Preview: Due January 9 - U.S. December Employment (Non-Farm Payrolls) - Slightly firmer with unchanged unemployment

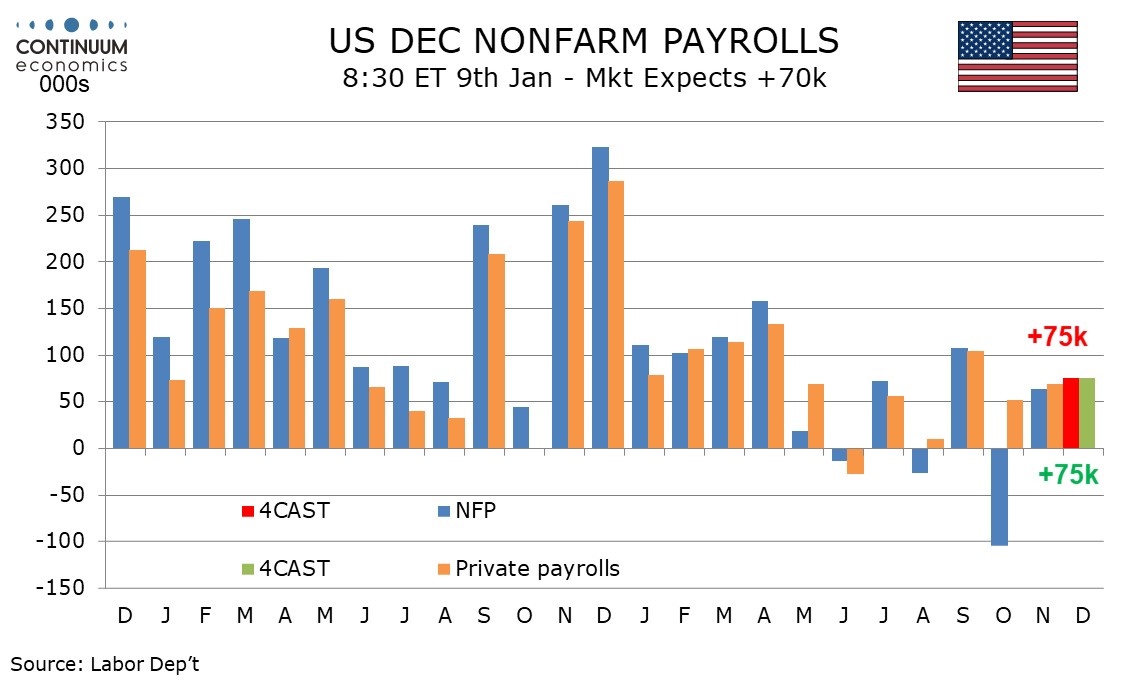

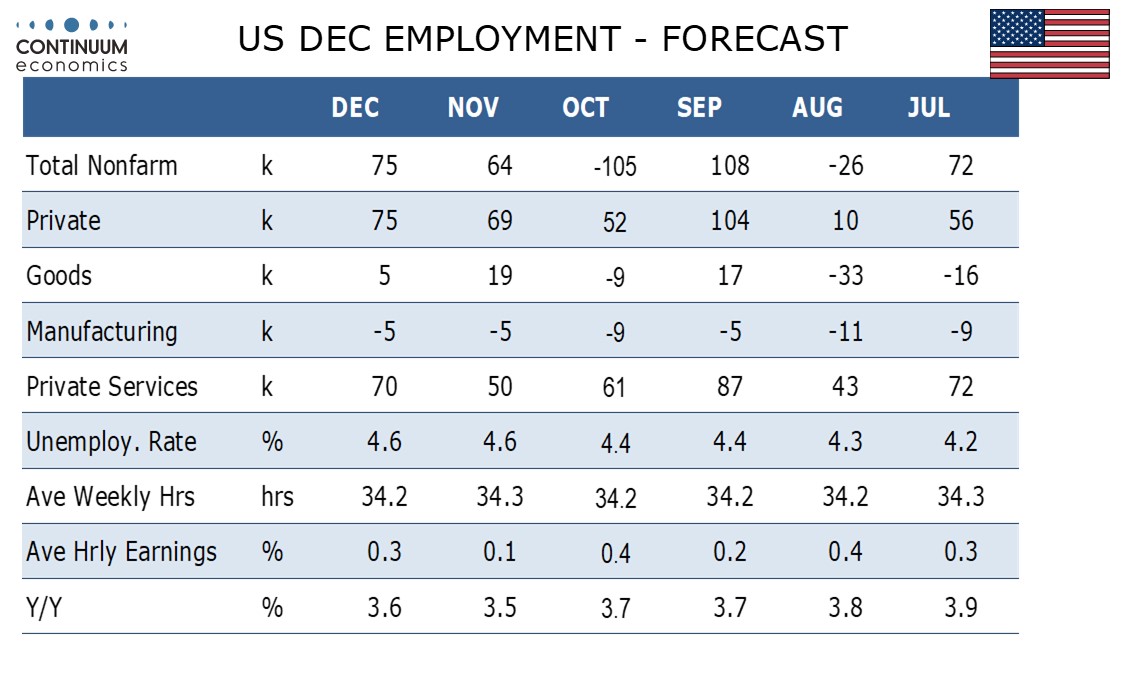

We expect December’s non-farm payroll to rise by 75k both overall and in the private sector, up from 64k and 69k respectively in November. We expect unemployment to be unchanged at 4.6% and a modest 0.3% increase in average hourly earnings.

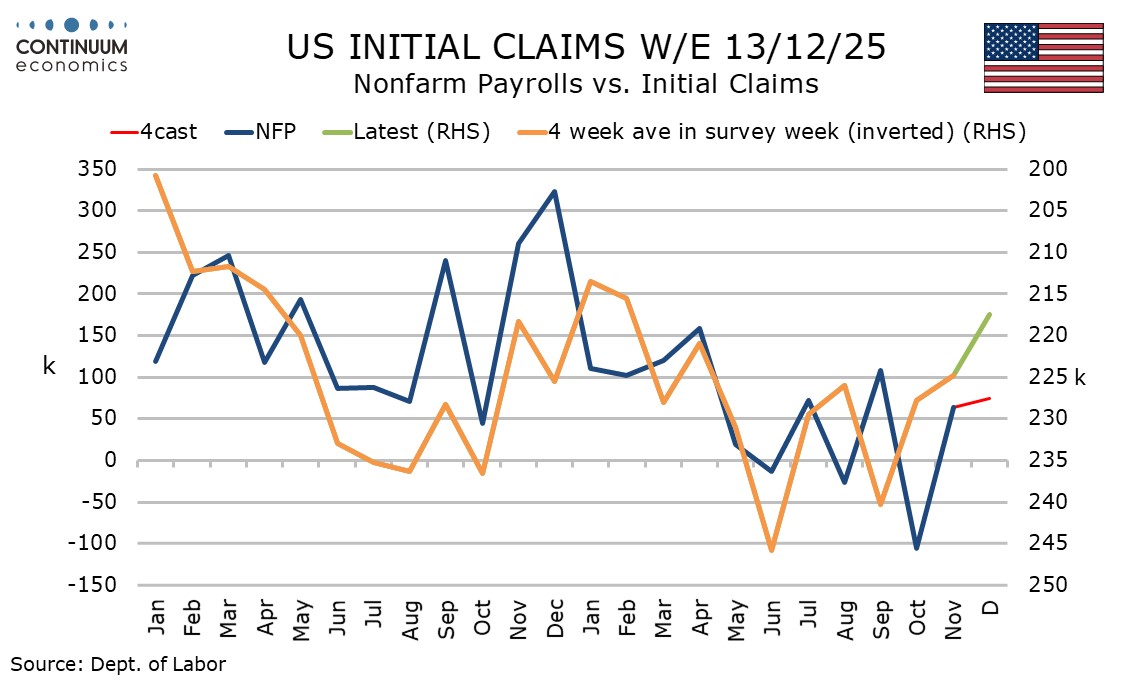

The labor market still looks subdued and Fed Chairman Powell suspects even the recent trend for moderate gains is overstating the true picture, but initial and continued claims have seen trend slip into early December, arguing for a slightly stronger payroll gain. Improved ADP data, which tends to underperform payrolls, and reduced layoffs in December data from Challenger, Gray and Christmas, is also supportive. The main area of improvement is likely to be leisure and hospitality, which was below trend at -12k in November.

The 6-month average for private sector payrolls was a modest 44k in October and November, the weakest since the declines caused by the pandemic. Our forecast would lift it to 61k in December, assuming no revisions. We do not ex[act any large payroll revisions this month.

