Canada April CPI - Continued progress in the BoC core rates

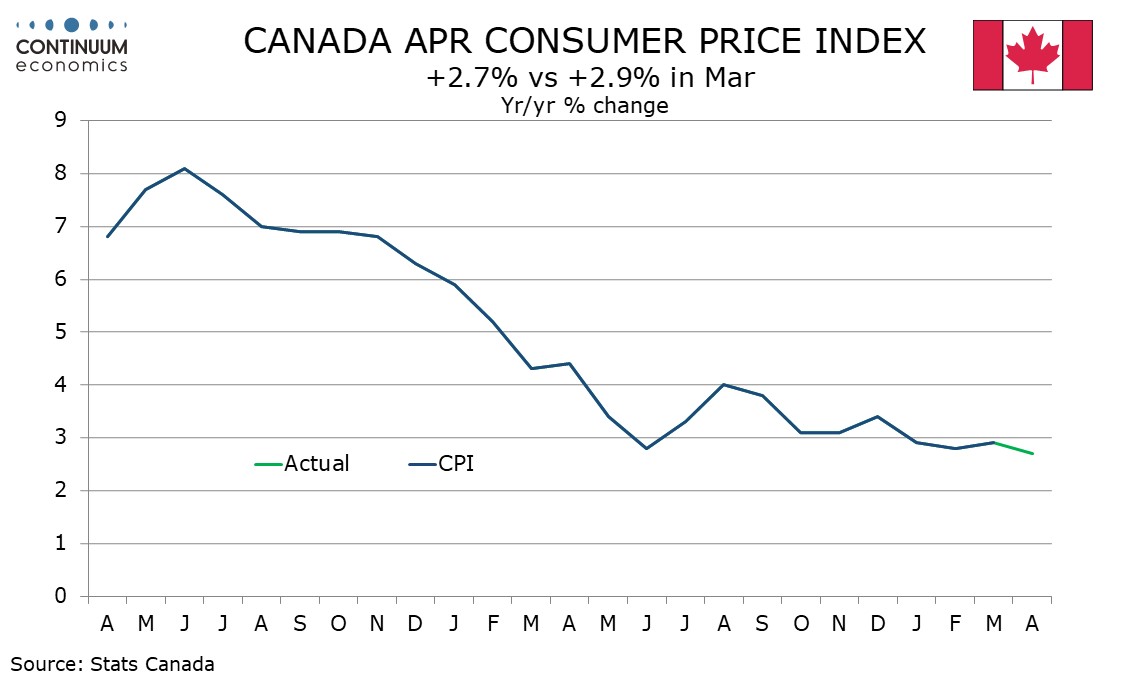

April’s Canadian CPI at 2.7% yr/yr from 2.9% is in line with market expectations and shows subdued data on the month and continued progress in reducing the Bank of Canada’s core rates. The headline yr/yr pace is the lowest since March 2021. The data should sustain hopes for a June BoC easing.

