CBR’s October MPC Summary Signals Another Rate Hike in December

Bottom Line: Central Bank of Russia (CBR) published the summary of October MPC meeting on November 6, and signaled another rate hike in December by noting that “While a rate hike at the next meeting is not predetermined, the probability is very high,” which can be associated with elevated inflation, weakening RUB and worsening inflation expectations. Under current circumstances, we now expect CBR to hike the key rate by 100 bps to 22% during the MPC scheduled on December 20.

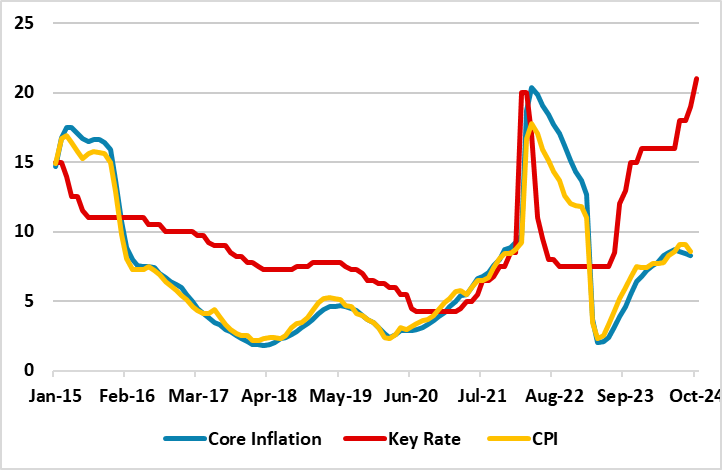

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – October 2024

Source: Continuum Economics

Despite aggressive tightening continues with pace in Russia as the CBR decided to lift the policy rate by 200 bps to 21% during the last MPC meeting given inflationary risks and its hawkish forward guidance, it appears the economy remains overheated as the growth in domestic demand is still significantly outstripping the capabilities, military spending is growing, and inflation expectations is on the rise. (Note: The inflation expectations reached 13.4% in October from 12.5% in the previous month).

More importantly, CPI is running above the CBR’s 2024 inflation forecast range of 8%-8.5%, which was revised as of October 25. (Note: CPI hit 8.6% YoY in September as MoM price growth fastened to 0.5% in September from 0.2% in August driven by the food and services prices, which surged by 9.2% and 11.6% in annual terms, respectively). We feel domestic demand, boosted by lending, rising wages and increased budget spending, continue to outrun production capacity.

According to the summary of October MPC meeting released on November 6, the policymakers agreed on the need to reinforce a tough signal due to growing inflation risks and to prevent premature expectations of an end to the tightening cycle. “While a rate hike at the next meeting is not predetermined, its probability is very high,” the bank noted.

The MPC summary also demonstrated that October meeting weighed rate hikes from 20% to 22% before the majority settled on 21% while CBR highlighted that most participants agreed that a sharp rate shift could heighten financial market volatility.

As restrictive monetary policy suppresses prices with lagged impacts, we feel cooling inflation off will take longer than CBR anticipates since inflation expectations of households and businesses continue to edge up. We think the risks to the outlook remain upside as the fiscal policy is making a big contribution to domestic demand coupled with surging military spending due to ongoing war in Ukraine.

CBR will likely have hard times in Q4 and H1 2025 until inflation starts cooling off, RUB stabilizes and inflation expectations would converge to CBR’s forecasts. Given CBR’s hawkish forward guidance, we now think it will not be surprising if CBR will decide to hike the key rate to 22% during the MPC scheduled on December 20.