USD flows: USD gains modestly on CPI

USD up modestly as CPI slightly above consensus and claims data weak. EUR resilient but downside favoured

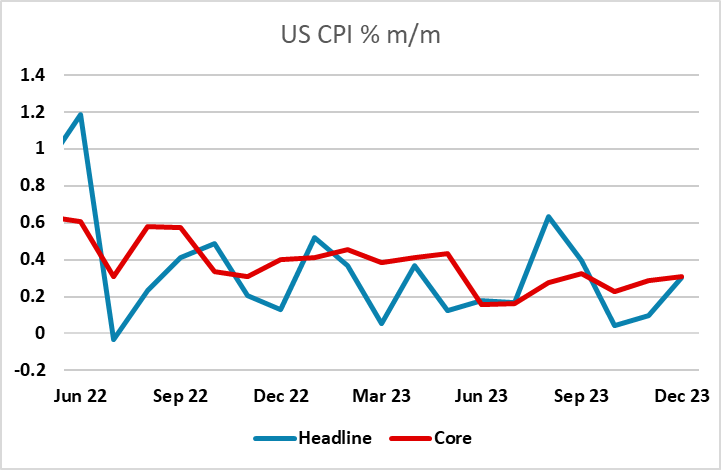

US CPI on the strong side of expectations, with headline and core data both printing 0.3%, but y/y gains more clearly on the strong side at 3.4% and 3.9% respectively, triggering USD gains across the board. The higher y/y prints likely reflect market expectations being on the low side of 0.3% (i.e. 0.25-0.29) when in fact both headline and core were (marginally) above 0.3. However, the initial move has been quite modest, but supported by another decline in continuing claims and another low initial claims number, the stronger CPI data should lead to more sustained USD gains as US yields move higher. Initially, there has been almost no movement in US yields, which may reflect positioning, expectations of a better January number and the high contribution of shelter, which was responsible for half of the 0.3% rise. But we would expect the USD to at least hold its initial gains.

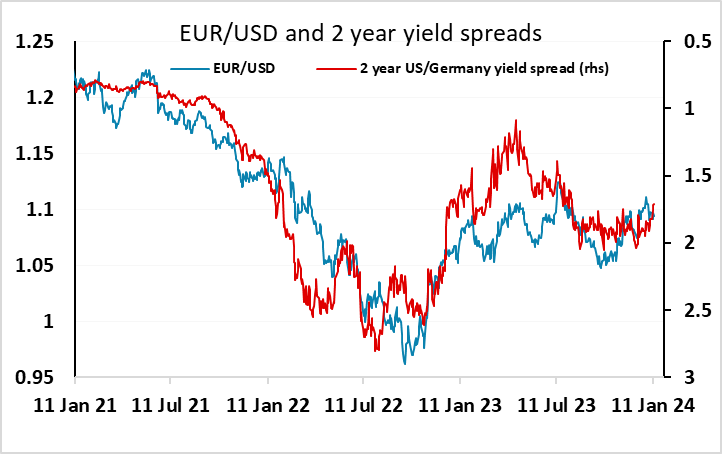

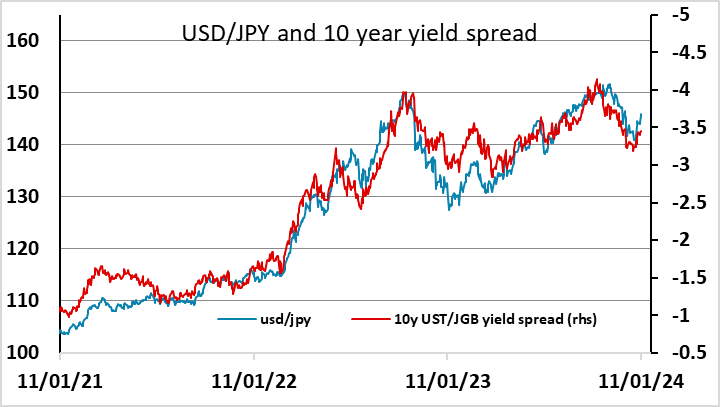

Initially, the JPY and the AUD have fallen the most on the release, with the EUR outperforming. But without more significant gains in US yields, it’s hard to make a case for sustained USD/JPY gains as going into the data the USD/JPY was already looking stretched relative to the usual yield spread correlation. Cross movement has been modest, but the JPY has weakened against the EUR, with EUR/JPY printing a high just below 160, but we would expect EUR/JPY to slip back if equities retain their initial negative tone seen after the data.