EZ HICP Review: Core Disinflation Signs Start to Flatten Out?

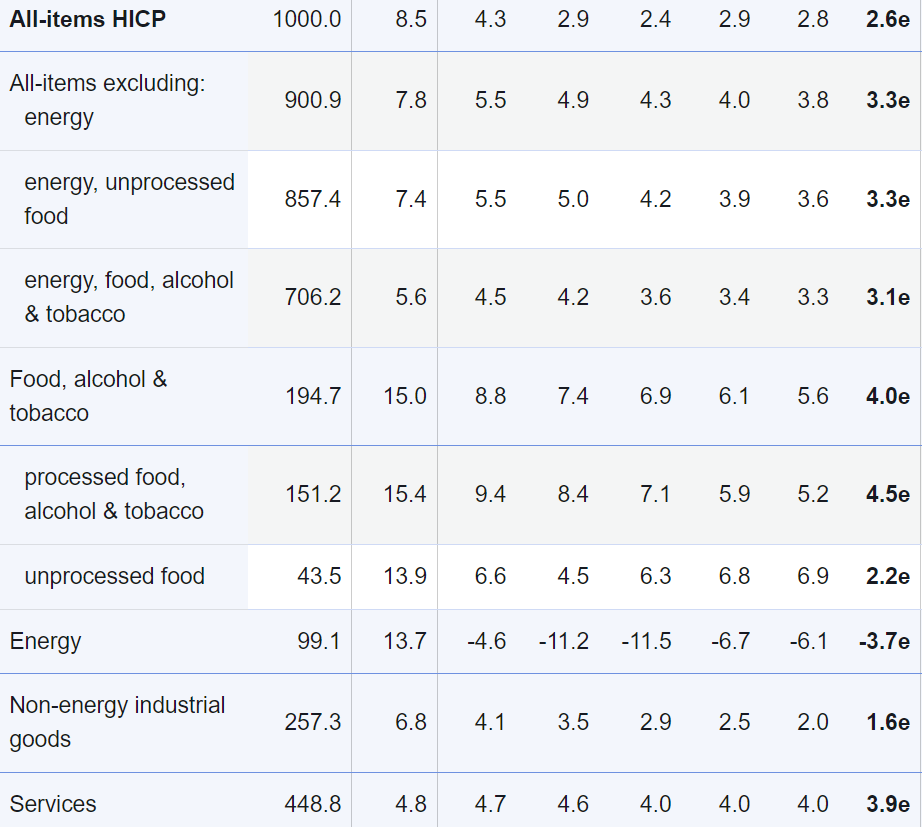

There has been repeated positive EZ news in the form of plunging inflation. This continued in the February numbers, albeit with the 0.2 ppt drops in both headline and core being less that most anticipated and with some hints that core disinflation may be marked. Regardless, the headline, at 2.6%, continued its recent decline while the latest core is still on course (figure 1) to meet the ECB Q1 projection of 3.1%, if not undershoot it, with the headline much more likely to undershoot. This may be even more likely if our March HICP projections prove anything like accurate; we see the headline down to a 31-month low of 2.5%, the latter encompassing more discernibly softer y/y services inflation. This is notable as the ECB has been somewhat troubled by the failure of services inflation to have fallen in the last few months, and the fact that it slowed just a notch to 3.9% y/y In February may harden some of the hawks worries about aspects of price resilient not least as monthly adjusted numbers (Figure 2) have also shown some fresh resilience. The February data, at least in terms of recent HICP swings, do not accentuate the case for an immediate rate cut.

Figure 1: Headline and Core Inflation Falling Together Again

Source: Eurostat

On-Target Inflation Looming in H2 As Resilient Services Succumbs Modestly!

February saw services fall albeit only modestly in y/y terms, this taking the core down in turn. The upside risks from fuel prices and from rents/eating out may also have been behind the slightly firmer than expected numbers. Regardless, possibly encompassing added volatility from the early Easter this year, we still envisage that the headline now hit target us after mid-2024, well over a year earlier than the ECB envisages, and then undershoot in H2, while the core should continue to fall in the interim regardless. The ECB is likely to revise down its current inflation profile at next week’s Council meeting, but maybe only for 2024 and parts of 2025. It may still suggest inflation settles a notch below target through 2026, despite a softer growth outlook, this possibly a result of downgrade for the envisaged productivity projections.

There are ever-clearer signs of soft underlying inflation at least in terms of non-energy goods and also in terms of persistent price pressures which are now running below the 2% target on an overall basis and even more so for core measures. Admittedly, services inflation has hardly fallen in y/y terms, a stability seen in seasonally adjusted m/m numbers, the question is whether this is true price persistence linked to high wages or reflection of one-off factors such as indirect tax moves.

Figure 2: Eurozone Disinflation; Stalling, Slowing or Reversing?

Source: ECB, CE,

Accounting For Base Effects

Regardless, in the February HICP data, the core rate hit a low of 3.1%, down over two ppt in the last five months. But this disguises an even clearer fall in recent price dynamics, as seen in m/m seasonally adjusted data (Figure 2), and with the smoothed core rate now consistent with target, but possibly less consistent with the undershoot hinted at in previous months. This is evident too in the adjusted data used by the likes of Chief Economist Lane, albeit on a slightly different measurement basis, using 3mth on 3mth changes rather than the 3 month m/m moving average we prefer for its slightly greater topicality (Figure 2). But notably the account/minutes to the Jan 24-25 Council meeting saw Lane very much underscore that the Persistent and Common Component of Inflation was the best predictor of inflation one and two years ahead and that this had eased to 2% in December – NB; it has fallen below 2% into 2024 and broadly so, something we have underscored of late. Nonetheless, the February data, at least in terms of recent HICP swings, do not accentuate the case for an immediate rate cut. The question is whether other data do add to the case, given softer European Commission survey data and fresh signs of actual falls in credit.