Trump Deregulation and U.S. Financial Stability

Regional banks will be the main beneficiaries from a further watering down or postponement (that is likely under the Trump administration) of the proposed capital increase under the Basel endgame. Combined with laxer M&A rules for bank takeover, this could help lending and credit growth for the U.S. economy – though the multi-year impact will likely be modest. Banks financial stability remains good if an adverse rate shock or recession were to occur, but the Fed are concerned about market risk from overvalued assets and areas of high leverage (life insurance companies and hedge funds).

How will deregulation under the incoming Trump administration impact financial stability?

Figure 1: Overview of Financial System Vulnerabilities (%)

Source: Federal Reserve Financial Stability Report Nov 24 (here)

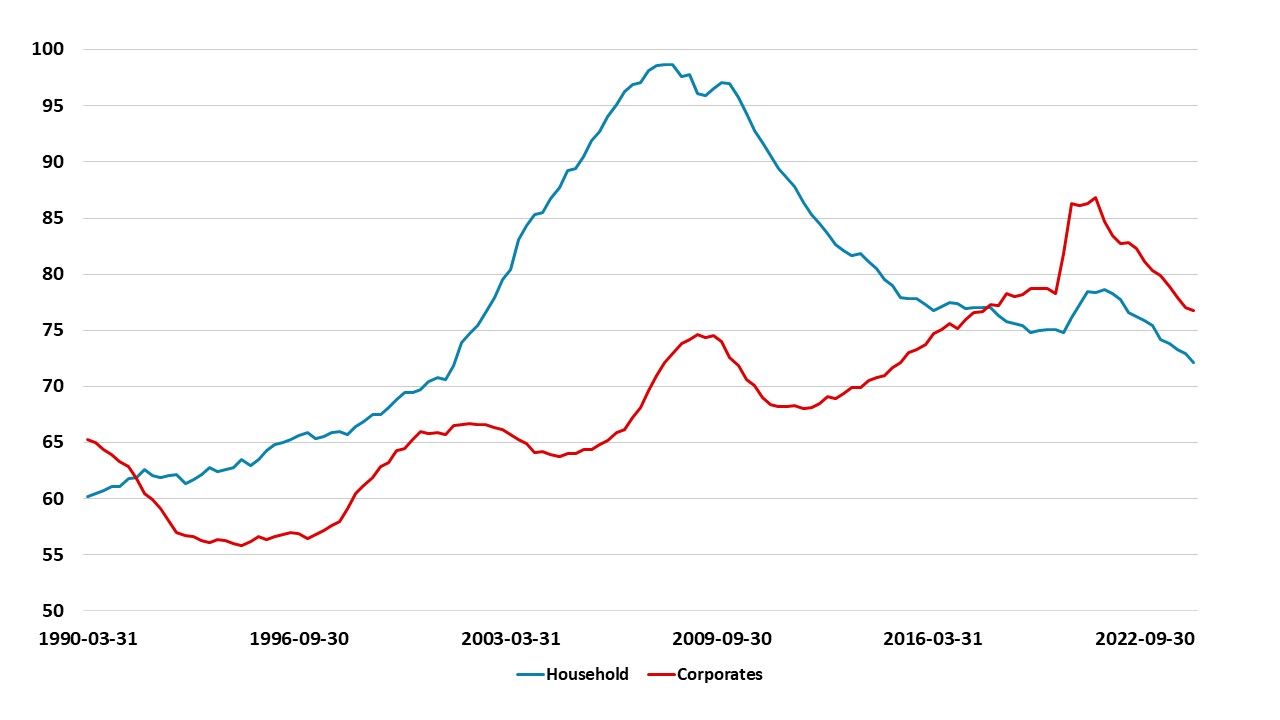

Bank stocks have rallied in anticipation of deregulation under a Trump administration, but what will it mean for financial stability? One focus will likely be a further watering down or freezing the Basel endgame as the OCC/FDIC, which will avoid banks having to increase capital and could free up some capital to increase leverage and lending – the main beneficiaries would be large regional banks with over USD100bln in assets rather than the giants. Secondly, the Trump administration is seen to open to relaxing M&A rules for small and mid-sized banks, though easing in bank stress and liquidity tests are not expected to see major changes due to the 2023 regional banking crisis. This would fit with an objective of trying to increase momentum for the U.S. economy and avoid crowding out by large budget deficits from the U.S. government. The latest Federal reserve financial stability report (Figure 1), makes clear that in aggregate households are under leveraged and businesses have moderate debt that is generally serviceable. The period since the GFC has seen significant deleverage by the household sector (Figure 2), with most new lending to prime customers with large wealth. Though auto loan delinquency has risen this is seen to a pocket of vulnerability, rather than a sign of widescale problems for the consumer. A bigger boost to lending could occur if regional banks capital ratios are reduced, but this seems unlikely after the 2023 regional banking crisis. Would this impact bank’s financial stability?

