ECB – What is it Actually Targeting as it Assesses Price Persistence?

The ECB remit is targeting an inflation rate of 2% over the medium term. Implicit in this is that this is measured on a moving y/y basis. However, there is nothing sacrosanct in this as the ECB is starting to be more open about using shorter-term measures, albeit more as indicators of price momentum (Figure 1). Regardless, there is also (very much among the more hawkish ECB Council members) a continued explicit focus on the breakdown of overall y/y inflation, even though this is not consistent with the actual remit. In particular, these is a concern that services inflation is still too high and indicative of persistent price pressures. We would argue that recent services inflation is actually running at an underlying rate of half the 4% y/y measure and is thus back in line with its long-term pre-pandemic average (Figure 2). This is backed up by the ECB’s own price persistent measures which have fallen clearly and rapidly below 2% of late and are also running close to the pre-pandemic average (Figure 3). All of which are issues that are fueling a clearer debate within the ECB and one that we feel will lead to the start of official rate cuts by June if not sooner.

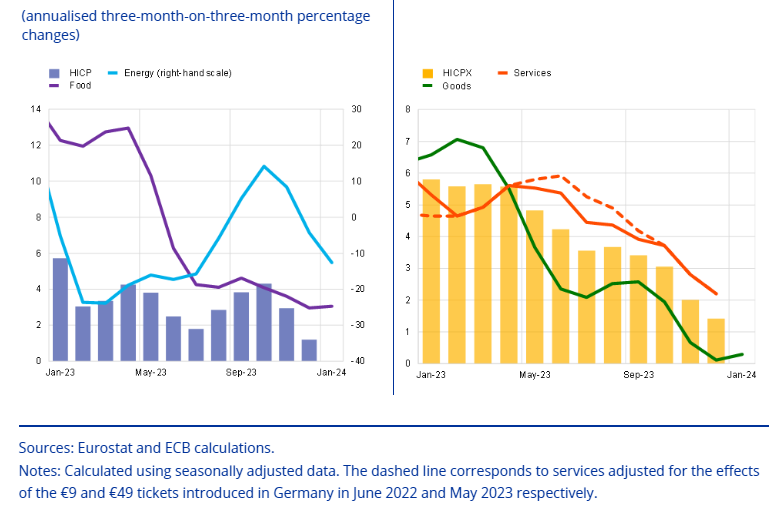

Figure 1: ECB Uses Adjusted Short-term HICP data to Assess Price Momentum?

Source; ECB

Gauging Price Momentum

The speed at which EZ inflation has fallen has surprised many, albeit not ourselves. The ECB is accepting that it has under-estimated the drop, which it also admits cannot be put down purely to lower energy prices. Admittedly, the headline HICP rate is still above the 2% target as is the core measure (ECB denoted as HICPX) which has become a more frequently used price gauge by the ECB to assess its policy spectrum. This drop though is even more apparent in the shorter-term measures of inflation, which we have been highlighting for some time. These are based on seasonally adjusted HICP data, computed on a long-standing basis by the ECB itself using the Eurostar unadjusted numbers. We have been using 3 month moving average m/m change adjusted numbers. These suggest that headline inflation has been running around an annualized rate of 1% on this basis and the core at around 2%. The ECB is using the same data, but even using a 3 mth on 3-mth moving average, comes up with something similar. Indeed, in a speech earlier this months, Chief Economist Lane featured such data and accepted that such ‘momentum indicators’ have eased further for headline inflation and all of its components, with momentum in goods inflation at zero and momentum in services inflation close to 2 per cent (Figure 1).

Resilient Services Inflation?

This is important as the hawks are already highlighting how y/y services inflation has seemingly become stuck at 4%. This was highlighted in testimony by President Lagarde this week, who said ‘core inflation (excluding energy and food) is declining gradually but its services component has shown signs of persistence’ albeit failing to note the impact that certain national fiscal measures have had on the aggregate of late. Moreover, this y/y services resilience may be short-lived as favorable base effects kick in with the looming February HICP numbers, with every likelihood that services inflation will be down to around 2% y/y by mi-year, with core goods around 1%, figures they are already at in smoothed seasonally adjusted terns, even on the ECB’s somewhat more convoluted measure (Figure 1 again).

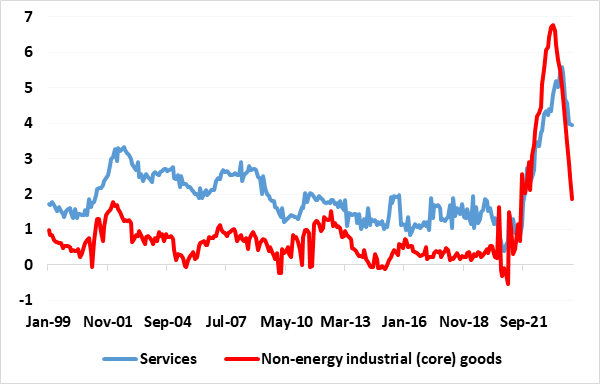

Figure 2: Services Inflation has Nearly Always Exceed Core Goods

Source Eurostat

The Historical Perspective

But the hawks will suggest that this is still an unbalanced inflation situation, with the relative strength of services inflation indicative of price persistence and with risks emanating from wages. If this line of argument is pursued, it misses the historical context. Indeed, such sector rates of inflation were the long-term averages during the period of lowflation in the decade before the pandemic and even in the decade before that when inflation was sometimes above target. Indeed, as can be gleaned from Figure 2, services inflation has always been well above core goods inflation, at least until the unprecedented supply problems thrown up by the pandemic and the war in Ukraine; the fact that core goods inflation has fallen so clearly and rapidly being very much an indicator of the manner in which supply conditions have eased considerably, a topic we have highlighted recently. Thus helps refute the hawk argument that the lowflation era was due to supply factors (increased global supply chains) that risk not being repaired. Perhaps a more authoritative worry is that recent productivity weakness will continue and this will lead to generally higher inflation, probably based around fatter core goods pressures. But surely this is best avoided by not pursing aggressive tightening policies that weigh on the necessary investment and growth to recovery.

Figure 3: Persistent Price Pressures Ebbing

Source: ECB - Persistent and Common Component of Inflation (PCCI)

Price Persistence Falling as Fast as it Rose?

Regardless, there are other measures of assessing price persistence, measures also compiled and computed by the ECB. It is this latter gauge which we follow and which is now clearly a measure that the likes of ECB Chief Economist Lane also favours has shown further signs of slowing (Figure 3), actually suggesting not only below target price pressures even on an overall basis but even softer signs at the core level but with the latest outcome at 1.7% only a few notches above its pre-pandemic average and having fallen of late as fast it rose previously. But this Persistent and Common Component of Inflation (PCCI) measure also offers lead properties, having repeatedly foreshadowed HICP inflation turning points in the past. An added reassurance comes from the fact that its recent slowing is an indication that price pressures are not broadening out, the very opposite. This is because the PCCI captures widespread developments across the HICP basket that are persistent (hence the name), this being all more crucial as the ECB hawks apparent focus is on preventing the recent inflation surge becoming embedded.

Overall, the ECB debate that will develop in coming months seems to be focusing on wages as perhaps the most important factor that may hold up services inflation. Over and beyond signs of softer wage pressures (negotiated wage in Q4 showed the first fall in this cycle, to 4.46% in Q4), it maybe that this is too granulated an issue and that appreciably weaker wage is neither a necessary not a sufficient condition to restrain services inflation