USD, JPY flows: JPY starting to come to the party, but...

USD/JPY down fairly sharply today but JPY continues to lag well behind European currency strength. JPY still has the most potential for major long term gains

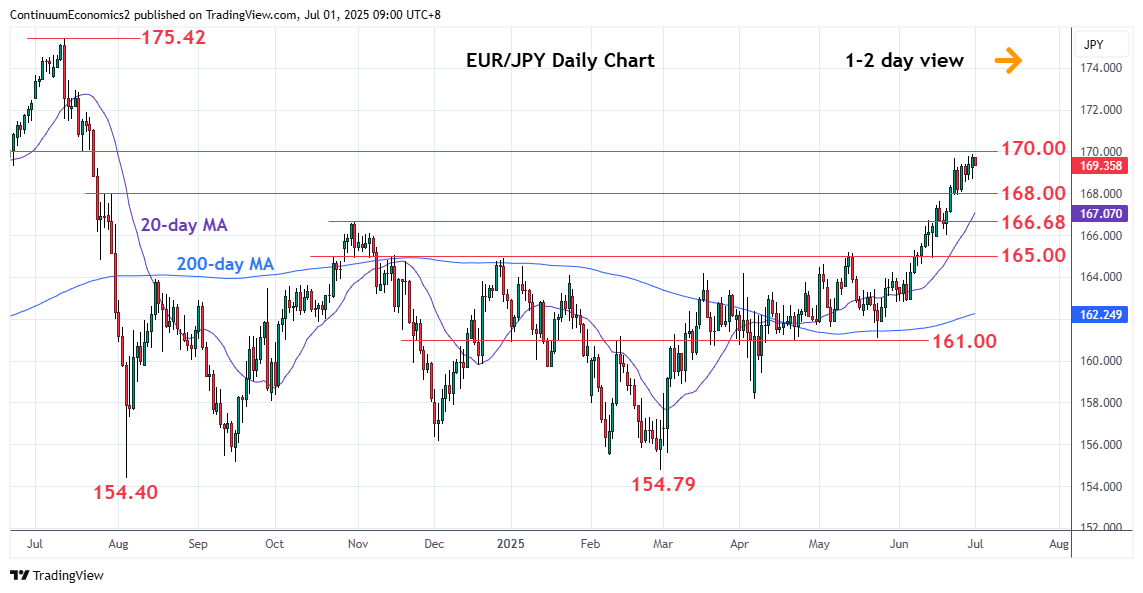

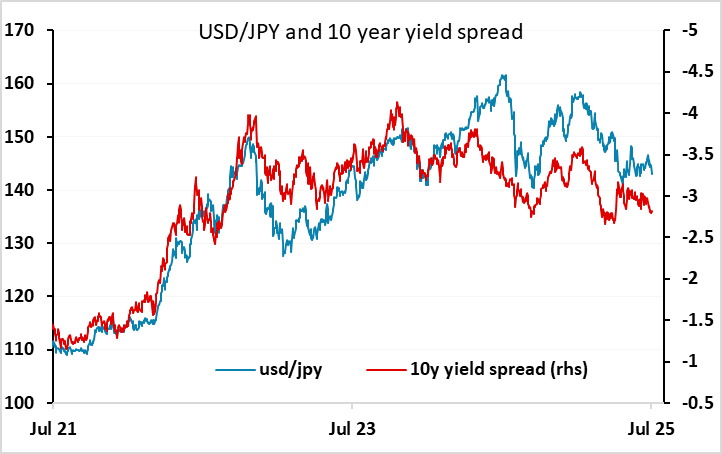

The structural decline in the USD is continuing in the European morning, with another new 10 year low in USD/CHF and a 4 year high in EUR/USD and GBP/USD. USD/JPY is starting to come to the party, with the JPY one of the best performers today, but at 143 is still 3 figures above its lows of the year. While other pairs are seeing the USD break away from the yield spread relationships that have held in recent years, USD/JPY remains (broadly) faithful to the correlation with the 10 year spread. The JPY remains generally very weak on the European crosses, trading close to the highs of the year in EUR/JPY and all time highs in CHF/JPY.

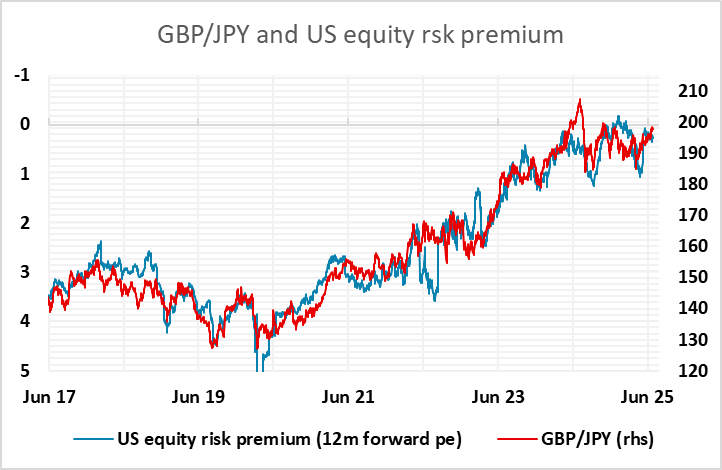

This JPY underperformance looks unsustainable, particularly since the JPY is coming from a record weak starting point, but JPY weakness remains underpinned for the moment by the resilience of equity markets. In spite of the rationale for USD weakness including worries about the impact of tariffs, the sustainability of the US’s fiscal position and the erratic nature of policy, the S&P 500 is holding close to all time highs with equity risk premia close to 20 year lows. This doesn’t sit particularly well with general USD weakness. Lower US yields and rising expectations of Fed easing are helping to support equities in this environment, but lower US yields typically imply higher equity risk premia, and should support the JPY on the crosses. Ultimately, we still see equities falling back as US growth slows. Downside may be quite limited if growth weakens only modestly and the Fed eases, but this will still mean higher risk premia and a stronger JPY. For now, technical suggest EUR/JPY may still hit a retracement level above 170 and GBP/JPY a level above 200, but if they do we suspect this will be a last hurrah.