USD, EUR, JPY, AUD, GBP flows: USD softer as yields dip

USD corrected lower with US yields overnight. Little news scheduled today but Fed speakers could drive trade. GBP softer after Bailey comments

The USD and GBP fell back overnight with US yields dropping through the session. This happened before the release of the Fed’s Beige Book which was similar in tone to the last report. This pulled the USD down across the board, with the AUD the best performer, reversing some of its weakness in the last week. The AUD initially fell on the Australian employment report which showed a decline in total employment, but the data was mixed and in the end had little net effect. GBP underperformed due to comments from BoE governor Bailey, who said the latest inflation data was in line with BoE forecasts and that he was expecting a strong drop in inflation next month. EUR/GBP more than reversed European losses to touch 0.8570.

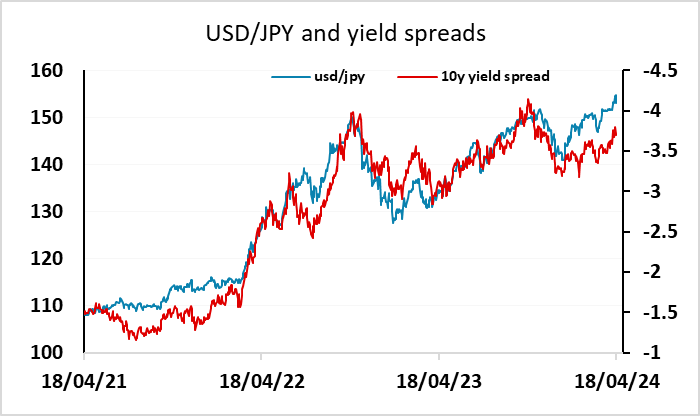

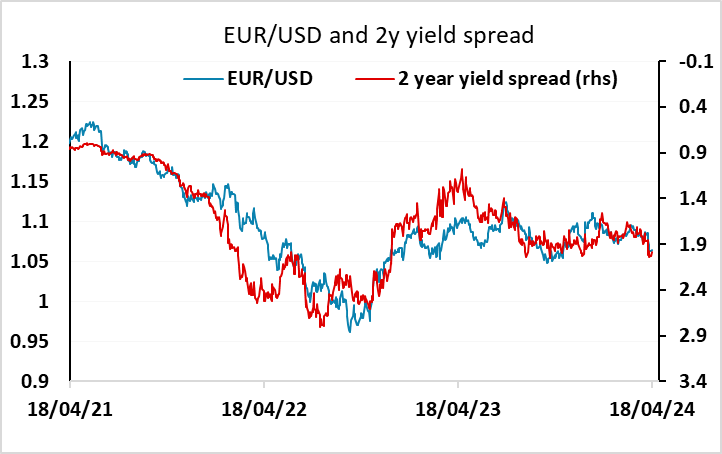

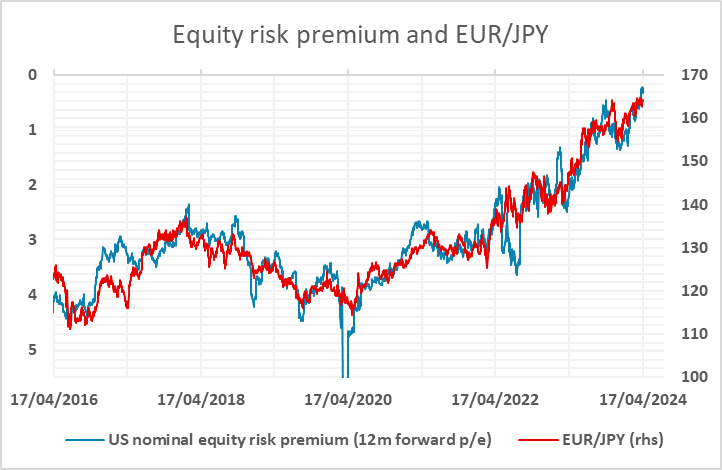

Today doesn’t have a great deal on the calendar, with just the usual Thursday US jobless claims data and Philadelphia Fed survey on the data front. However, there are Fed speakers Bowman, Williams and Bostic who could impact US rate expectations, which remains the prime driver of the main FX pairs. The drop in US yields overnight lines up with the recovery in EUR/USD and via the implied rise in equity risk premia, takes some of the upward pressure off EUR/JPY and the other JPY crosses. Yield spreads still suggest USD/JPY is too high here, and the comments from the MoF’s Kanda overnight still signal intervention is on a hair trigger at these levels. Kanda said Japan is in talks on FX and other issues with US & others and G7 reconfirmed commitment on forex stance put forward by Japan after attending the G20 meeting.