Figure 2: U.S. Household and Corporate Debt/GDP (%)

Source: BIS/Continuum Economics

Probably not in aggregate looking at the Federal Reserve financial stability report, where banks capital is seen to be resilient. Though CRE loan delinquency has been increasing, this has been with the better capitalized large banks and regional banks have not seen a noticeable increase in NPL’s. What could impact financial stability?

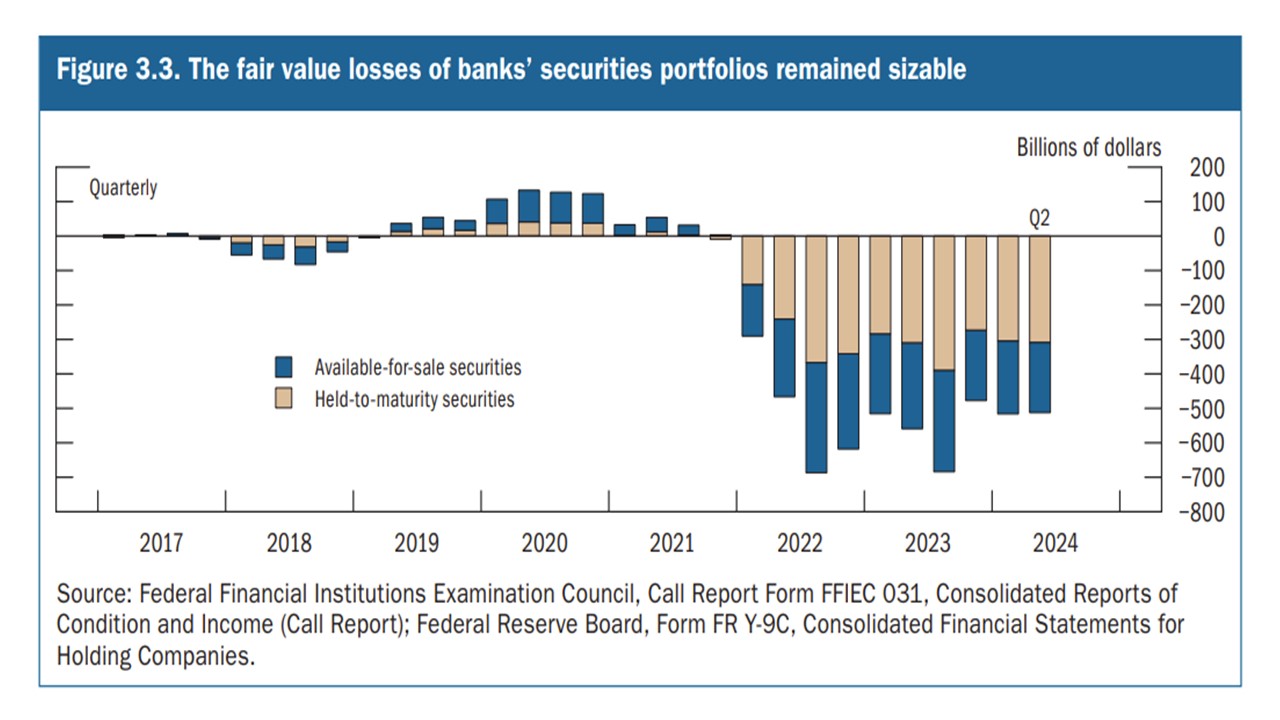

a) Interest rate shock. If U.S. Treasury yields surge due a 8-9% of GDP budget deficit, then this could worsen fair value losses on bank security holdings (Figure 3). Even so, this would probably require a persistent shift higher in U.S. Treasury yields to 5.50-5.75% or above (here) and even then this would likely only trouble some weaker banks rather than the system as a whole. It is worth mentioning that hedge fund leverage is high due to large cash-future basis trades and any large and sustained volatility in U.S. Treasury yields could cause some deleveraging.

Figure 3: Fair Value Losses of Banks Security Holdings (USD Blns)

Source: Federal Reserve

· U.S. recession. A U.S. recession could cause some problems for weaker banks, though even here the impact would be slow moving and through rising NPL’s over a number of years. The bigger threat is to overleveraged sectors or those with illiquid assets and liabilities. On this score the Fed financial stability report still remains concerned about U.S. life insurance companies; some money market funds and stable coins in the crypto space.