Mexico CPI Review: CPI Grew 0.1% in February

The February CPI figures released by Mexico's National Institute of Statistics and Geography show a slight 0.1% increase, aligning with expectations. Year-on-year CPI dropped to 4.4%, ending a three-month rise. Food and Beverages notably fell by 1.3%, while Housing and Transports saw positive growth. Core CPI rose marginally to 5.3%. Inflationary pressures from wage increases and fiscal policies persist, though Banxico's cautious approach may lead to a 25bps cut, maintaining tightness through 2025. Inflation is expected to decelerate to 4.0% by end 2024.

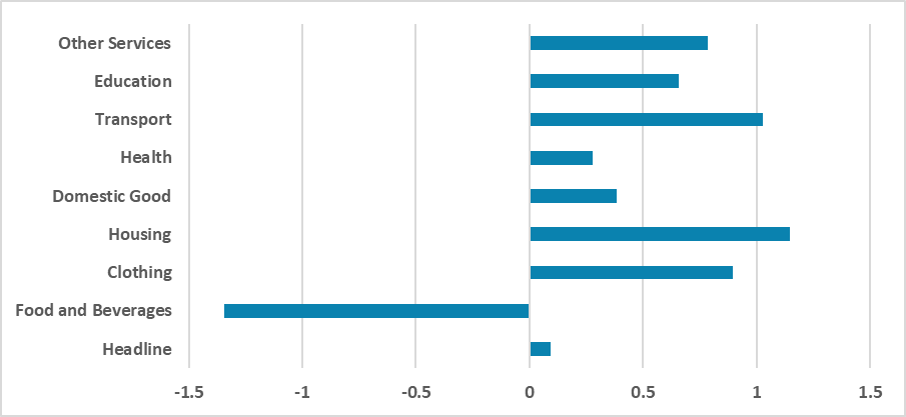

Figure 1: Mexico CPI by Groups (%, m/m)

Source: INEGI

The National Institute of Statistics and Geography of Mexico has released the CPI figures for February. The data show that the CPI has increased by only 0.1% during February, in line with our preview and most market participants. Therefore, year-on-year CPI has dropped to 4.4% from 4.8% in January, ending the rising spree of the last three consecutive months. Looking at specific groups, the biggest contributor to the strong fall of inflation in February was Food and Beverages, which fell 1.3% during the month. All the other groups presented positive inflation, with Housing growing 1.4%, influenced by the rise in energy tariffs, and Transports, which grew 1% in the month, influenced by the rise in Diesel and Gasoline.

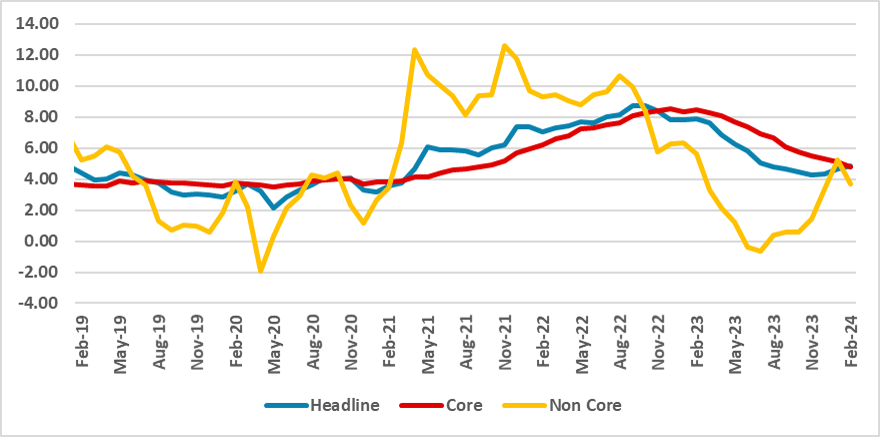

Figure 2: Mexico’s CPI (%, Y/Y)

Source: INEGI

Core CPI has grown 0.5% during February, and its year-on-year index has risen marginally to 5.3% from 5.2%. The bad news comes from the Services CPI, which grew 0.6% in the month. In the non-core group, the 4.1% drop in the non-core food group more than compensated for the rise in energy tariffs (+2.1%); thus, non-Core CPI fell 1.1%.

The story moving forward will be a dispute between two major forces. First, the labor market is running hot, with wage inflation possibly putting pressure on core CPI. Additionally, in this second phase of the disinflation process, CPI tends to fall slower, especially due to core inflation stickiness. Additionally, a looser fiscal policy will also have an inflationary impact. On the other front, monetary policy will continue to be contractionary, acting as a handbrake against inflation. The road to 3% is still quite far, and expectations for 2025 have yet to converge on this target.

However, inflation has already fallen sufficiently for Banxico to start their cutting strategy. Recently, the board has dropped the commitment to sticking with the 11.25% policy rate level, indicating that the cut would depend exclusively on data. As Banxico will be cautious, we believe they will follow a 25bps cut route. This will allow them to maintain the general level of tightness, especially for 2025, due to the lag in monetary policy actions. We see inflation continuing to decelerate in 2024, ending the year at 4.0%.