South Africa’s Load Shedding Remained a Strong Headwind in 2023

Power cuts (load shedding) remained a major headwind for South Africa in 2023. When we analyse the last four months of the year, we see the situation relatively got better in the first half of November, particularly after strong scheduled electricity blackouts and load shedding in September, but the nightmary power cuts returned back in late November due to numerous factors such as breakdowns of coal-fired power plants, unit repairs, theft of electricity transmission infrastructure and widening demand-supply gap. We think South Africa and China cooperation in clean energy investments and electricity transmission coupled with support from G7 Just Energy Transition Partnership and private sector’s uptake of alternative energy sources can help relieve loadshedding and ignite long-term electricity production in 2024-2026, but the transition will take time.

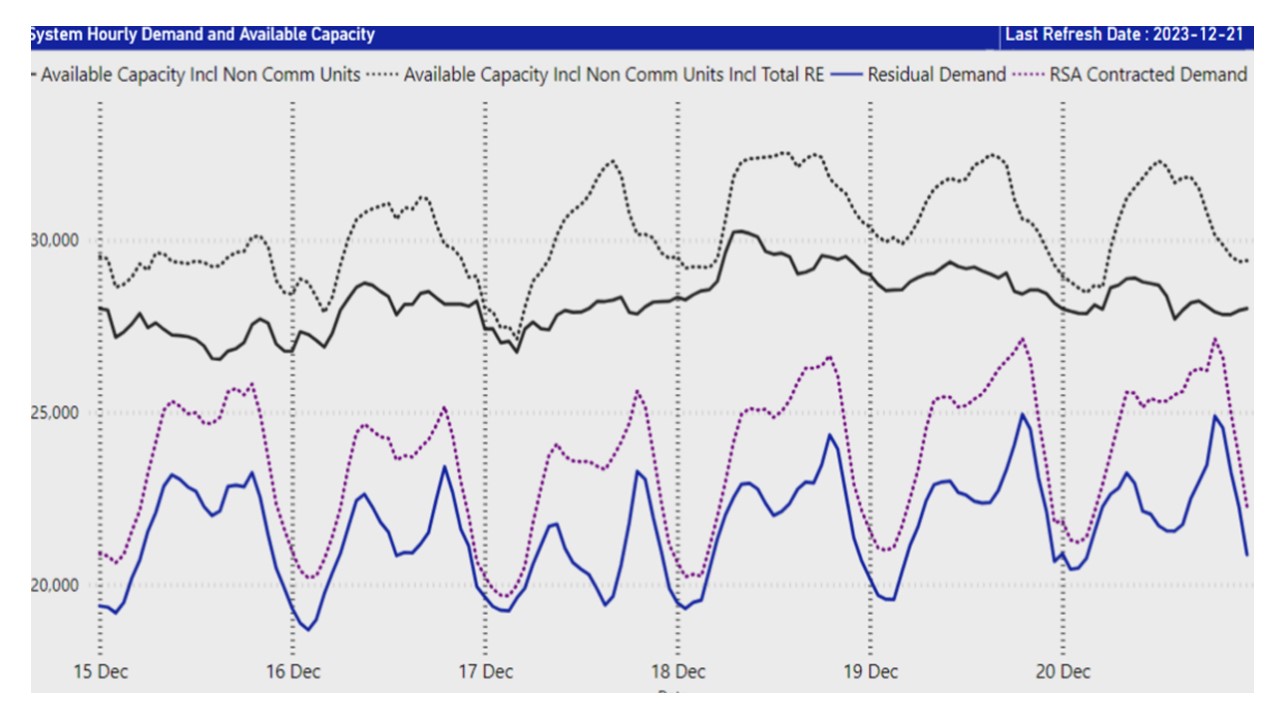

Figure 1: System Hourly Demand & Available Capacity, December 15- December 21

Source: Eskom

(Note: When we compare hourly RSA contracted demand against available capacity to check what the amount of surplus/shortfall was in the past week; we see that available capacity could not match with the total RSA contracted demand for specific periods during the day).

Taking into account that average estimated impact of loadshedding on South Africa’s GDP continues to be around 1.5%, the power cuts remained a major headwind in 2023 so far. Despite temporary short-term recoveries, we feel the major problem continues to be the increasing trend in overall demand combined with insufficient generating capacity and other infrastructure related problems like breakdowns of power plants, and long unit repairs. When we analyse the recent developments, it appears there has been a relative relief in the first half of November, following Stage 5 and Stage 6 loadshedding intermittingly implemented in September. Despite Stages 1-3 loadshedding was exercised in the first half of November, the blackouts got worse in the remainder of the month as Eskom restarted Stages 4-6 loadshedding. (Note: Eskom mentioned that the implementation of Stage 6 loadshedding in the second half of November has allowed the replenishment of the emergency reserves at pumped storage and Open Cycle Gas Turbine power stations and helped Stage 4 loadshedding was implemented in the last week of the November). Stages 2-4 blackouts were implemented in early December.

Despite problems, president Cyril Ramaphosa seemed optimistic stating that the work of the electricity ministry would ensure that loadshedding was a thing of the past by 2024, while we think the current situation is not that bright. Ramaphosa mentioned that “Energy has been a great drawback to us, but we are working on it, and we are certain that by 2024, the energy crisis will be over.” On the Eskom front, despite there has been drops in breakdowns at Eskom’s power stations and less severe loadshedding suspensions in December, it appears reaching Eskom’s energy availability target for March 2024 will not be straightforward. (Note: According to Medium-Term System adequacy outlook 2024-2028 published by Eskom on October 30, Eskom plans to reach the target of hitting an Energy Availability Factor (EAF) of 65% by March 2024, and reaching 70% by March 2025) (Details are here). According to a media statement by Eskom on December 13, however, EAF deteriorated to 55.30% resulting in frequent implementation of loadshedding for the period ended September 30. The latest data shows that the power company is struggling to get further than an EAF of 55% – which is even lower than the 60% EAF target Eskom set for March 2023.

Apart from EAF, Eskom recently said there had been an improvement in the performance of its generating units. This is good news for the country as Eskom seems to accelerate its maintenance, which should help power stations to work better as soon as the demand would start to surge in 2024 while the demand and breakdowns are lesser by the end of 2023. Despite positive developments, we are of the view that Eskom still needs to find an immediate solution to the crisis either by improving its power availability by upscaling generation and EAF or by reducing demand while we think that it is not straightforward to improve availability in the short run. The country had targeted lifting the share of renewable energy in its power generation mix from 11% currently to 41% by 2030, and we think both private and government investments may accelerate in 2024, despite major reforms having to wait on the 2024 election outcome. As South Africa aims to diversify its generation mix and reduce greenhouse gas emissions via limiting coal usage, we foresee the integration of renewable energy sources would not be so easy. Taking into account that South Africa and China recently signed agreements on cooperation in clean energy investments and electricity transmission, and Germany’s KFW development bank signed an agreement in November 2023 to lend the country €500 million below market rates to help the country during its transition from the use of coal-fired electricity under the framework of G7 Just Energy Transition Partnership, we think these initiative will likely help the country to increase the supply of electricity (here). According to sources, the impact of load-shedding on the South African economy will be negligible from 2025 due to the private sector’s rapid uptake of alternative energy sources, adding 6,000 MW to the grid by the end of 2025. Within this framework, we also foresee that the country can deal with loadshedding problem in 2024-2026, but this require a strong political will and continued investments.