FOMC Preview for January 28: No change with early 2026 data awaited

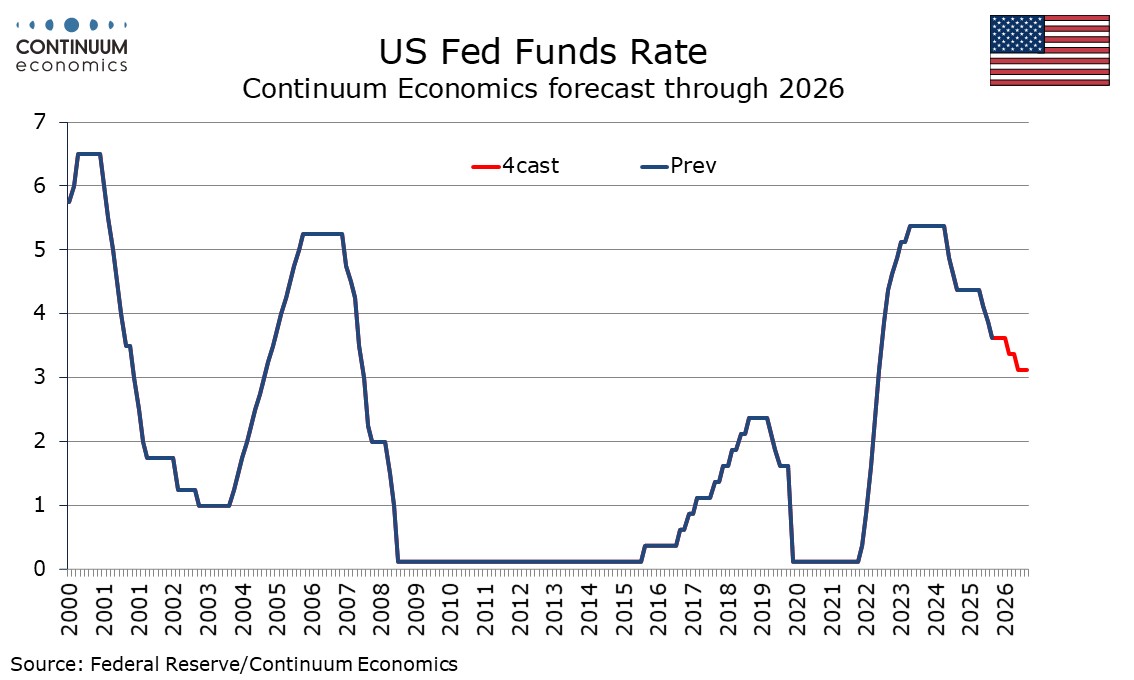

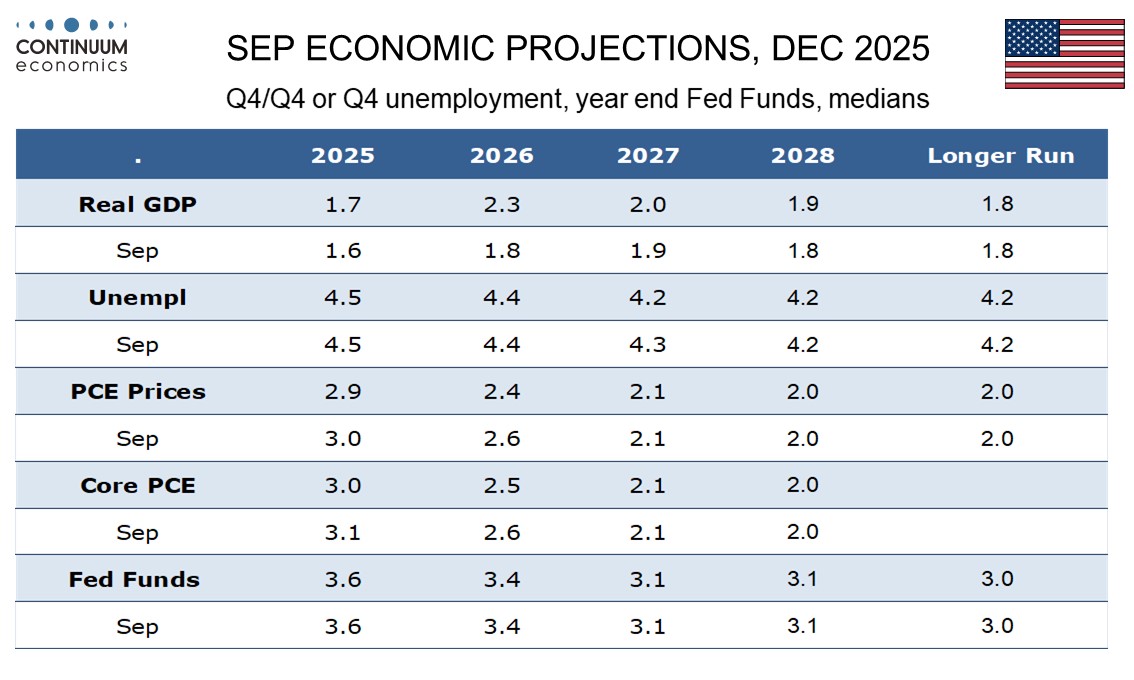

The FOMC meets on January 28 and rates look set to be left at 3.5-3.75%, and while rates are likely to move lower in 2026, they are unlikely to give many hints over what is likely in March, with future decisions dependent on data. The FOMC will not update its economic forecasts or dots at this meeting.

We expect only one dissenting vote, with dovish Governor Stephen Miran likely to call for a 50bps easing. This will signal broad support for Chair Jerome Powell at the FOMC, despite pressure from President Trump for lower rates. The voting line up will change, with hawks Hammack and Logan, moderate Kashkari and the slightly dovish Paulson replacing the recently hawkish Schmid, Goolsbee and Musalem, as well as moderate Collins. The net effect of this on policy decisions will be marginal.

The statement will be fine-tuned to take recent data into account, but few other changes are likely. December’s statement described growth as moderate. Given a stronger than expected Q3 GDP and positive signals on Q4 any fine-tuning will be positive but cautiously so. Job gains remain quite slow, but December’s unemployment rate of 4.4% was unchanged from September. December’s statement stated unemployment had edged up from September. December’s statement noted that inflation had moved up since earlier in the year. It now appears to be stabilizing, though the FOMC is likely to continue describing it as somewhat elevated.

All this will allow the Fed to take a cautiously optimistic view on both growth and inflation, suggesting no urgency for any policy change. The Fed will be watching for incoming data. While any change from the currently fairly flat labor market picture would be noted, it is inflation data that is likely to be of most significance. Recent years have tended to see a pick up in Q1. If that occurs this year, the Fed may pause into Q2, as is our expectation, though further progress on inflation would raise confidence that inflation is heading back towards target. We do not expect easing in March, but it is unlikely to be ruled out. At the press conference, Powell will face many questions about the future of the Fed. He will choose his words carefully, but will stress the importance of Fed independence.