BJP's Political Confidence Shines Through in India's FY25 Interim Budget

India's interim budget for FY25 presented ahead of the upcoming general election, reflects the government's commitment to economic growth, infrastructure development, and fiscal responsibility. Finance Minister Nirmala Sitharaman highlighted key aspects of the budget, emphasizing a multi-pronged approach to economic management, sector-specific initiatives, and a vision for a developed India by 2047. The Finance Bill passed on February 7 highlights the continued push for infrastructure driven growth, limited populist schemes targeted at female and youth vote bank and the government's confidence of returning to power in June 2024. The interim budget provides sufficient indication that should the Narendra Modi-led Bhartiya Janta Party return to power policy continuity is certain.

Infrastructure Outlays and Fiscal Deficit

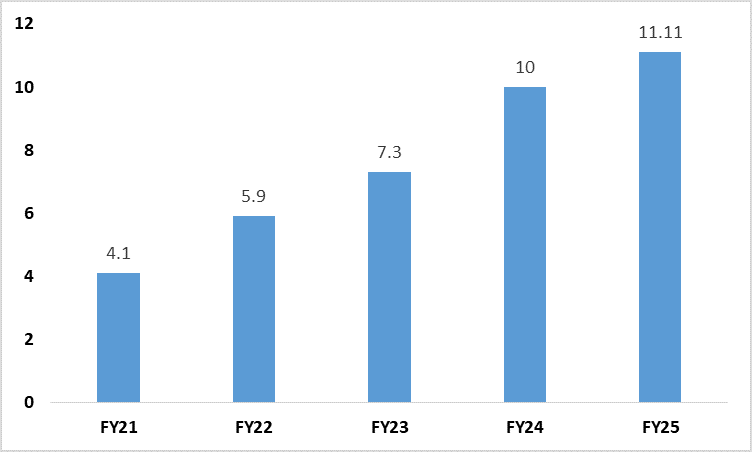

The budget allocates INR 11.1tn for capital expenditure in FY25, marking an 11.1% y/y increase. Noteworthy infrastructure projects include the provision of free electricity to 10 million households through rooftop solarization and the establishment of coal gasification and liquefaction capacity of 100 MT by 2030. Massive capital expenditure outlays are directed towards major railway corridors, aviation sector expansion, and green energy projects such as offshore wind energy, coal gasification, and bio-manufacturing. Meanwhile, the outlays for the promotion of electric vehicles and the establishment of a bio-manufacturing and bio-foundry scheme align with environmental sustainability goals. Furthermore, the government plans to construct 20 million affordable houses over the next five years, supplementing the existing nearly 30 million houses already built.

Figure 1: Government Capex Outlays (INR tn)

The government’s focus has been on capital expenditure driven economic growth and targeted towards providing basic infrastructure across both rural and urban India. The 11.1% y/y increase in capex follows a similar 10% y/y increase in FY24.

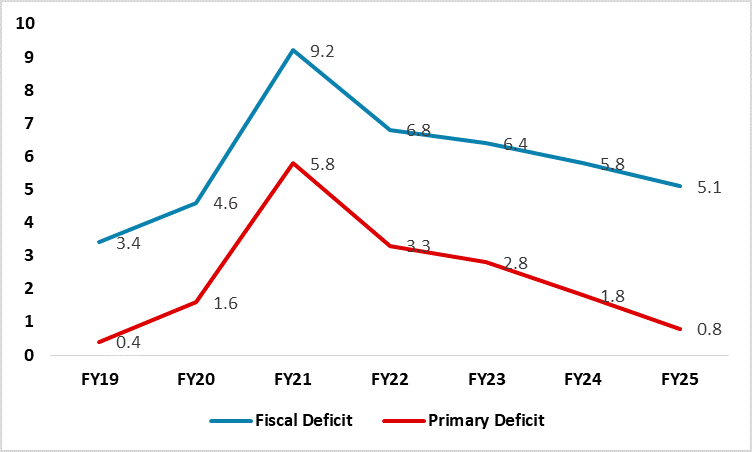

Despite the surge in capex over the years, the government continues to remain on the path of fiscal consolidation. The fiscal discipline is evident in the target of 5.1% fiscal deficit as a share of GDP for FY25, showcasing the government's focus on responsible financial management. The government has also revised the deficit target to 5.8% of GDP for FY24, with an ambitious commitment to reduce it below 4.5% by FY26.