Public sector employment plunged by 157k in October before a modest 5k decline in November. October’s plunge was due to DOGE layoffs coming through after having been kept on the payrolls for six months. It did not reflect the government shutdown, as government workers did receive their salaries, albeit late. We see no reason to expect a big move in government in December.

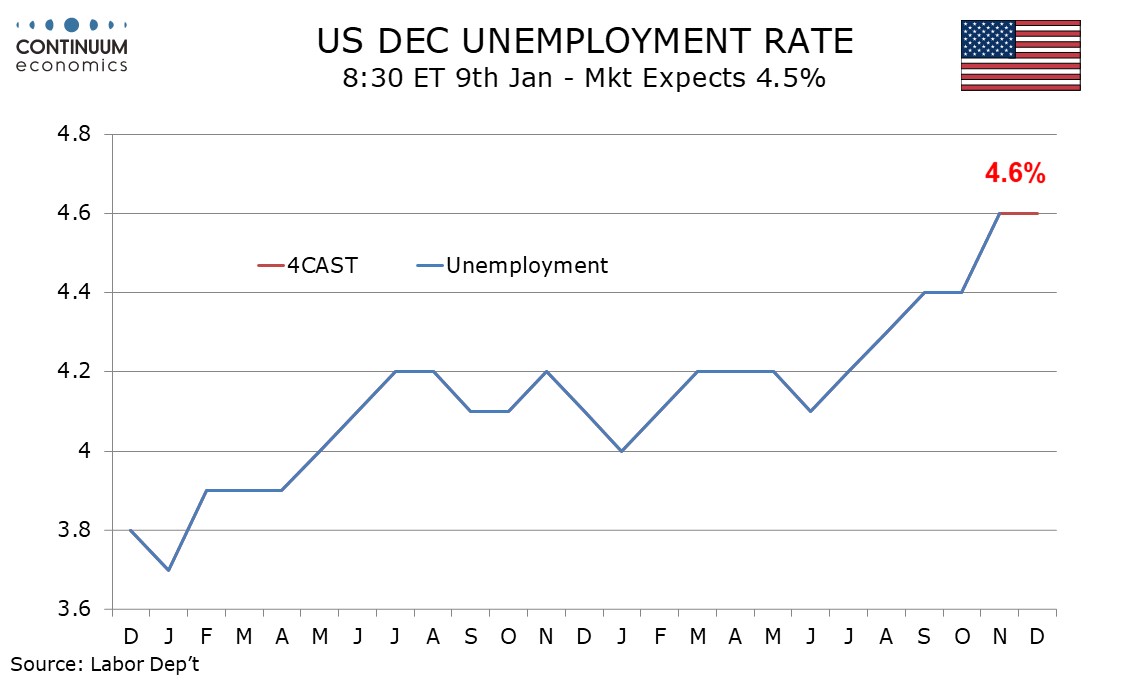

We expect labor force growth to exceed that of employment in December, but not by enough to lift the unemployment rate from 4.6%, though before rounding we expect a rate closer to 4.6% than November’s 4.56%. Reduced optimism on the labor market in the Consumer Confidence survey is consistent with higher unemployment. Annual historical revisions are due for unemployment this month. These are almost always marginal, but it makes the data before rounding harder to predict.

