ECB Review: ECB Bowing to Markets?

With the ECB staff updated forecasts pointing to headline inflation below target somewhat earlier, now in H2 2025 and then through 2026, and the core rate at target on the basis of market rate pricing of future official rates two years hence some 150 bp below current levels, this implies a tacit Council endorsement of that rate profile. The rejigged rhetoric probable reflects what are still divisions within the Council but where the doves may be getting the upper hand as inflation surprises on the downside. We continue to envisage rate cuts if 75-100 bp this year starting in June with something similar though 2025. Indeed, President Lagarde’s comments were consistent with June moves, provided no upside surprises are seen.

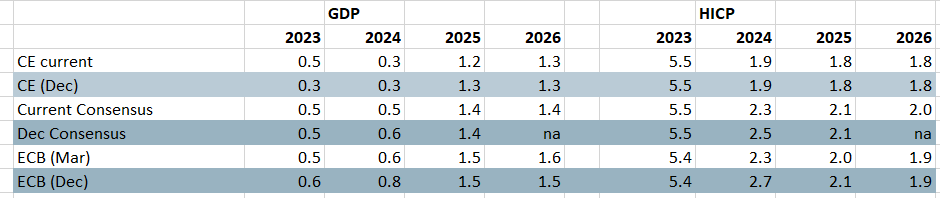

Figure 1: ECB Forecasts in Perspective

Source: Bloomberg, ECB, Continuum Economics

Modest Forecast Downgrade Expected

As Figure 1 highlights, the ECB made negligible changes to the real economy outlook. The changes to inflation outlook were also not marked but, more importantly, also much more meaningful. Indeed, HICP inflation forecasts have largely been revised down, in particular for 2024 which mainly reflects a lower contribution from energy prices but where the target is now undershot two quarters earlier (ie from H2 next year) and stays below through 2026 (Figure 2). As notable, the core inflation projections (excluding energy and food) have also been revised down and average 2.6% for 2024, 2.1% for 2025 and 2.0% for 2026, the first time that the core has been consistent with target in the current cycle.

This has come alongside hardly any changes in the real economy outlook, with the ECB pointing to the economy picking up and growing above trend at 1.5% in 2025 and 1.6% in 2026, supported initially by consumption and later also by investment. We think this is optimistic. But the point is that the ECB still accepts that even this real economy outlook delivers price stability, if not a slight target undershoot and this on the basis of that economic outlook encompassing official rates cuts of some 150 bp over the course of the next two years or so. The ECB projections use official rates roughly averaging 2.4% in both 2025 and 2026 (based on market based assumptions). In other words, the ECB is at least implicitly endorsing market rate thinking.

Reassessing Market Thinking

This is a slight change in tone as previous ECB meetings have made (perhaps only half-heartedly) attempts to rein in market thinking. Notably though, at the last meeting in January, it was noted that market rate thinking then encompassing much clearer and earlier rate cuts) was in part a circular reaction – in other words market rate thinking reflected a different (and possibly more valid) trajectory for both inflation and real growth. It was suggested then that and this needed to be carefully assessed and it seems as if duly has at the March meeting, a discussion probably made all the more intense by the manner in which headline HICP inflation has surprised on the downside both late last year and so far into 2024. Indeed, the ECB cut its forecast for this quarter by 0.3 ppt to 2.6%!

This does not mean that rate cuts are a done deal in June, but would be hard to rule out given the earlier and sustained target undershoot. More information is wanted by seemingly the whole of the Council given the apparent unanimous manner in which today’s decision was arrived at and the continued insistence that policy will be data driven. Very clearly the focus is on wages as this is seen being very much inter-related to domestic/services inflation. But while wage developments and possible labor hoarding are important in assessing the inflation outlook, wages are far from the whole story in this regard, with the role of profit margins also crucial. Sufficiently broad enough data on all these issues may take until June, chiming with the easing hints that the ECB has offered repeatedly this year, repeatedly pointing to a summer timetable.

There were some mixed messages in the latest ECB verdict. The ECB rhetoric in the statement was largely unchanged still pointing to rates being at levels that maintained for a sufficiently long duration will return inflation to target and that policy rates being at sufficiently restrictive levels for as long as necessary. If anything there was a hawkish addition in the more explicit reference to ‘domestic price pressures remain high, in part owing to strong growth in wages, suggesting more information on the latter may be sought before any policy action is taken. However, we would see this as the ECB wanting to avoid too quick a move away from restrictive policy rather than any real concerns.

President Lagarde suggested no formal rate cut discussion has yet taken place, though this is mincing words as she admitted the Council has start to discuss the issue of ‘dialling back on its restrictive stance’ and also went out of her way to makes clear she was not try to suggest later cuts. The ECB is preparing to ease and only adverse news on inflation will prevent a June move (there have been some disappointing readings regarding services numbers of late, albeit which we still think is noise not trend).

Figure 2: ECB Sees Earlier Inflation Target Undershoot

Source: ECB, last four macro-projection vintages

We continue to envisage rate cuts of 75-100 bp this year starting in June with something similar though 2025, with the risks of faster moves and the issue of whether to rein in balance sheet reduction likely to come to the fore once actual cuts begin.