Eurozone: Retailers’ Margins – the Profits of Gloom?

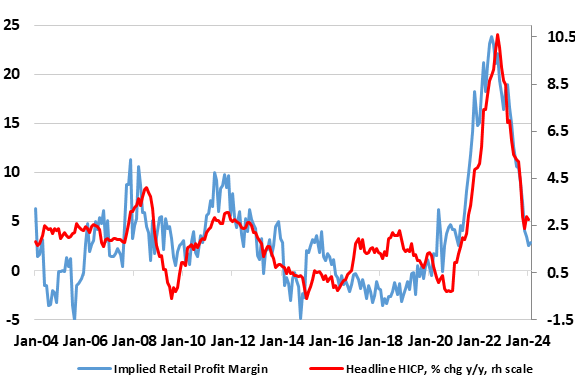

For all the ECB focus on the wage picture as the key factor shaping how HICP inflation may fare, the ECB has admitted to ‘significant uncertainty surrounding the link between wages and price-setting’. Productivity is one obvious other important consideration albeit probably the main alternative issue is the extent to which firms may absorb what are clearly high labor costs by squeezing profit margins. We have long regarded this as an important issue as very strong profit margin growth clearly contributed to the surge in inflation into 2022, but now seems to be reversing very strongly, thereby refuting any claim that the recent inflation slump is either mainly energy related or not durable. In this regard, we have compiled a crude measure of retailing profit margins (based on survey data) that not only correlates with HICP inflation (Figure 1) but which also implies that the latter has further to fall. This is unsurprising given the weak demand backdrop that may intensify unless the ECB eases back on the aggressive policy moves it put in place up until late last year.

Figure 1: Retail Profit Margins Being Squeezed

Source: European Commission and Continuum Economics

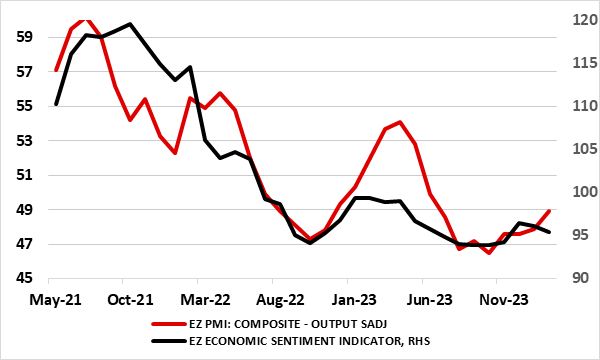

At last month’s Council meeting one key question was raised as to whether profit margins would have enough scope to continue absorbing the rise in unit labour costs. The ECB has acknowledged (mainly based on quarterly national account data) that firms’ profits are now far from the exceptional levels of 2022, when firms seemingly took advantage of high inflation to increase profit margins. Most recently, but more based on anecdotal evidence, the ECB has accepted that profit margins have come down and maybe even to the point where some firms were now starting to cut back on investment because of a lack of profitability. It was agreed that manufacturing sector weakness suggested that profits might continue to buffer unit labour costs. By the ECB hawk worry is, in contrast, that as services are largely shielded from global competition and demand is still robust, this thereby provides scope and rationale to boost profit margins. This picture was one that PMI survey data have underlined with the headline figure suggesting a service sector led recovery is in the offing. That picture is refuted by European Commission survey data (also now up to February) which actually suggest a contused slippage in business sentiment, encompassing added weakness in both the factory and services sector (Figure 2).

Figure 2: Contrasting Business Survey Messages

Source: European Commission and Markit

This therefore complicates both the policy backdrop and outlook as it uncertain to what degree, if at all, high unit labour costs can/will be passed through to prices. In this context, the significant uncertainty surrounding the link between wages and price-setting that was acknowledged by the ECB last month may be even more acute, accentuating a need to monitor a broad set of variables to understand very much including the contribution of profits to domestic inflation.

For all the talk of assessing profits and margins (where the likes of stock returns suggest that corporate profitability overall is still high), one issue that really matters in assessing the impact on consumer prices is how retailing margins maybe faring. To assess this we have used the same European Commission survey data used in Figure 2, albeit looking at the price expectations components of the various sectors covered to compile a gauge of retail margins. Basically this aggregates by weight the price expectations of the services and factory sectors as a measure of retail costs and then relates this to the price expectations of the retail sector. As Figure 1 highlights the correlation (and we think causation) is striking in suggesting that retailers did pad out margins significantly as HICP inflation jumped but have seen them compressed since. This is seemingly continuing, as Figure 1 also shows, implying more downward pressure on HICP inflation but also suggests that margins have been a very significant contributing factor in the swings in inflation. And with demand weakness set to continue, this likely further squeeze on margins is likely to continue eating into HICP inflation.