BoE Preview: Easing Bias to be Made Clearer?

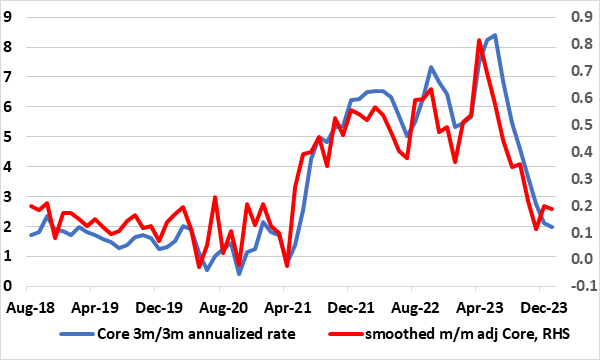

It would be something of a shock if the BoE was to vote to do anything but keep policy on hold when the MPC gives its next verdict on Mar 21. More likely than not there will be no further dissents in favor of a further hike, merely one again calling for a cut. But despite recent CPI underlying falls (Figure 21), the majority may again discuss how ‘persistent’ are price and cost pressures, not least as the MPC has requested early access to the February CPI (formally due Mar 20). Helped by favourable base effects, this should show a clear slowing in what has been seemingly resilient service sector price pressures, at least in y/y terms. If so, then the implicit easing hints offered back at the February decision may be repeated, if not accentuated, paving the way for a (25 bp) start to rate cutting at either the May 9 of Jun 20 meetings, especially as headline CPI may be below target by the latter date. This should pave the way for around 100 bp of cuts this year and almost as much in 2025!

Figure 1: Underlying Price Pressures Have Clearly Eased

Source: ONS, CE

Policy in Perspective

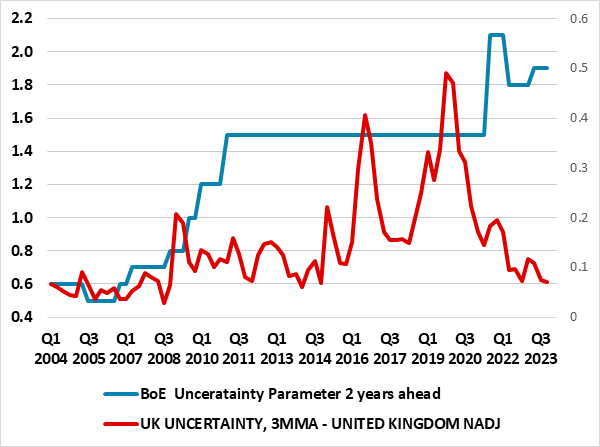

As was widely expected, the BoE kept policy on hold for a fourth successive meeting in February and notably and abandoned its previous tightening bias. It even hinted that policy could be eased but stressed more evidence was needed before this could happen. But clearly the BoE was uncertain, if not confused when it made its February decision and updated its projections. The MPC vote was three ways, the first time stable policy, rate hikes and cuts were seen at one meeting since 2008. In addition, its inflation forecast continued to have a very elevated uncertainty premium (Figure 2) that basically suggest inflation 2-3 years hence could be two ppt either side of the near 2% projection. This is hardly an authoritative means on which to base policy and where this uncertainty premium does no chime with survey measures assessing uncertainty.

Regardless, clearly MPC thinking had shifted, despite two rate hike demands which are unlikely to be repeated this time around. As the Governor said in the February press conference, it was no longer a question of how restrictive policy needs to be but one of how long current restriction needs to stay in place. Particularly given what we think is over-pessimism about so-called persistent inflation pressures, we think that this implicit easing bias will be exercised soon, with rate cuts starting in Q2 and 100 bp on the cards for the whole of this year and more to come in 2025. The QT issue, will again be left to one side at least for the time being.

BoE Uncertainty

Inflation has surprised on the downside of late and to a degree that even the BoE accepts the headline CPI rate may hit the 2% target next quarter (we see a clear undershoot). But unlike ourselves, the BoE sees this being short-lived with the rate back towards 3% by year-end before then easing back below target more durably only in the third year of its projection horizon, thereby remaining above target over nearly all of the remainder of the 2-year policy forecast period. This reflects what the BoE believes are persistent price pressures something it sees is embodied in currently high services inflation, this the MPC feels is the best indicator of domestic pressures.

But at the same time, the BoE admits that the larger than expected fall is a result of an easing in global supply problems, something with which we concur. However, unless these global pressures resume and given the still weak domestic economy (and with around a third of the impact of policy hikes yet to come) through then why should inflation rise afresh. Partly, the BoE view is that second round effects will take more time to unwind or revers, this view coming in spite of what the BoE’s own models suggest. Instead it reflects the price pessimism of the MPC majority, albeit with this being very uncertain.

Figure 2: The BoE’s Persistent Uncertainty Outlook

Source: ONS, CE

Price Pressure Persistence Dissipates

We are therefore puzzled why the BoE has not followed the lead of the ECB in providing formal seasonally adjusted data which gives it the potential to assess up-to-date inflation developments that are not dominated by base effects from a year before. However, some recent MPC speeches (and from both ends of the policy spectrum) have started to use seasonally adjusted data, albeit on a 3-month/3-month annualized basis rather than the more up-to-date 3-month m/m moving average we prefer. Bu as Figure 2 highlights, both measures have shown a clear slowing of late, actually to a degree that suggest recent core price pressures are sub-target. But it is question whether the February CPI data will extend this downtrend!