Preview: Due February 2 - U.S. January Employment (Non-Farm Payrolls) - Labor Market Still Strong

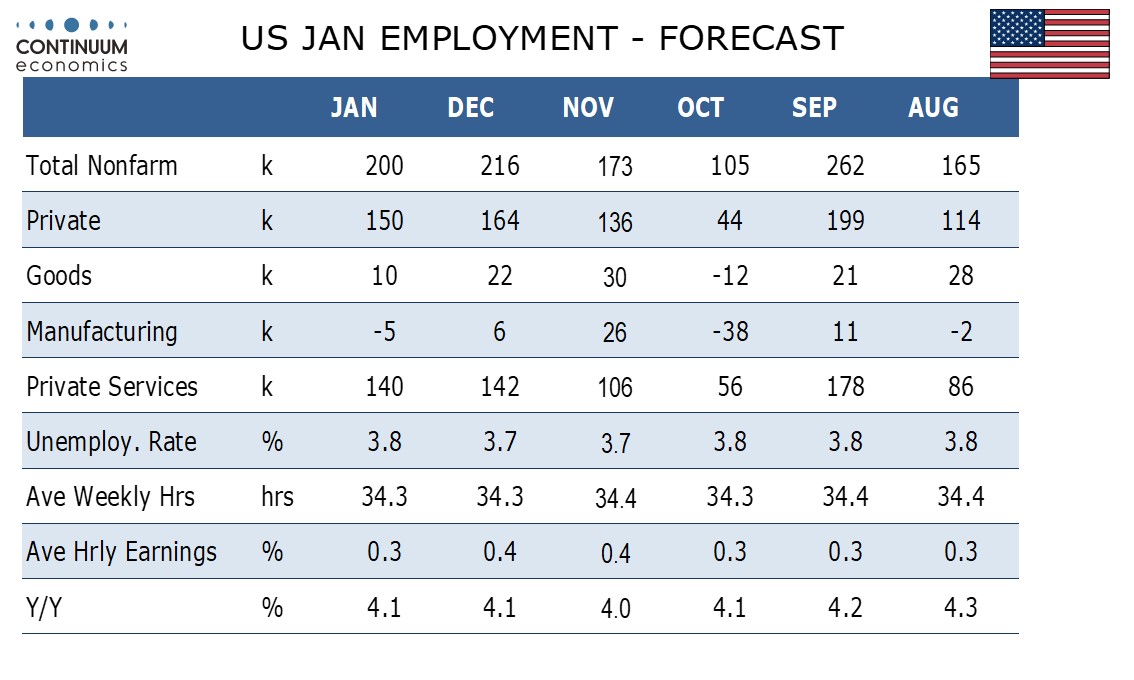

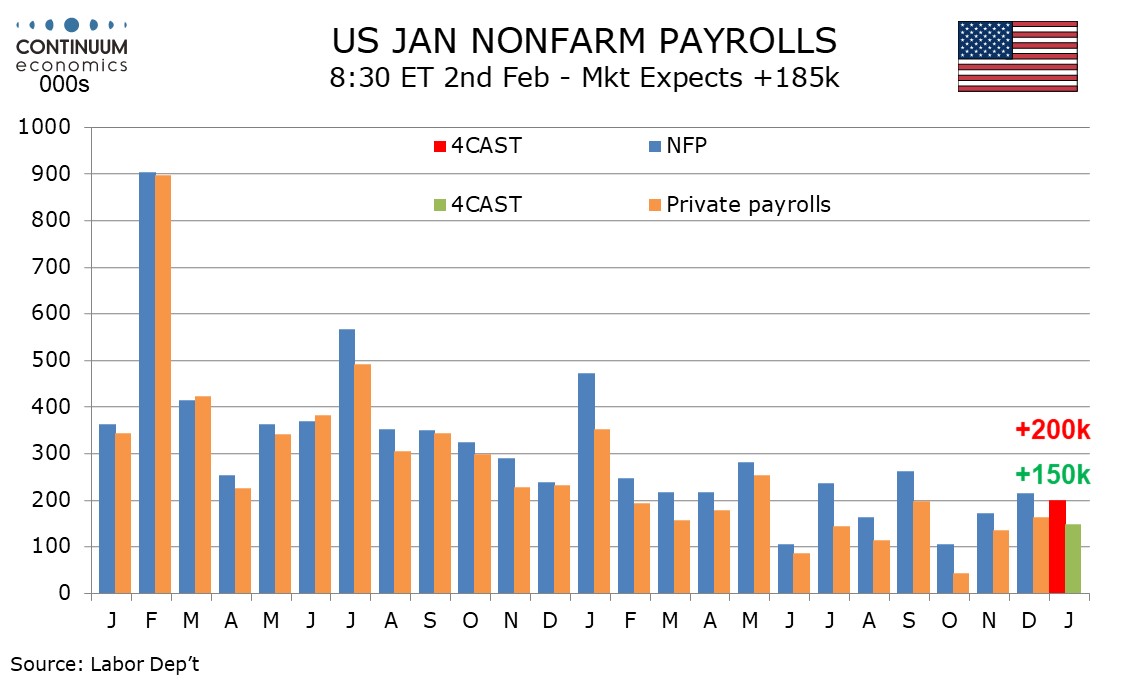

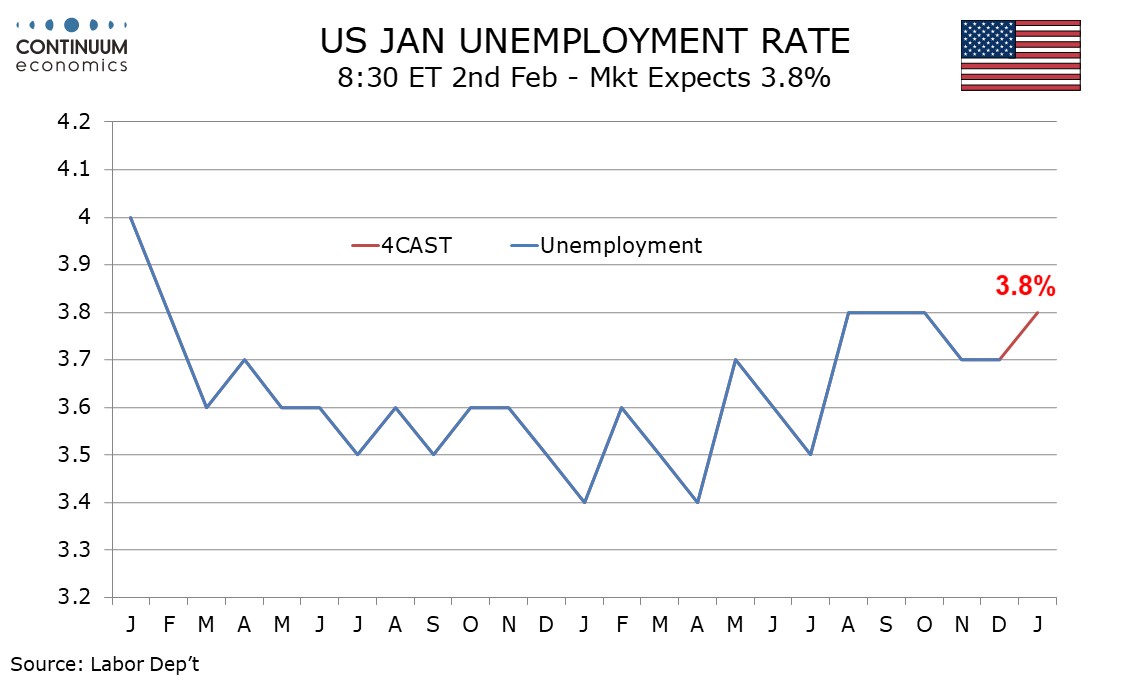

We expect a 200k increase in December’s non-farm payroll, with private payrolls up by 150k, slightly slower than December’s respective outcomes of 216k and 164k but stronger than the October and November reports. We expect unemployment to nudge up to 3.8% from 3.7% and a 0.3% increase in average hourly earnings to follow two straight gains of 0.4%.

