USD, JPY, CHF flows: JPY and CHF weaken after lower US claims data

Correctve gains extend for the USD and other higher yielders

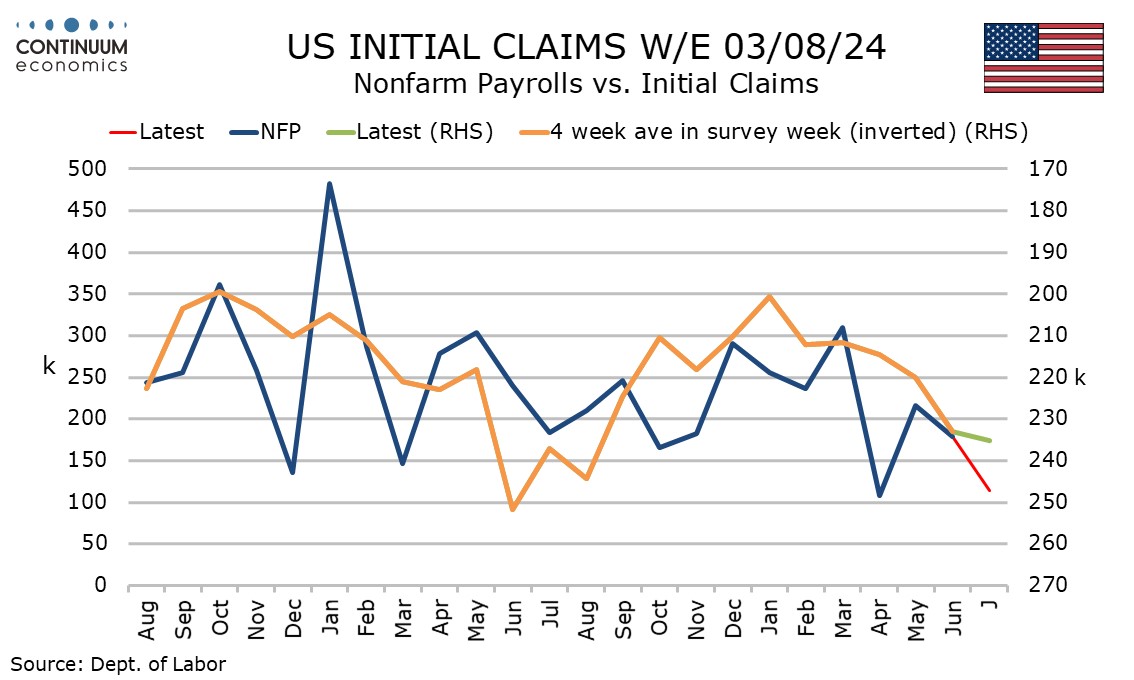

The USD has managed a general recovery after the lower than expected initial jobless claims data for the latest week. There was also a small downward revision in the continuing claims data, but the latest week showed a rise to new highs after the revision While the data doesn’t show a clear deterioration, the underlying picture continues to be one of a gradually deteriorating labour market. The fall in initial claims more than fully reverses a preceding 15k increase though the 4-week average of 240.75k is the highest since August 26 2023.

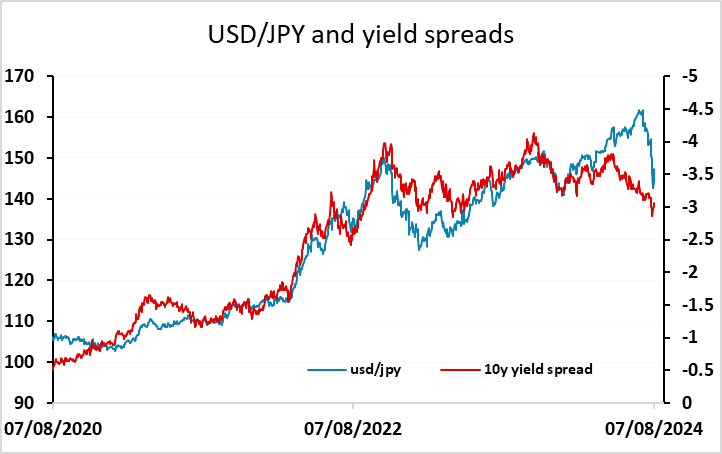

The USD is generally higher, but the JPY and CHF have weakened the most and the AUD and NOK have held their own with equity futures recovering strongly. There may still be scope for more gains in USD/JPY with the 1.4791 high from Wednesday an initial target, with similar scope for USD/CHF gains. Big picture we continue to see scope for a further correction higher in the JPY, but in the short run, there is potential for a move back to the retracement level at 148.50.