India Rising: Upward Trajectory to Sustain

India's economic landscape in FY24 continues to impress with robust growth across various sectors. With a stellar GDP performance in Q2, heightened foreign investments, and impressive performance in areas like aviation and coal production, India’s growth trajectory appears to be increasing consistent and supported by strong policy measures. Given recent high frequency data, our expectation is now of a 6.9% y/y growth in real GDP, up from our earlier forecast of 6.4% y/y.

Sustained Private Consumption Drives Industrial Development

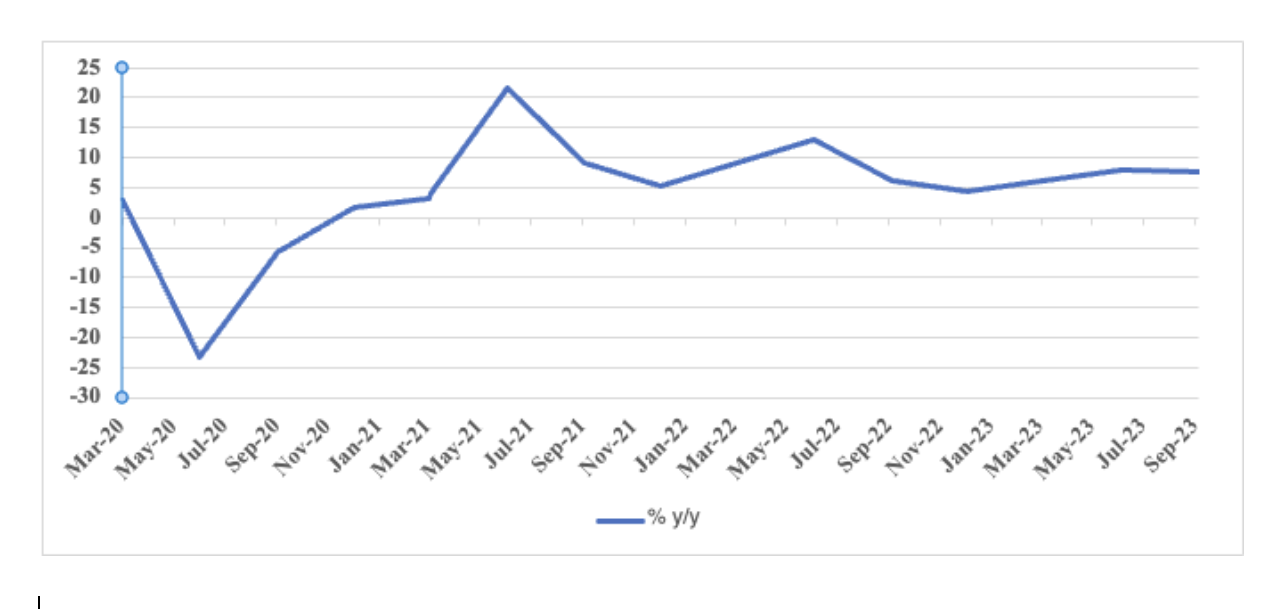

Figure 1: India Real GDP Growth (% change)

Source: Continuum Economics, MOSPI

Despite a slight dip in private consumption growth to 3.1% y/y in Q2, India's GDP soared by 7.6% y/y, surpassing market expectations. The manufacturing sector played a pivotal role, recording a stellar 13.9% y/y growth. Sustained consumer demand, coupled with near-full industrial sector capacity utilisation and reduced stock, contributed to this remarkable performance. The construction sector also thrived, reflecting increased demand for real estate and government-led infrastructure projects. All of these factors point to a consistently rising level of economic activity across the country. India’s growth was primarily driven by 10.9% y/y increase in capital formation and a 12.4% y/y increase in government spending. However, over the final quarter of FY24 the expectation is that funds would be channelled away from ministerial spends and towards cash infusions into India’s rural economy, given the upcoming elections in May 2024. Gearing up for the national elections, the government has stepped up pace on its mega infrastructure projects and is likely to provide a boost to rural consumption spend through putting out farmers loans, cash hand outs etc. Although a politically motivated move, this will support India’s rural economic consumption levels to increase, which although recovering are still below potential.