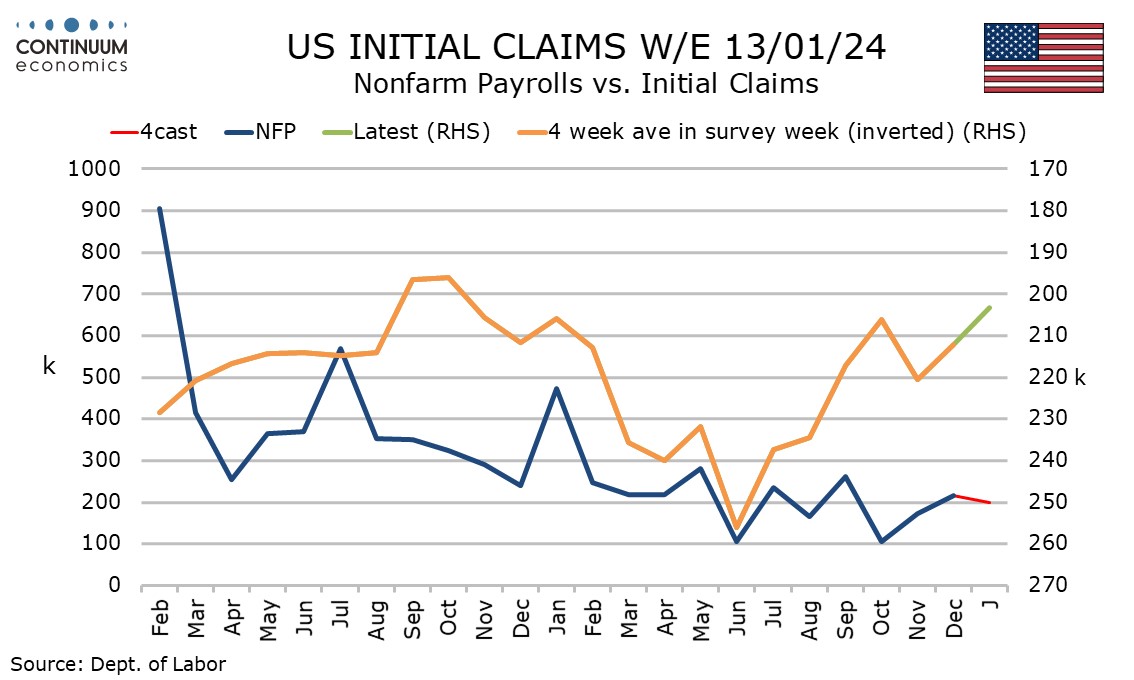

Risks are reasonably balanced around our 200k forecast but there is greater uncertainty than usual. Higher December job openings and stronger labor market perceptions in January's consumer confidence report imply upside risk. Lower initial claims (despite an uptick since the payroll was surveyed) are another positive signal.

Seasonal adjustments are strongly positive in January to compensate for expected seasonal layoffs. January in 2023 was well above trend with a rise of 472k (originally reported as 517k) as seasonal layoffs failed to materialize, but weather was then unusually mild for January. This January, some harsh weather may weigh against the upside risks. ADP data, which tends to be less weather-sensitive to payrolls, slowed in January after a stronger December.

Adding to uncertainty is January payrolls being the month in which annual historic revisions take place. Risk on the revisions leans to the downside. The Labor Dept’s preliminary estimate for the March 2023 benchmark revision is for a downward revision of 306k. The average revision for the first eleven months of 2023 is negative at 40k per month. Still, dramatic revisions which significantly undermine the picture of a strong labor market are unlikely.

