Mexico: Economy Contracts in August, Slowdown Continues

Mexico’s economy contracted by 0.3% in August, with agriculture down 9% and the industrial sector shrinking by 0.5%. Construction dropped 3.6%, and employment growth slowed. Weaker internal demand and stabilizing U.S. demand signal more challenges ahead. Banxico may cut rates further, but subpar growth is likely in 2025, amplified by fiscal consolidation efforts.

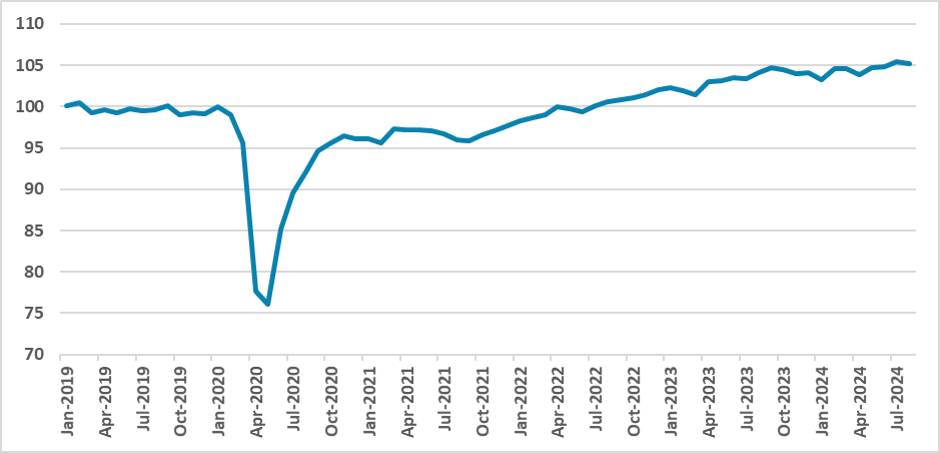

Figure 1: Mexico’s Monthly Economic Activity Index (Seasonally Adjusted)

Source: INEGI

Mexico’s National Statistics Institute has released its monthly estimates for economic activity (IGAE) for August. The data show that the Mexican economy contracted by 0.3%. If we combine this data with Banxico’s advanced estimates for economic activity, Mexico will likely experience an economic contraction in Q3, which was not anticipated by most market participants. Agriculture dropped by 9% in the quarter, while the industrial sector—which has been the main driver of Mexico's recent growth over the past year—contracted by 0.5% in the month. We also highlight the significant decline in the construction sector, which contracted by 3.6% in the month.

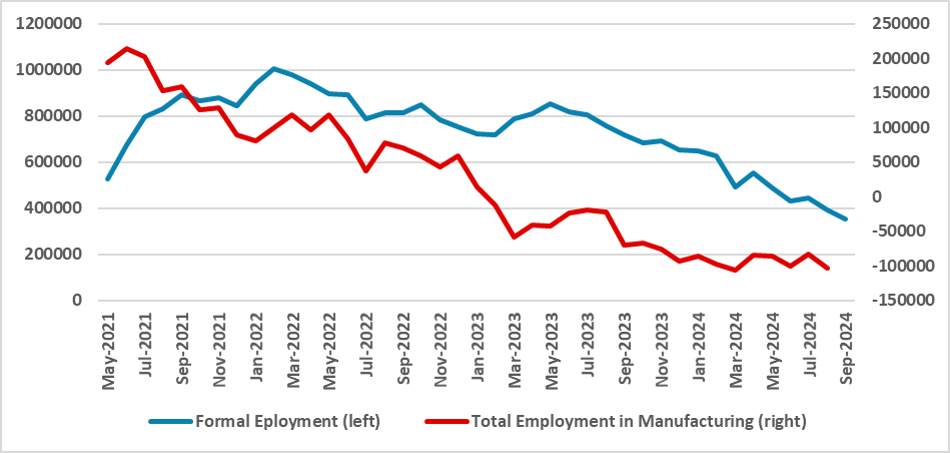

Figure 2: Employment (Variation in the last 12 months)

Source: IMSS and INEGI

Further signaling the slowdown, employment numbers are also plummeting. Formal employment, affiliated with social security, is decelerating, registering only a 35,000 increase in the past 12 months. One important indicator for job growth—manufacturing employment—is actually 10,000 lower than in the previous 12 months.

The implications of this deceleration are twofold. First, internal demand is weakening. Although Mexico continues to register a low unemployment rate (2.5%), consumption is expected to stabilize over the next few months. This will likely push the output gap back toward negative levels, allowing Banxico to further cut the policy rate. It also indicates that external demand from the U.S. is stabilizing after the strong surge seen last year. Finally, we believe that the timing of the deceleration will amplify the negative impact of the institutional reforms promoted by the current administration.

The extent and duration of the contraction remain to be seen. Monetary policy will only enter expansionary territory in 2025, and the government seeks to implement fiscal consolidation next year, further reducing internal demand. This suggests that the likelihood of Mexico experiencing subpar growth in 2025 is increasing.