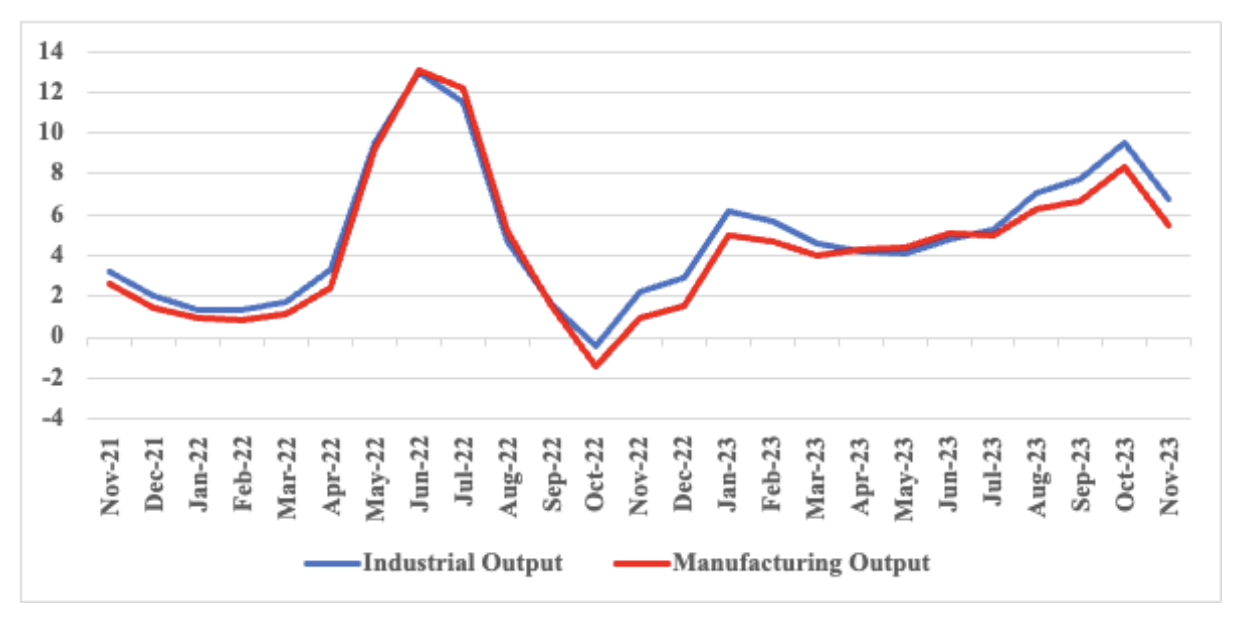

Figure 2: Industrial and manufacturing output (% y/y)

Source: Continuum Economics, MOSPI

Other signs of sustained private consumption levels are evident from the growth in domestic air passenger traffic, which rose 9% y/y increase in November 2023 alone, surpassing 12.7mn passengers. Meanwhile, on the automotive front, retail vehicle sales rose 21.4% yy/ in December. Of particular importance was the 28% y/y surge in two-wheeler sales, which often work as a proxy for middle income growth, and rural growth in India. It is noteworthy that both tractor and commercial vehicle sales have also been on the rise, albeit marginally, suggesting a recovery in agriculture and growth in logistics. The overall industrial growth though has been revealing choppy trends, given a surge ahead of India’s festive season September-October, followed by slowing growth of 2.4% y/y in November. This was further highlighted by reduced demand under the employment guarantee scheme. Employment under the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) declined by 7.1% y/y in December, reflecting improved economic activities and increased employment opportunities in sectors like agriculture and industry. The decline alleviates pressure on the government, which had already exhausted the allocated budget of INR 600bn for FY24 by November.

Persistent Export Earnings

India’s export sector is poised to match the previous year's level of USD$ 53bn, despite restrictions on key commodities. The government's proactive promotion of novel products, including bananas and value-added millet products, showcases a commitment to diversification. Meanwhile, India’s key service exports are showing promise even as demand from its main market slows. India’s services exports have found new markets in UAE, Saudi, and the wider region beyond Europe and the US, which is likely to spur growth over the coming years as well. Additionally, given the latest available data, October 2023 witnessed a 21-month high in net FDI into India, reaching US$ 5.9bn. Major source countries included Mauritius, Singapore, Cyprus, and Japan, with the manufacturing, retail, wholesale trade, energy, and financial services sectors attracting significant investments. Despite a global economic slowdown impacting cumulative net FDI for April-October 2023, the surge in October underscored India's attractiveness to foreign investors.

Fiscal Performance on Track

The Goods and Services Tax (GST, a key indirect tax) collection for December consistently above INR 1.6 trillion for six out of nine months, instills fiscal confidence and highlights the rising level of economic activity levels. Meanwhile, overall fiscal performance remains robust, with a 21% y/y increase in net direct taxes, amounting to INR 13.7 trillion (US$ 164bn) from April 1 to December 17. This positions the government well to meet fiscal targets, compensating for dwindling disinvestment receipts and increased expenditure on subsidies (particularly food subsidies).

Following these dynamics, we have revised our growth forecast for India upwards to 6.9% y/y in FY24. India’s economic resurgence is characterized by dynamic growth across sectors, from manufacturing and exports to air travel and coal production. With strong GDP growth, sustained FDI inflows, robust tax collections, and sustained policy from the in-coming government in May 2024 (we expect Narendra Modi to be re-elected), India is likely to witness above 6% y/y growth over the medium term.