Brazil: Revision of Targets Shows the Weakness of the New Fiscal Framework

The Brazilian government has revised its budget targets for 2025 and 2026, lowering the deficit to 0% and a 0.25% surplus in 2025 and 2026 respectively, from 0.5% surplus in 2025 and 1% in 2026. However, reliance on revenue increases poses challenges amid resistance from Congress. Despite reduced targets, we find the government overly optimistic, with rigid expenditures hindering adjustments. Market reactions suggest uncertainty, necessitating vigilance over the Central Bank's tightening strategy and its impact on rates.

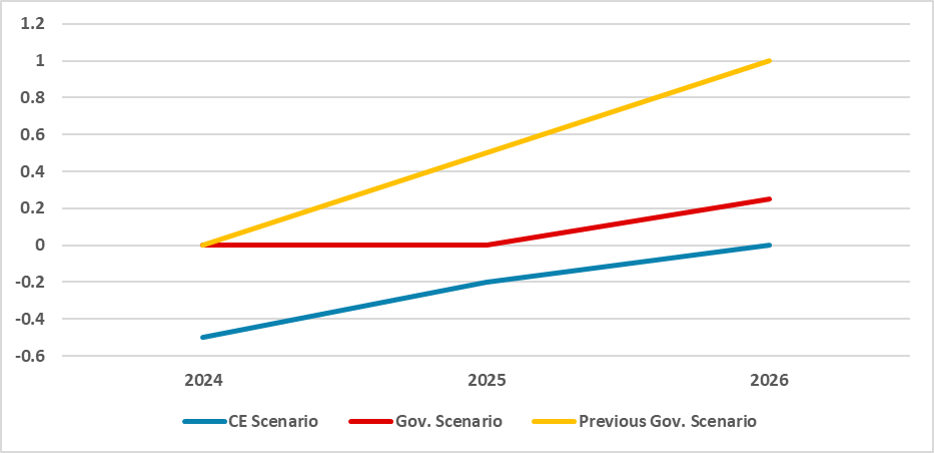

Figure 1: Primary Result (% of GDP)

Source: Continuum Economics and STN

The Brazilian government has sent the Budget Law for 2025 to Congress. The law has revised the primary surplus target. Previously, the target was set at a 0% deficit in 2024, a 0.5% surplus in 2025, and a 1% surplus in 2026. However, the government has abandoned the current target and reduced it to 0% in 2025 and 0.25% in 2026. The entire problem is that the government's strategy relies on increasing revenues, which affects economic activity and faces resistance from Congress. On the other hand, the government is not aiming to reduce expenditures. Finance Minister Fernando Haddad is currently battling with other ministries advocating for increased expenditures to reduce poverty and stimulate growth.

Even with the reduced target, we believe the government is too optimistic. Expenditures are rigid, preventing their reduction, and real expenditure will be allowed to grow at 70% of revenues. This would imply a slow adjustment given that every expenditure will utilize most of this room to grow. Coming from the 2.1% deficit in 2023 and applying our forecast for revenue and expenditure growth, we see the 2024 deficit at -0.5%, significantly lower than the 0% target for 2024. For 2025, we see the fiscal deficit at -0.2% of GDP, while the so-called fiscal equilibrium would only be achieved in 2026, the last year of Lula’s government.

Markets have not reacted well to the news. The time for the new fiscal framework to become firmly established, which is 2025, will test the government's appetite to stick with it. There are several doubts that the government will reduce the pace of expenditure growth, especially if growth is reduced to 2%, as we forecast. Government expenditures are aiming for a 2.5% GDP growth, and with lower inflation reducing the pace of growth, it means that at some point, the government will need to apply the brakes to expenditures.

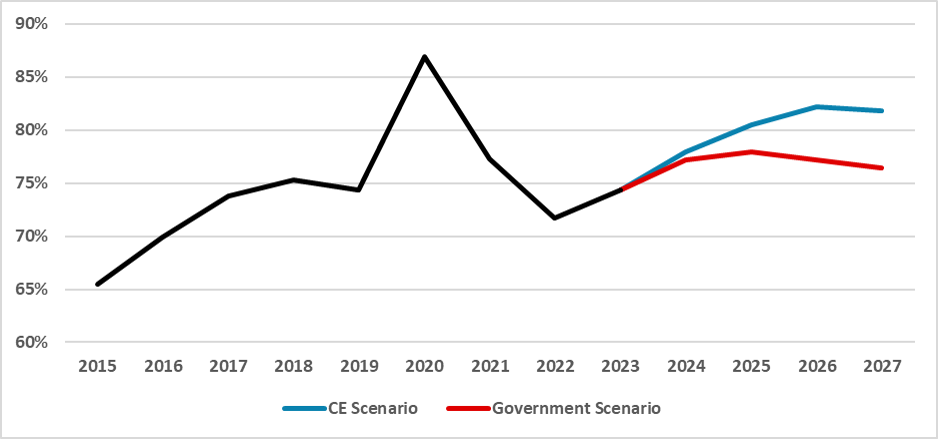

Still, the situation is not catastrophic. Our estimates indicate that debt/GDP will grow slightly in the next few years, but it will not be unsustainable by 2026, stabilizing at 82% of GDP. With government estimations, which we see as too optimistic, it would stabilize at 78%. Market reactions, with treasuries rising and the BRL devalued, are likely related to external factors, and they should reverse in the next few weeks. However, we will be very attentive to whether the Brazilian Central Bank revises its tightening strategy, which could affect the value of the terminal rate, which we now forecast to be at 8.5% in 2025.

Figure 2: Debt/GDP Scenarios

Source: Continuum Economics forecasts.