EZ HICP Review: More Core Disinflation Signs But Services Inflation More Stubborn?

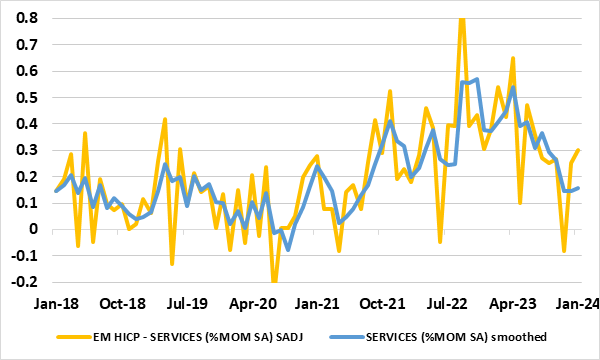

There has been repeated positive EZ news in the form of plunging inflation. This continued in the January numbers, albeit with the 0.1 ppt drops in both headline and core being less that most anticipated. As a result, the headline, at 2.8%, resumed its recent decline having risen to 2.9% in December due to based effects, the later partly reversing in January. The core fell a notch to 3.3%, a 22-month low and very much on course to meet the ECB Q1 projection of 3.1%, if not undershoot it. The ECB may be somewhat troubled by the failure of services inflation (Figure 1) to have fallen in the last few months, this stable 4.0% y/y reading also evident in more resilient but still more modest m/m adjusted numbers (Figure 2). This is the first signs of price resilience for some time and will be grasped by the hawks, although it may reflect fiscal-driven indirect tax hikes (most notably in Germany) rather than solid demand factors. The next few months will be telling as there are very marked and favourable base effects that should bring services y/y inflation down at least 0.5 ppt!

Figure 1: Headline and Core Inflation Falling Together Again

Source: Eurostat

Below-Target Inflation Looming Despite Stable Services!

Regardless, we still envisage that the headline now hit target before mid-2024, well over a year earlier than the ECB envisages, while the core should continue to fall in the interim regardless. There are ever-clearer signs of softer underlying inflation at least in terms of non-energy goods and also in terms of persistent price pressures which are now running below the 2% target. Admittedly, services inflation has failed to fall for two successive months, a stability seen in seasonally adjusted m/m numbers, albeit the later running at an annualized rate of half the headline 4% outcome (Figure 2).

Figure 2: Smoothed Services m/m Price Pressures Stable Around Target

Source: ECB, CE, with seasonal adjustment made by CE and smoothed is 3 mth mov avg