Updated Bank of Canada View: One More 50bps Easing in December, Three 25bps Moves in 2025

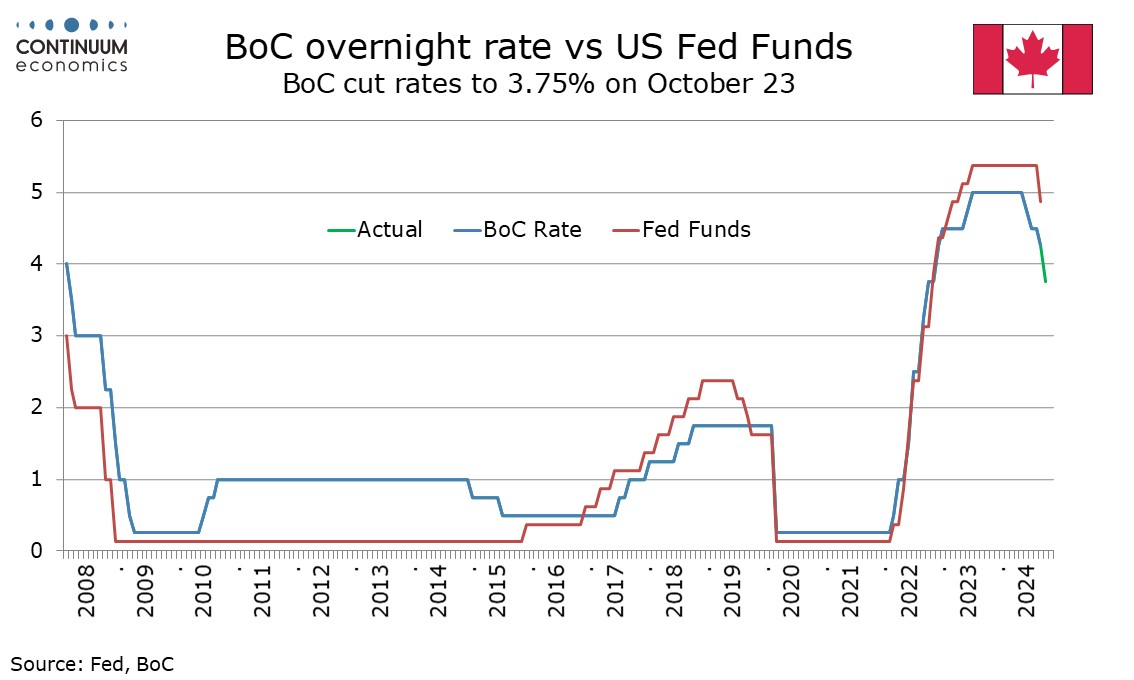

The Bank of Canada has accelerated the pace of easing, cutting by 50bps to 3.75% after three straight meetings when policy was eased by 25bps. The accelerated pace of easing was largely as expected and follows headline inflation data moving back to target. The BoC wants to lift the pace of GDP growth and is likely to do so, and how quickly growth picks up is likely to determine whether further 50bps moves will be seen. We now expect a 50bps move in December, before three 25bps moves in 2025.

While there are tentative signs that the economy is starting to regain momentum, we are not convinced enough will be seen by December to prevent a further 50bps easing, which would take the rate to 3.25%. That would put the rate at the upper end of the 2.25%-3.25% range the BoC sees as neutral, and after that easing is likely to be more cautious unless inflation falls below target or growth fails to respond to easing. While some improvement in the economy is likely, risk for 2025 is for data to underperform the BoC’s expectations. We expect two 25bps easings in Q1 of 2025, and one more in Q2 taking the rate slightly below the midpoint of the neutral range at 2.5%. 2026 may see rates nudged back up to neutral.

