USD, EUR, JPY, AUD, NOK flows: Risk positive tone remains post FOMC

USD remains under general pressure but AUD may be the best performer while tone remains risk positive

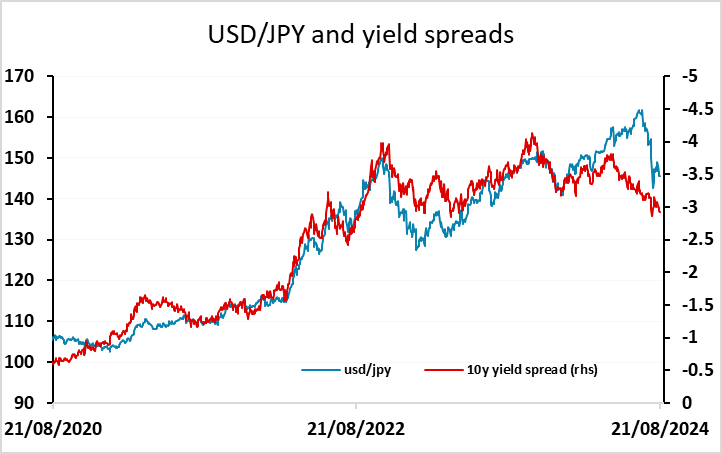

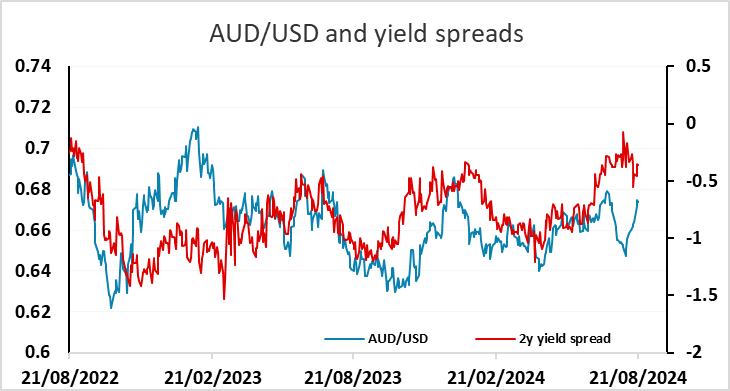

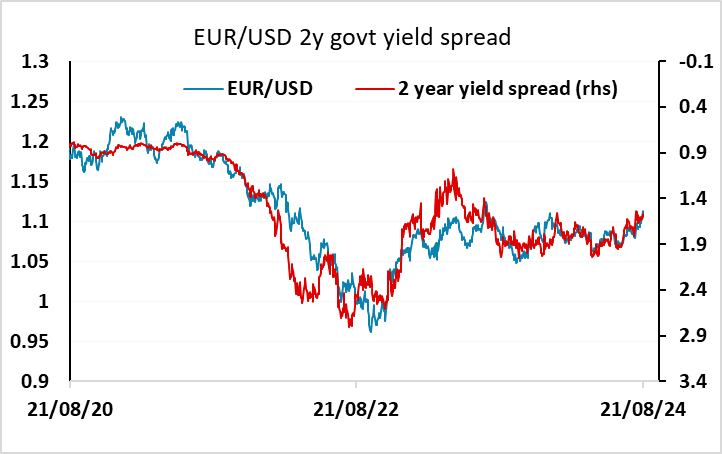

After the much as expected FOMC minutes, US yields are a tad lower but there has been little significant movement in yield spreads or equities. We are still in a position where EUR/USD looks fully valued relative to yield spreads, but the JPY and AUD look to have more upside scope. EUR/JPY also looks a little stretched relative to equity risk premia. However, the underlying sentiment is risk positive, with the S&P500 just a shade off the all time highs having rallied strongly since the post-employment report dip. In this environment the AUD may be the best performer, with the JPY likely to need either some more contraction in yield spreads or some deterioration in risk sentiment to make more progress.

This morning sees PMI data from Europe, and that could determine the tone for EUR/USD. With the recent Eurozone data not particularly positive, the scope for further EUR gains looks limited if the PMIs remain soft and the market is taking a risk positive view. In Europe, the NOK continues to look like the best value currency, but this morning’s slightly weaker than expected Q2 GDP data at 0.1% q/q may help prevent near term gains.