EUR, USD, JPY, GBP, AUD, CAD flows: Early risk positive tone, JPY remains soft

Likely to be a quiet Friday with holidays extended. Mild risk positive tone with JPY still weak

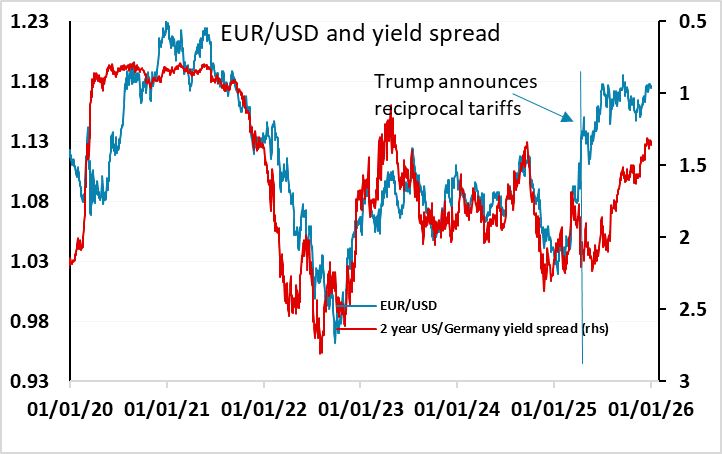

It’s likely to be a very quiet first trading day of the year with a lot still on holiday. Japan, China, Switzerland and New Zealand are on official holidays, but many will not be returning until next week. There hasn’t been a great deal of change in the FX landscape over the past couple of weeks. EUR/USD has traded a 1.17-1.18 range since December 11, while USD/JPY has traded within the 155.50-157.80 range established on December 19 when the BoJ raised rates. The USD failed to benefit from the stronger than expected US Q3 GDP data released on December 23rd, with the riskier currencies being favoured as equities moved to new highs once again, with the S&P500 peaking on December 26. Final manufacturing PMIs for December are unlikely to have much impact today.

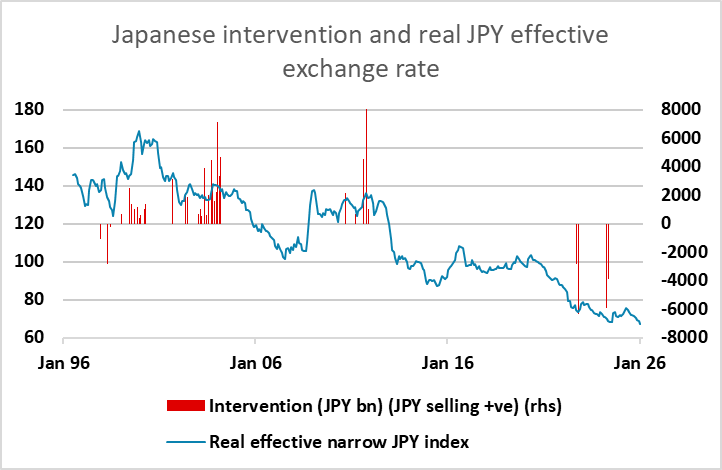

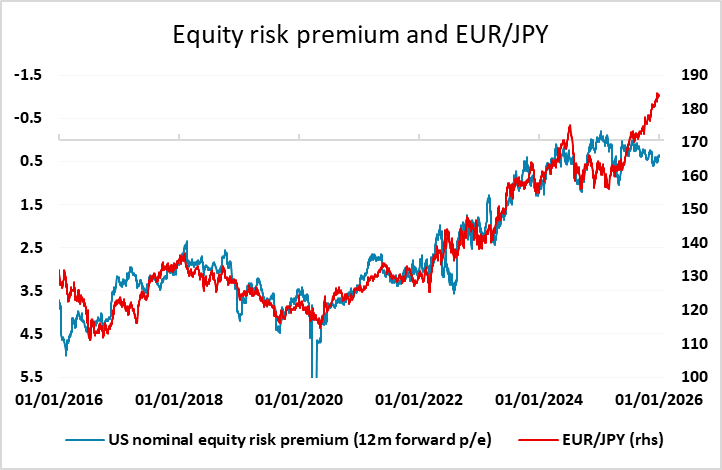

Asian trading saw the JPY under a little pressure with the AUD and CAD making some initial gains in a generally mildly risk positive scenario. AUD/JPY stopped just short of the December 29 high of last year. However, we doubt we will see further significant moves today, with the focus now shifting to next week’s data, with the December US employment report prominent. GBP has also been firm in the last couple of weeks, but all the JPY crosses continue to look dramatically out of line with both fundamentals and the normal yield spread and risk metrics. The risk of intervention from the Japanese authorities remains significant if we see JPY weakness extend next week, with the JPY at new all time low on a real trade-weighted basis.