Sectoral Initiatives

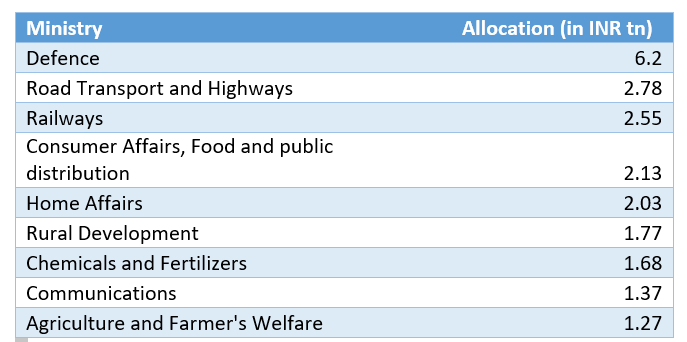

The interim budget places a strong emphasis on agriculture, with initiatives like Nano DAP and Aatmanirbhar Oil Seeds Abhiyan. Additionally, programs for fisheries, dairy, and women's empowerment in rural areas aim to uplift key sectors of the economy. The youth are targeted through investments in education, skill development, support for startups, and sports achievements. Healthcare initiatives, including the expansion of Ayushman Bharat and cervical cancer vaccination, prioritize public health. Outlay for all of these initiatives while continuing from earlier years, also underscores the government’s aim in securing a large vote share in the up-coming elections. Through targeted initiatives highlighted above, the government is looking to secure the female vote (which accounts for about 49% of voting population) and farmer vote (agriculture accounts for about 45% of India’s workforce). The government also through the budget highlighted its continued focus on defence sector support. Among key ministerial outlays, defence budget remained one of the highest at INR 6.2tn. The allocation and sustained increase in defence outlay is both prompted by the BJP-government's long standing view of developing the sector and also its view of dealing with external threats aggressively. We remind that India shares a long border with Pakistan and China with frequent skirmishes taking place in the tense border areas.

Table 1: Key Ministerial Outlays

Tax Reforms

On the tax front the government maintained a neutral stance, especially in the context of tax rates, focusing on fiscal and electoral prudence. The government aims for INR 30tn in revenue receipts, reflecting an 11.2% y/y increase. The growth is primarily anticipated in tax revenue, particularly from direct taxes (corporate + personal) and goods and services tax (GST), driven by expectations of strong economic activity. Additionally, non-tax revenue is projected to reach nearly INR 4tn in FY25, marking a 6.4% y/y increase. A significant portion of non-tax revenue is anticipated to be sourced from the Reserve Bank of India's surplus and dividends from state-owned enterprises.

Further, as part of her budget speech, finance minister, Nirmala Sitharam announced that the government is considering withdrawing all outstanding tax demands unto INR 25,000 from 1962 to 2009-10. In her budget speech she noted that significant disputed tax demands were weighing on the system. This measure is likely to support about 10mn taxpayers.

Key Stats

The central government anticipates a 2.8% y/y reduction in the estimated budget gap to INR 16.9tn in FY25. The deficit will primarily be funded through gross borrowing of INR 14.1tn from the market, with net borrowing expected to be INR 11.8tn, a slight 0.4% y/y decrease. An additional INR 4.7tn will be generated through small savings proceeds. Moreover, the Centre targets raising INR 500bn through disinvestments in FY25. The current fiscal year's asset sales goal was significantly reduced after unsuccessful attempts to privatize IDBI Bank, Shipping Corporation of India, and CONCOR. Up to now in FY24, the government has garnered INR 125bn through stake sales in state-owned companies, including Coal India.

Figure 2: Fiscal Deficit and Primary Deficit (% of GDP)

In the context of the upcoming election, the budget's focus on infrastructure-led growth and fiscal responsibility is a strategic move, in our view. The government's confidence in its comeback is evident from the interim budget where is refrains from doling out excessive populist schemes. In the interim budget ahead of the 2019 general election, Modi's government introduced direct cash support of 750 billion rupees for impoverished farmers, expanded income tax exemptions to a larger population, and provided various other incentives, resulting in a fiscal deficit wider than initially projected. However, this year Sitharaman left little doubt that the BJP will come back to power in 2024. She highlighted as part of her speech that the government would provide a detailed budget in July, upon its return. However, it is noteworthy that the government did extend its free food grain scheme by another five years in December, indicating that it didn’t entirely abandon populist measures. The scheme would support 800mn people but will also be a drag on public finances. Nonetheless, the place holder budget underscores a positive outlook for investors and business sentiment especially as it reinforces the expectation of the return of the BJP in May 2024 (in line with our forecast), continued focus on capital expenditure as a means of supporting growth and to a large extent policy continuity in terms of push for manufacturing sector and continued impetus to digitalisation.