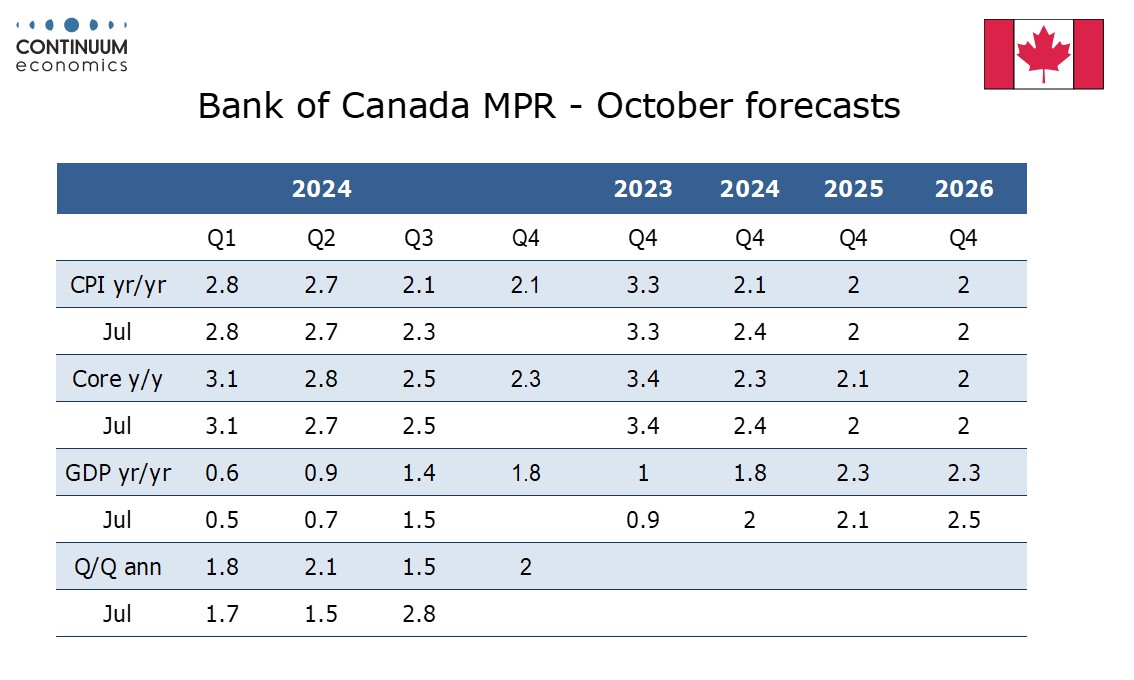

The BoC’s economic projections are not dramatically changed. Headline CPI is seen ending 2024 at 2.1% yr/yr in Q4, rather than 2.4%, with 2025 and 2026 seen on the 2.0% target. However the downward adjustment to core CPI in 2024 is marginal and offset by an upward adjustment to 2025 which is now seen at 2.1% rather than 2.0%. Q3 GDP is seen at only 1.5% annualized rather than the 2.8% seen in July, but the BoC had already recognized that July’s forecast would prove too high. Q4 is seen at 2.0% annualized with yr/yr growth nudged down only modestly to 1.8% from 2.0%. 2025 and 2026 are both seen at 2.3% Q4/Q4, which should allow the output gap to narrow.

While the forecasts may not have changed much the tone of the BoC’s communication is clearly more optimistic on inflation, with inflation expected to remain close to target with risks seen as balanced. The biggest downside risk is seen to be growth taking longer than anticipated to pick up. Upside risk are lower rates fueling a stronger rebound in housing or wages remaining high relative to productivity. While risks are seen as balanced, the downside risks seem a little more pressing at the moment.

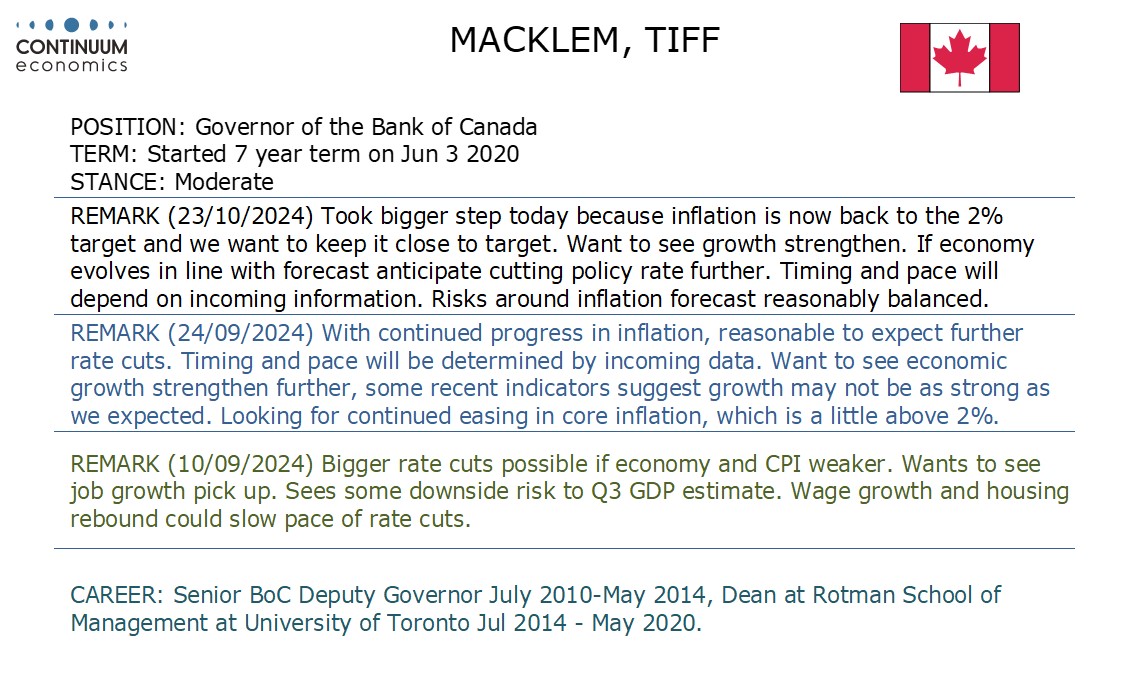

In justifying the more aggressive move the BoC stressed inflation, which is appropriate given that the inflation picture has significantly improved while a subdued growth picture is not a change. However the growth picture is a problem and Governor Tiff Macklem continues to state that the BoC wants it to pick up. He added that there was a clear consensus for the 50bps cut. Going forward uncertainty is high, not only on the Canadian economy but more so on the US outlook post-election and globally.