UK Budget and Gilts

The UK government is leaking parts of the October 30 budget to allow markets to adjust before the full announcement. While the new fiscal rule for debt/GDP could raise some modest concerns over increased supply for the gilt market initially, attention will quickly switch to the BOE November 7 and whether the BOE signals it remains gradual or will become more activist. The final piece of the jigsaw is spillover from U.S. Treasuries, which is dependent on economic data and the election.

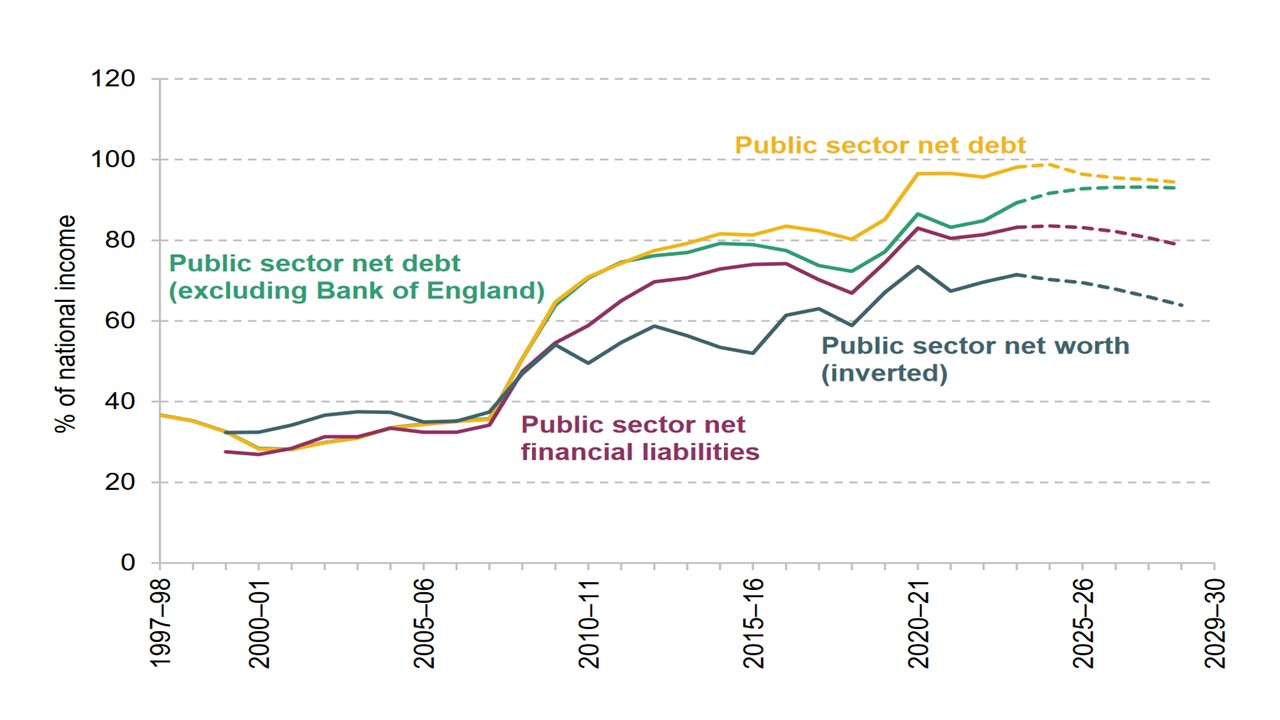

Figure 1: Different Measures of UK Government Debt (March 2024 outcome and Forecasts % of GDP)

Source: OBR/IFS Green Budget (here)

Leaked news reports suggest that the UK will amend one of its fiscal rules to Private sector net financial liabilities (PSNFL), which will provide more room for government investment spending than the existing Public sector net debt rule (excluding the BOE). By 2028-29, the full extra scope could be £53bln according to the IFS Green budget, though the FT has reported that only part of the room will be used and this could be around £20bln to keep public investment at 2.5% of GDP. What does this mean for the gilt market?

