JPY, CHF flows: CHF recovering after CPI but gains to be short-lived

CHF gains on slightly smaller than expected decline in Feburary CPI, but CHF downside still favoured with CHF/JPY the best value trade.

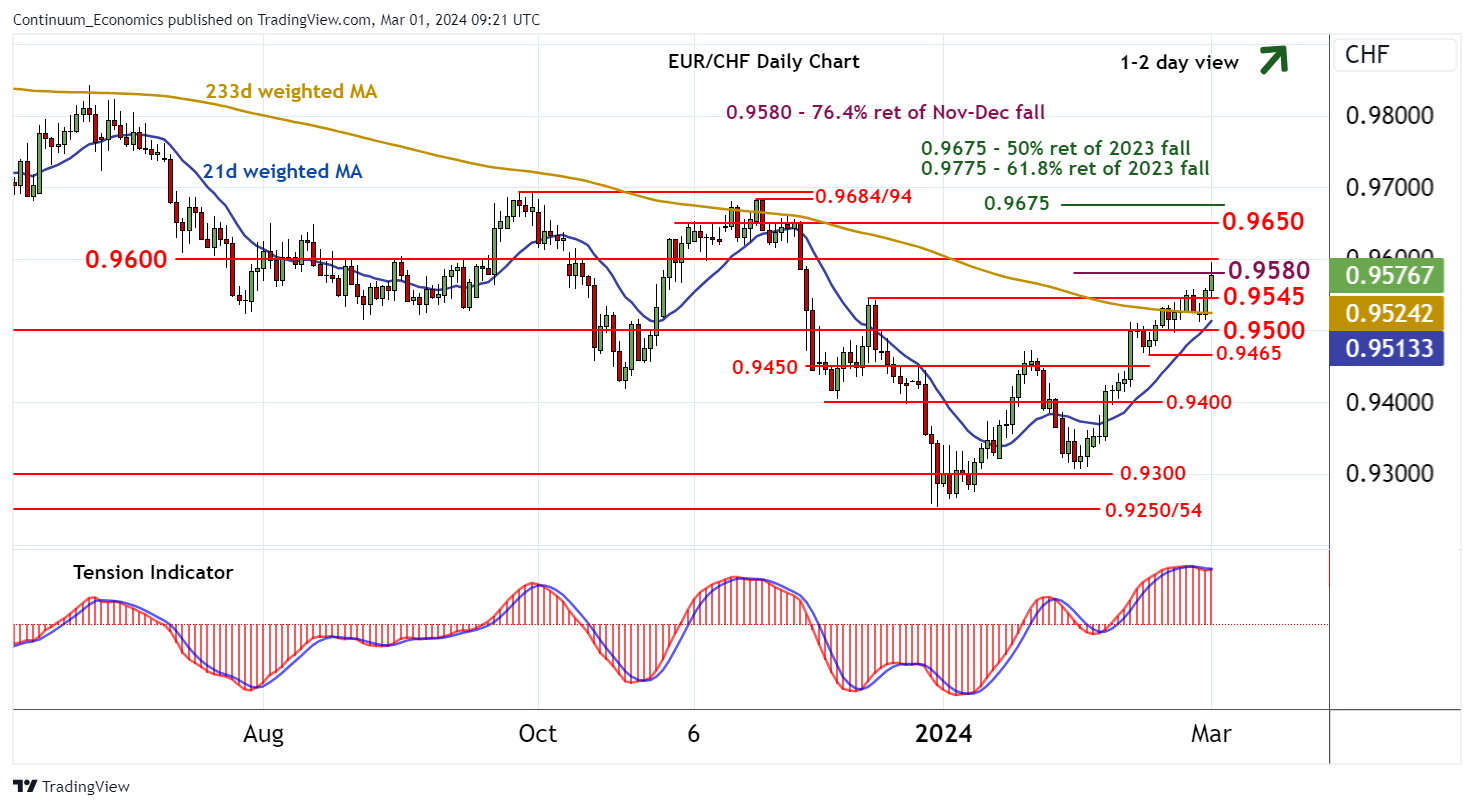

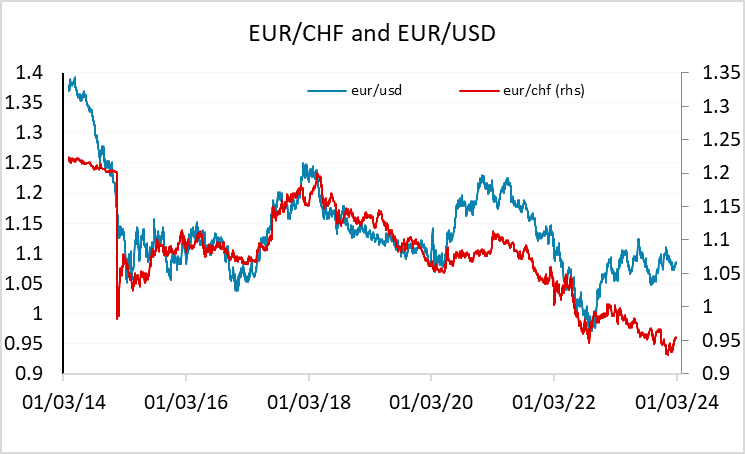

EUR/CHF has moved lower after February Swiss CPI fell a little less than expected, coming in at 1.2% y/y against the market consensus of 1.1%. But the sharp decline in January to 1.3% against a consensus of 1.7% was much the more significant move, and the continuing decline in inflation should maintain an underlying weakness to the CHF, provided we don’t see a significant turn in risk sentiment. We continue to expect EUR/CHF to continue to move up this year with the 0.9254 low from December unlikely to be challenged, but the 0.9685/95 highs from September and November last year will be hard to break ahead of monetary policy action from the SNB. Today’s dip on the slightly weaker than expected inflation numbers shouldn’t extend far, with support in the 0.9535/50 area.

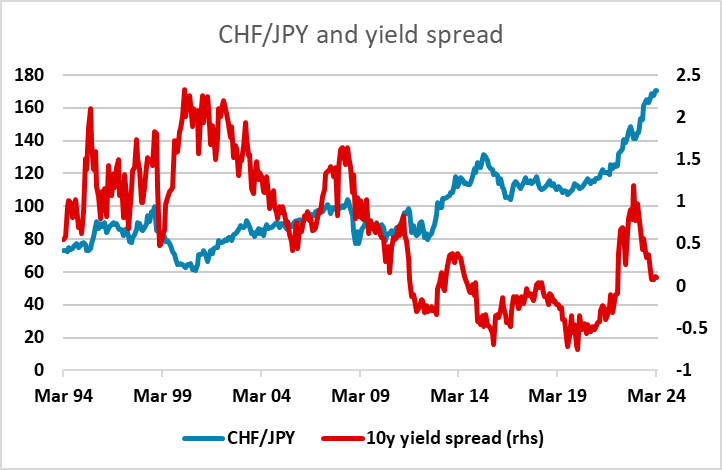

We still see CHF/JPY as the best value play against the CHF. This remains in the range that has held through this year, with today’s CHF recovery taking back to the centre of the recent range at 170.50. From a medium term perspective, we expect a break lower, so any move towards 171 should be seen as a selling opportunity. The overnight talk of the government officially declaring an end to deflation to prepare for BoJ tightening has had little impact on the JPY thus far, but as the prospect of BoJ tightening approaches, possibly concurrent with SNB easing, a break lower in CHF/JPY looks increasingly likely in the spring.