Eurozone GDP Preview (Apr 30): Less Weak?

According to revised official national accounts data, the EZ economy was in recession in H2 last year, albeit modestly so and against a backdrop of marked, if not increasing, national growth divergences. This geographical variation is likely to have continued into Q1 (Figure 1) where we see a flat overall EZ q/q outcome masking moderate growth in Spain but a further slide in Germany. But there are upside risks to this view, albeit hardly a result of improving fundamentals. Indeed, real GDP may be bolstered afresh by weaker imports, a possible surge in the very volatile Irish economy and the impact of unseasonable weather which may account for the solid growth posted in early Q1 figures in services and particularly construction sectors. Thus even the ECB’s 0.1% q/ q Q1 GDP growth projection could be exceeded, this forecast, however, needing full perspective as it has been downgraded by 0.1 ppt in each of the last three central bank updates. As a result, we would not read too much into any apparent strength’ in the Q1 GDP numbers and, if this upside surprise occurs, it is unlikely to sway ECB thinking which is currently more dominated by price developments.

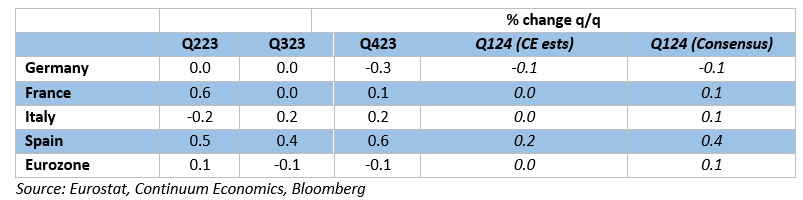

Figure 1: Divergent Q1 EZ GDP Picture

Geographical Disparity?

Overall the now small q/q drop in Q4 EZ GDP reading was below ECB thinking but this reflected marked divergences among the EZ economies, most notably among the ‘Big 4’. Spanish GDP growth picked up to 0.6% q/q continuing a very solid and relatively balanced path seen of late. In contrast, the German economy sank 0.3%. While this apparent non-German resilience may possibly provide the Council with a little less urgency, this activity backdrop (where the Q1 economy may be flat in flat y/y terms) will have little to impact on ECB thinking,. Regardless there are some better (at least less adverse) real economy signs, some implying recovering activity, the question being the extent to which ECB tightening has yet to deliver anything like its full impact on demand and could thus stamp on these alleged green shoots.

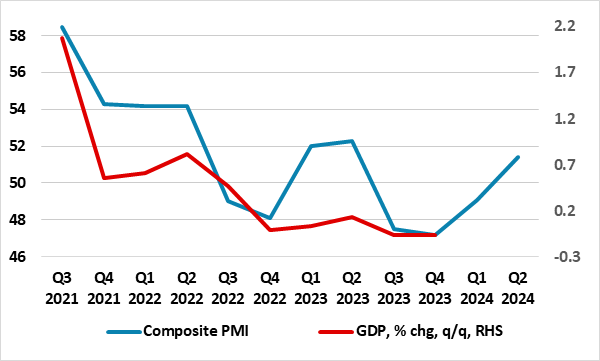

Such a backdrop may reassure some Council members who may still be wary that the ECB’s recently downgraded growth forecasts are still too optimistic, they taking much from the improved PMI readings seen through Q1 and into the early part of this quarter. But we remain wary of the messages from the composite PMI, not least given the misleading picture it has offered in the past regarding actual EZ GDP swings (Figure 2). This may be partly a result of its limited geographical coverage and its lack of account of the construction, retail and government sector readings – all volatile but also very rate sensitive. Moreover, the broader based European Commission business and consumer survey data (to be released the day before Q1 GDP figures) may be telling as it slipped afresh last time around and remains very much in contraction territory.

Policy Tightening Still Filtering Through

Thus we remain of the view that the ECB is still too optimistic, not least as nowhere near the full extent of its policy tightening has filtered through yet, this formal hiking being accentuated both by the ECB balance sheet shrinkage and by credit standards being raised by the banking sector. But the ECB has been very aware of a still very weak credit and bank deposit backdrop. This was accepted at the March Council meeting where the account noted that a reduced supply of liquidity was also contributing to monetary tightening. Notably, this negative impact from its balance sheet reduction on credit dynamics was very much underscored in the just-released bank lending survey (BLS). Indeed, the BLS was explicit in highlighting that the shrinkage in the ECB monetary policy asset portfolio had a further negative impact on banks’ financing conditions and liquidity position, resulting in a moderate tightening of terms and conditions and a negative effect on lending volumes. This is something we have long argued was occurring and is evident in the unprecedented drop in bank deposits stemming from the ECB balance sheet reduction (Figure 2). This is all the more important as the ECB has no plans (yet) to slow, let alone stop, its unconventional tightening regardless of what and when its reduces official rates. It could be argued that if the ECB pursues further balance sheet reduction, then larger/faster conventional easing may be needed!

Figure 2: PMI Surveys Poor Guide to EZ Growth

Source: Markit, Eurostat

Flash GDP in Perspective

Amid a paucity of reliable data, there are some more positive signs for the last quarter. Admittedly, it may be more the impact of unseasonable weather (very cold in north Europe and mild to unusually warm elsewhere) which accounts for the solid growth posted in early Q1 figures in services and particularly construction sectors – NB: services production data is a recent Eurostat innovation. And there are some downside risks too, such as what may be widespread fiscal consolidation, this possibly already evident in what may be contracting Italian consumer spending.

Otherwise, and as we have underlined before, it is important to recognize that there are clear shortcomings to the flash estimate for EZ GDP. No details comes with these flashes and they are prone to clear revisions. Indeed, the original Q3 and Q1 GDP numbers gave a clearly misleading impression, in that they implied initially modest growth in both quarters. Then Q2 GDP was initially recorded at 0.3%, only to be revised back as well, the same fate besetting the Q3 numbers too. Time will tell whether the Q1 flash numbers will tell any more authoritative a story! Regardless, the apparent resilience in overall GDP makes the sharp and broad fall in inflation all the more likely to have been driven more by supply factors than demand. But with demand likely to buckle or at least be constrained by policy tightening the disinflation process may have much further to run.