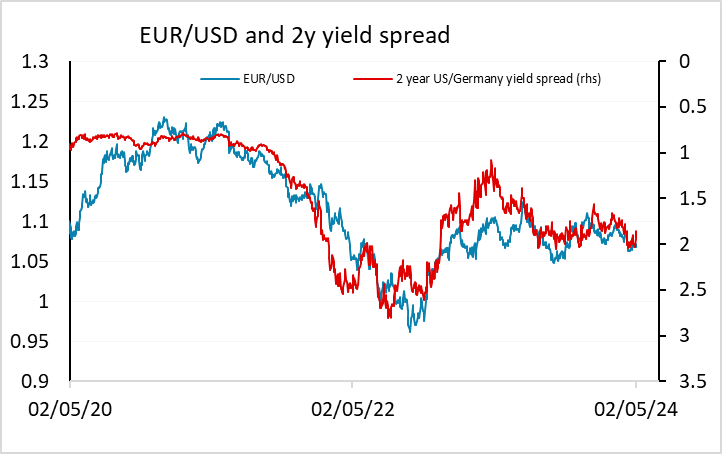

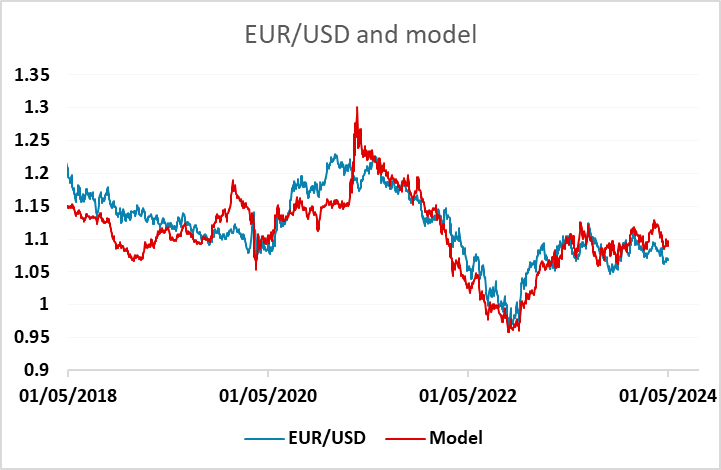

The softer USD therefore looks like it could extend. For EUR/USD, there could also be some support from the better Eurozone data seen in the last couple of releases. While stronger European activity is unlikely to stop the ECB from easing if inflation continues to come in under target, it will be supportive for sentiment and for European equities, and that does tend to underpin the EUR. Our model suggests there is some upside scope even at current yield spreads.

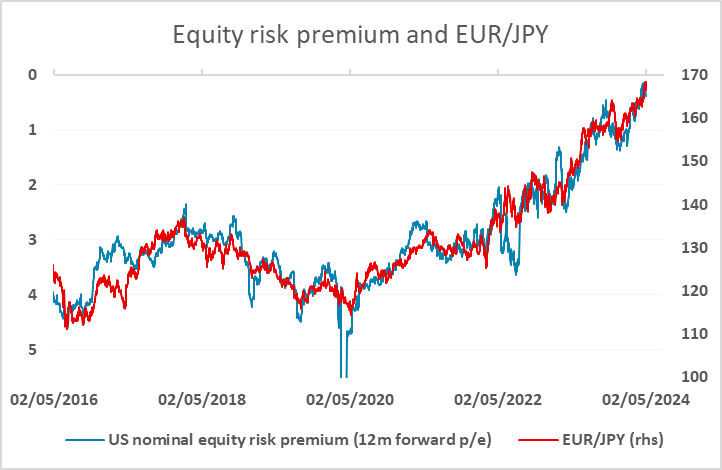

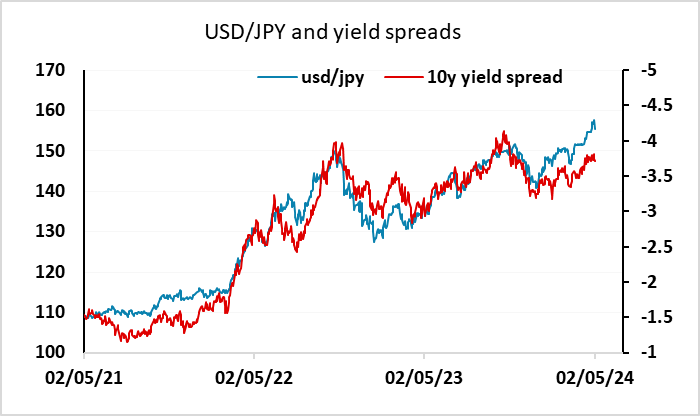

For USD/JPY, the BoJ looks to have taken advantage of the lower US yields after the FIMC and the thin conditions in early trading in Wellington NZ last night to conduct another round of intervention sending USD/JPY to a low of 153. This is intended to get the best bang for their buck and hurt short JPY positions. Those holding such positions will be warier if the BoJ are prepared to attack at any time and look for big moves. To us this confirms that 160 is a likely high in USD/JPY, and we see scope for substantial JPY gains over the year, particularly against the USD. EUR/JPY downside is less clear as low equity risk premia still support, but we would still favour the JPY due to the large real JPY depreciation seen in recent years.