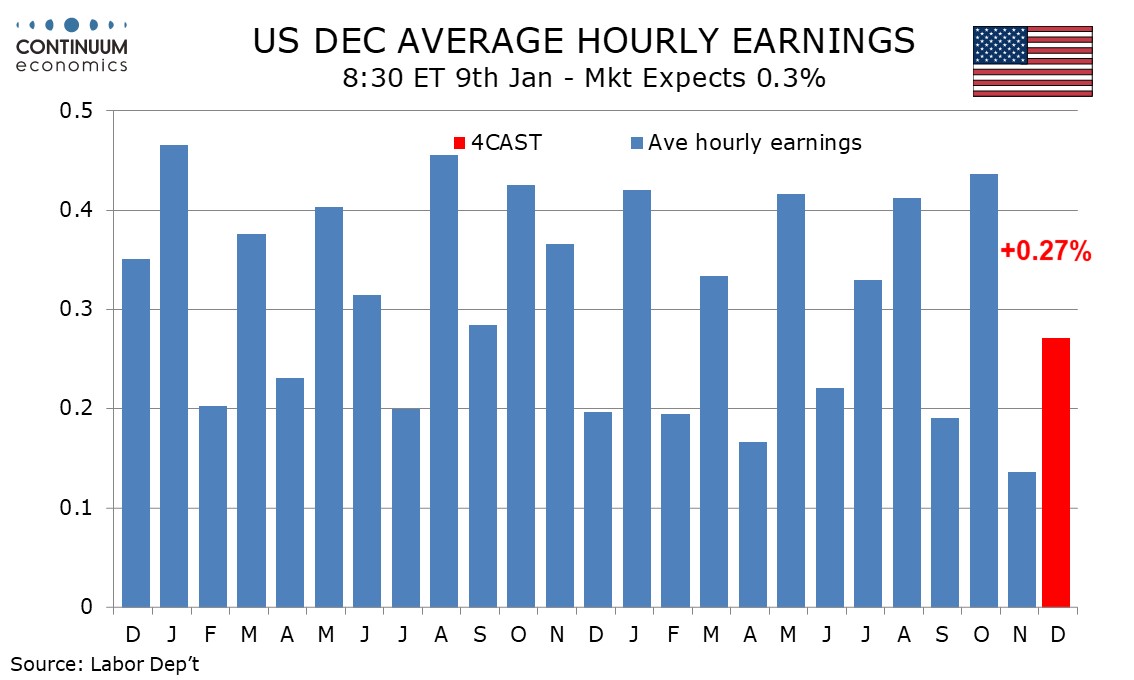

We expect a 0.3% rise in average hourly earnings, in line with trend, though before rounding a rise of 0.27% would hint at a continued modest loss of momentum. Yr/yr growth would however then correct higher to 3.6% from November’s 3.5%, which was the slowest since May 2021.

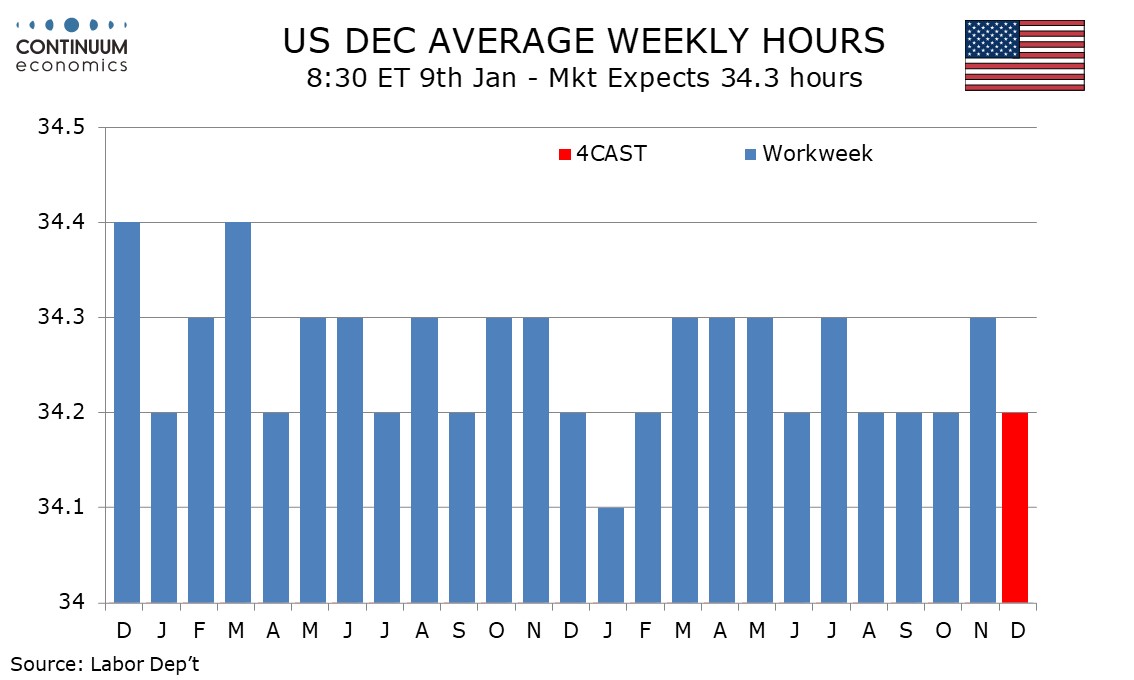

The workweek picked up to 34.3 hours in November after three straight months at 34.2. A dip back to 34.2 appears more likely than another 34.3. This would leave aggregate hours worked up by a modest 0.5% annualized in Q4, after a flat Q3.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.