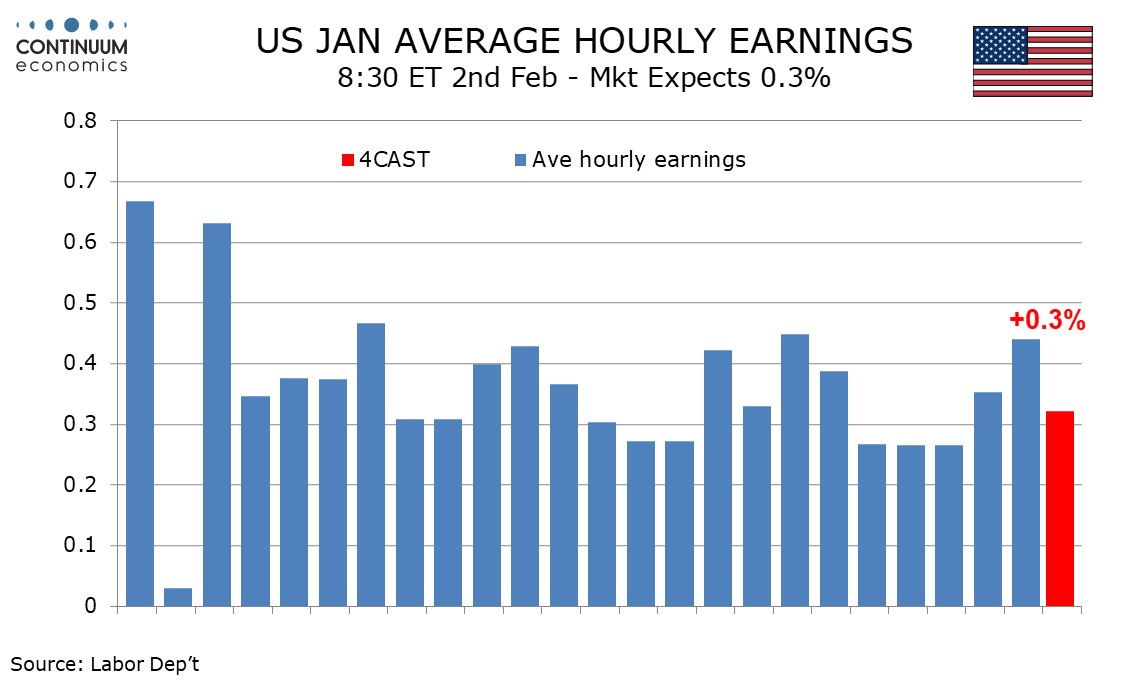

0.4% gains in average hourly earnings in November and December, with the later even stronger before rising, followed gains of 0.3% in August, September and October, all of which were slightly below 0.3% before rounding. Trend is probably closer to 0.3% than 0.4% and we expect January to see a 0.32% increase before rounding. This would leave yr/yr growth at 4.1%, unchanged from December.

Recent Household Survey data, which calculates the unemployment rate, have been weaker than the non-farm payrolls, which adds to the case for payroll revisions being negative. However December’s Household Survey was particularly weak with employment and the labor force both down by over 650k, leaving unemployment unchanged at 3.7%. Some rebound is likely in January, though we feel the labor force will rebound by more, lifting unemployment to the 3.8% rate seen in August, September and October. Unemployment remains low, but does appear to have bottomed.

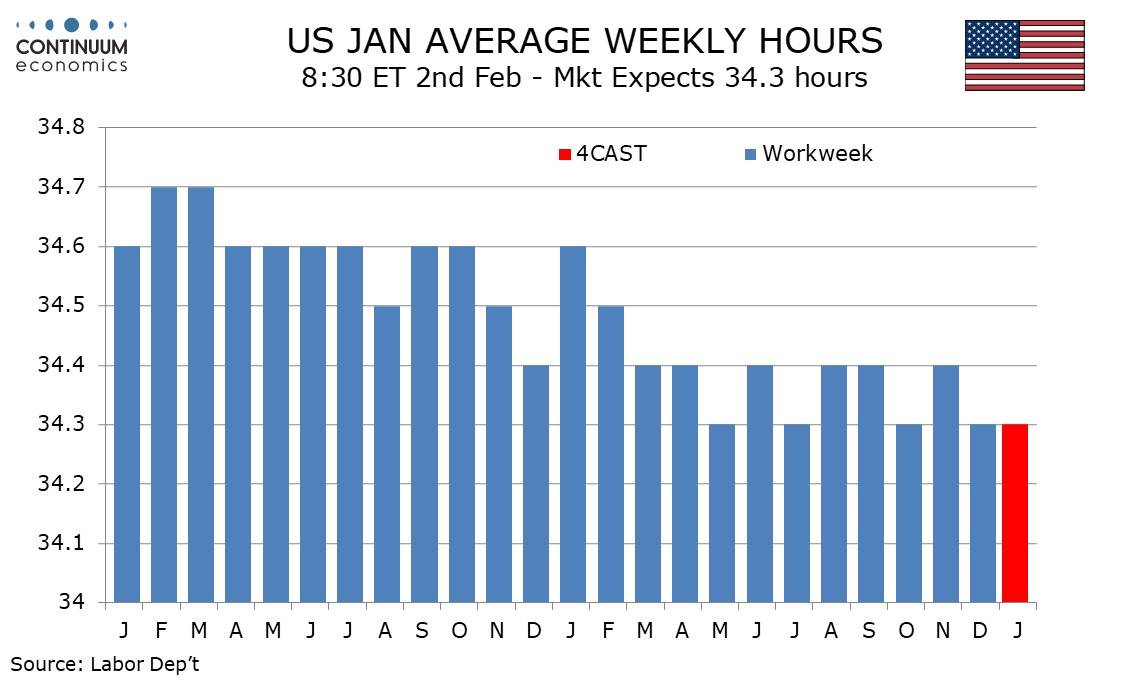

We expect the workweek to be unchanged at 34.3 hours. The last ten months have seen six at 34.4 and only four at 34.3 and a second straight 34.3 has not been seen since before the pandemic. However this month we suspect bad weather argues for an outcome on the lower end of the narrow range.