Preview: Due January 15 - U.S. December CPI - Stronger overall, core rate maintaining trend

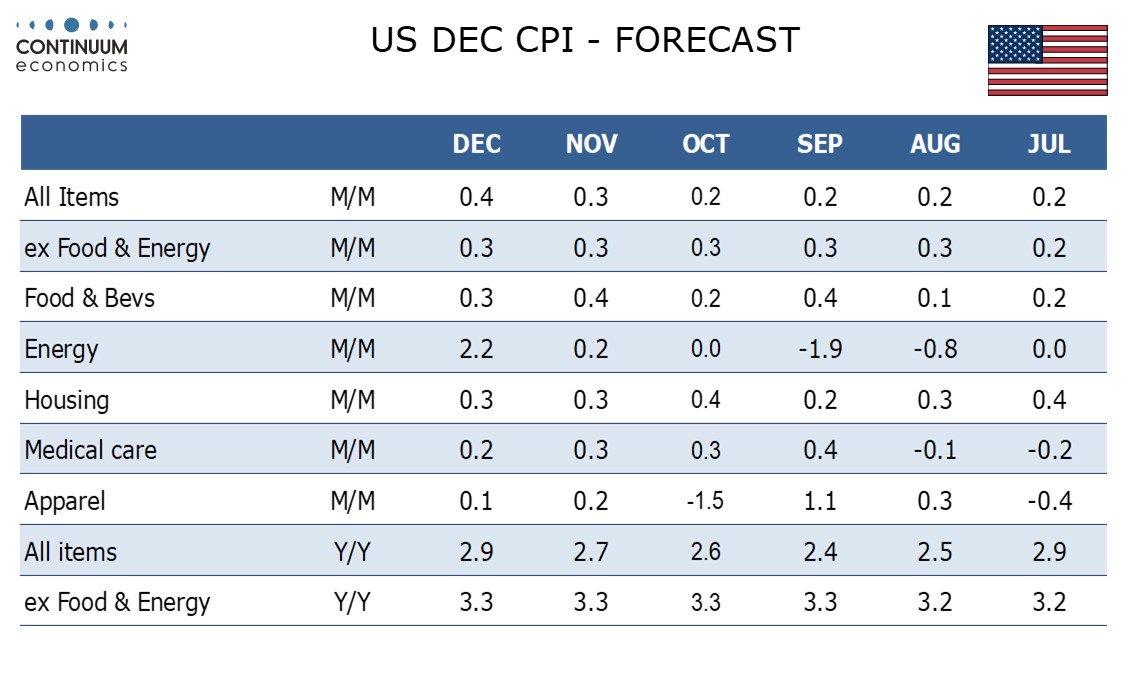

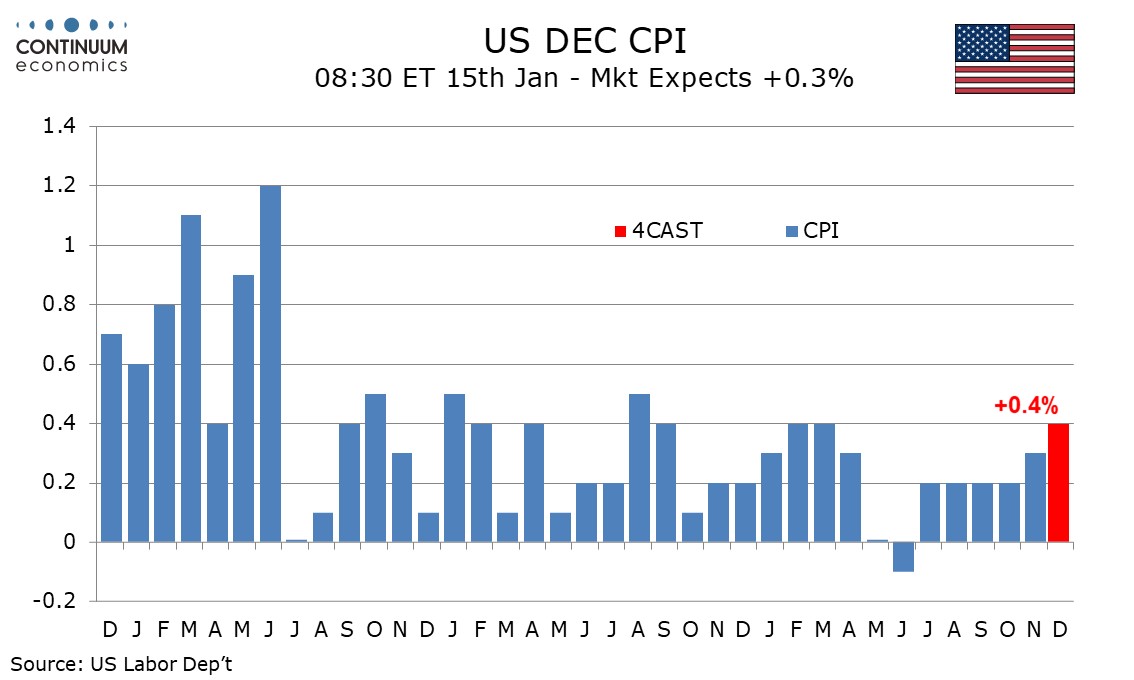

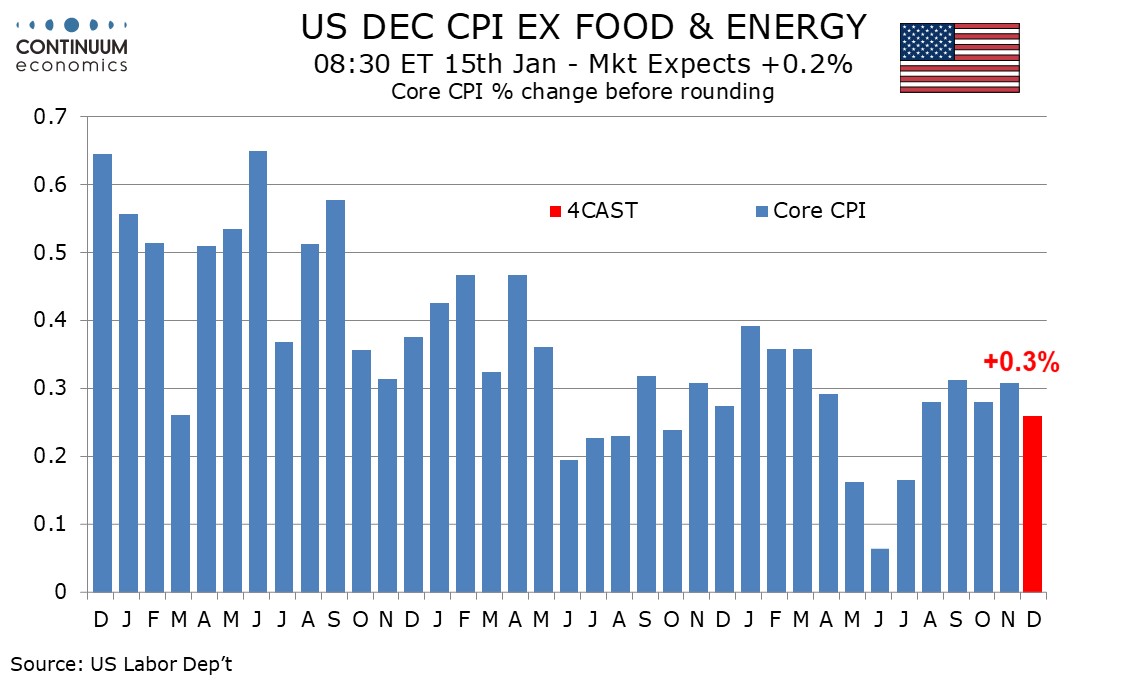

We expect December’s CPI to increase by a nine-month high of 0.4% overall with a fifth straight 0.3% increase ex food and energy. We expect the ex-food and energy index to increase by 0.26% before rounding, which would make it the softest of the five straight 0.3% gains in the core rate.

Gasoline prices saw little change before seasonal adjustment but are likely to see a significant increase seasonally adjusted. Food with a 0.3% increase is likely to remain supported by recent gains in the price of eggs.

November’s core CPI saw owners’ equivalent rent slow to 0.2%, its slowest since early 2021, after October picked up to 0.4%. We expect December to return to September’s 0.3% pace, still consistent with a loss of momentum in trend. However, a slightly firmer gain in owners’ equivalent rent may make a slowing in core CPI to 0.2% hard to achieve, even if, as we expect, most components of core CPI see some slowing from November. Autos look unlikely to repeat strength seen in November, but a recent negative trend in used auto prices appears to have found a base.

Core CPI is showing some residual seasonality even after seasonal adjustments and whether early 2025 data shows the strength seen in early 2024 and 2023 will be crucial. Recent data has looked similar to that of late 2023, and a fifth straight 0.3% rise ex food and energy would deliver a fourth straight 3.3% increase in the yr/yr ex food and energy pace. We expect overall CPI to pick up to 2.9% yr/yr from 2.7%, a third straight acceleration from September’s 2.4% but still below the yr/yr core rate.