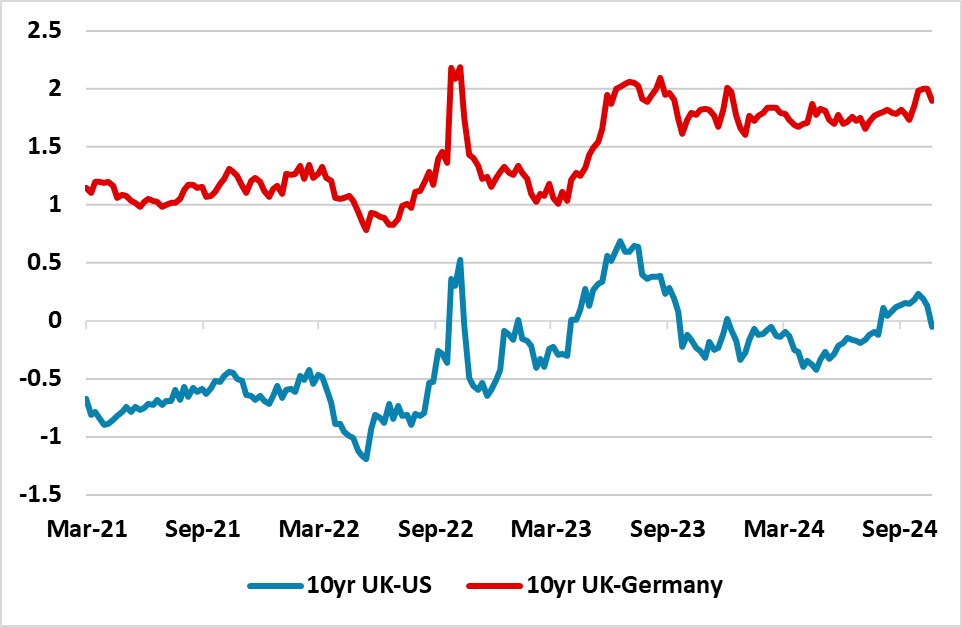

For gilts, three other considerations are also relevant. Firstly, what other tax and expenditure changes will occur relative to the Conservative plans, with widespread reports of less expenditure cuts financed by tax increases to help balance the current budget (here) – this being the other fiscal rule the Government has adopted. This helps fiscal credibility and could be either growth neutral or positive (depending on timing and expenditure helping more than adverse impact of tax hikes). Secondly, the gilt market is concerned about funding, as the BOE is still undertaking QT at a pace of £100bln per annum as confirmed in the September BOE meeting. An extra £20bln per annum is not huge, but for a gilt market still shaken by the 2022 Truss budget debacle (Figure 2) it is not comfortable. However, the key is details in Wednesday budget on how the scale-up occurs to say £20bln per annum, as all of this is unlikely to be used in year 1.

Figure 2: 10yr Gilts Versus Treasuries/Bunds (%)

Source: Datastream/Continuum Economics

The third issue is the BOE. A 25bps cut is now widely expected next month, plus a further 25bps in February and March. The budget could be a multi-year consideration for the BOE if a scale up in new investment spending boosts growth, but the key is the greater than expected slowdown in UK inflation and volatility and some softness in the UK real sector, the latter possibly exacerbated by damage to business confidence from tax rises. It is unlikely that the BoE will agree that any increases in government capital spending will have a material impact on boosting the supply side, at least over the 2-3 year forecast horizon it focuses on.

Some short-term unease could be seen in the gilt market after the budget on supply concerns rather than real fiscal concerns. However, these could soon disappear if the BOE does a dovish cut on November 7 and intensifies speculation about a speed up in BOE easing. BOE Bailey has hinted at speeding up easing (here), but BOE Pill has stuck a more cautious tone. The BOE voting/minutes/ monetary report and press conference could also sharpen the debate over whether the next 25bps arrives December or February.

The final piece of the jigsaw is the U.S. election and the reaction of U.S. Treasuries, which we have highlighted is symmetric depending on the election outcome (here). If Trump wins and economic data remains resilient, then 10yr Treasuries yields can move higher – with a clean sweep for GOP through 4.50%. Though this is U.S. centric we would still see gilt yields being dragged along initially.

This all means competing force for gilts in the coming weeks, but we would not be overtly concerned about the effect of the budget itself.