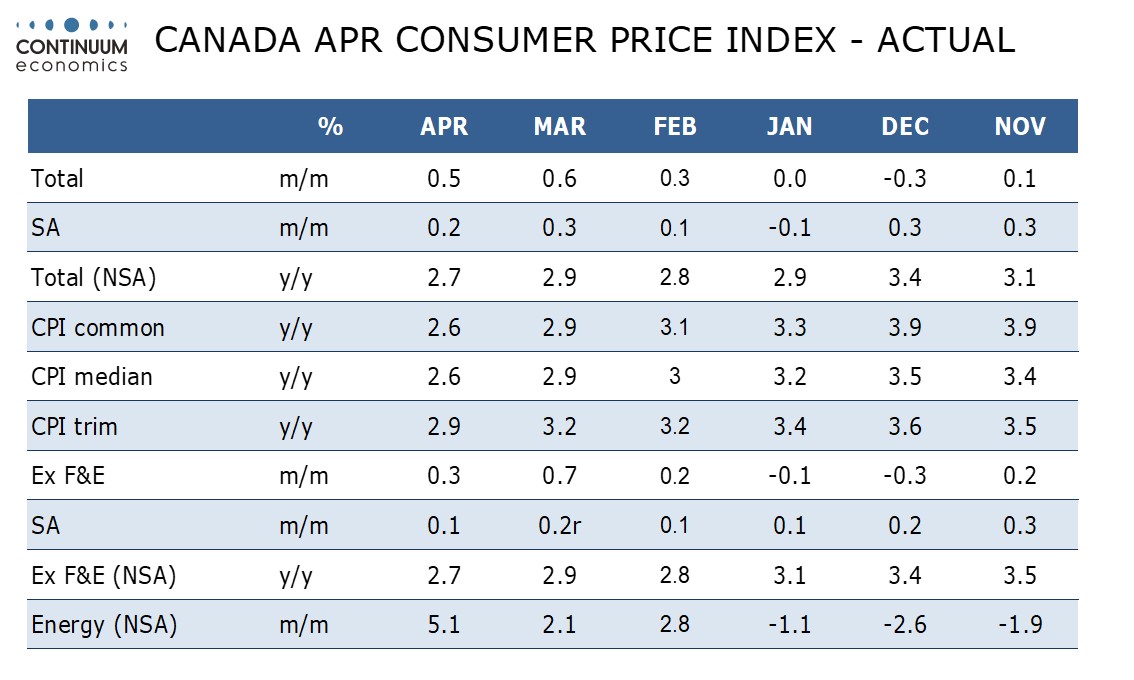

On the month CPI rose by 0.5% overall and 0.3% ex food and energy. Seasonally adjusted however the overall rise was only 0.2% with a 0.1% ex food and energy pace, with March ex food and energy revised down to 0.2% from 0.3%. With January and February having seen gains of only 0.1% seasonally adjusted ex food and energy this presents a subdued underlying picture in the year to date.

The seasonally adjusted data continues to show strength in shelter which rose by 0.5% while transport rose by 0.6% with support from energy. Elsewhere the data was subdued. Clothing, which fell in January and February but rebounded in March was unchanged, meaning that unlike January and February, the weak seasonally adjusted ex food and energy pace was not restrained by clothing.

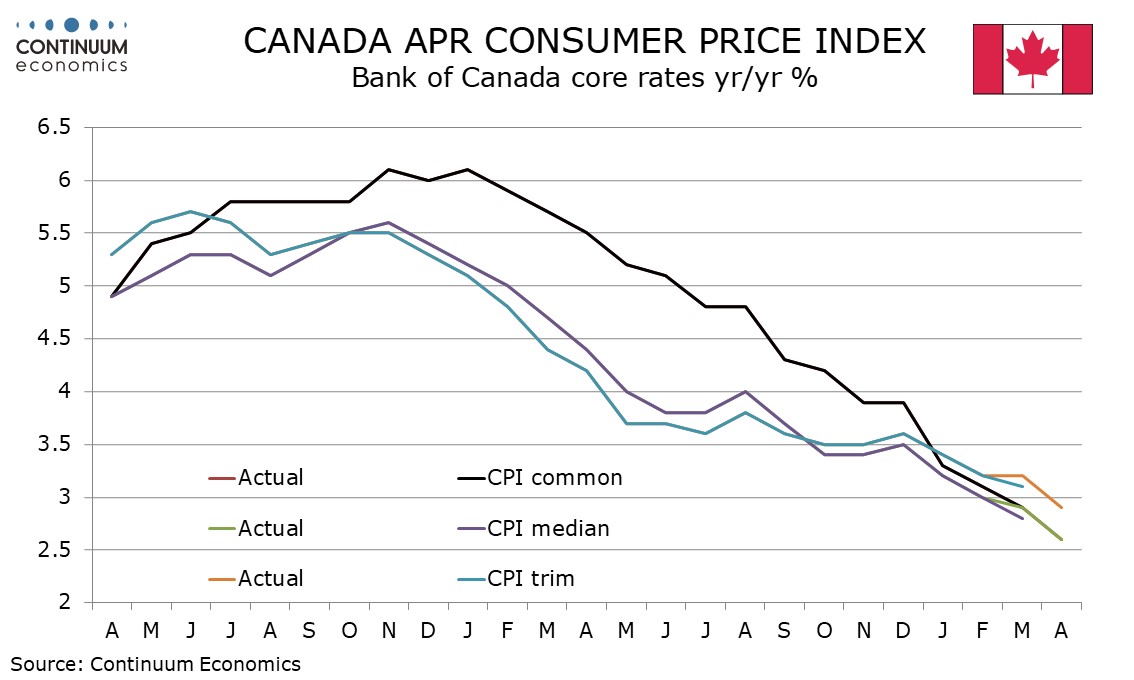

The ex food and energy rate is not one of the BoC’s three core rates, which all continued to slip, CPI-common and CPI-median to 2.6% from 2.9% and CPI-trim to 2.9% from 3.2%, all measured yr/yr. These are all still above the 2.0% target but moving in the right direction with the average at 2.7% matching the overall pace.