Mexico: More Institutional Reforms on the Pipeline

Morena's political dominance has strengthened with Claudia Sheinbaum's election and judicial reforms, allowing them to shape the Supreme Court. This boosts their ability to push controversial policies, like state control of Mexico’s energy sector. However, economic slowdown and potential U.S. political shifts, such as a Trump victory, could dampen investor confidence and derail nearshoring momentum by 2025.

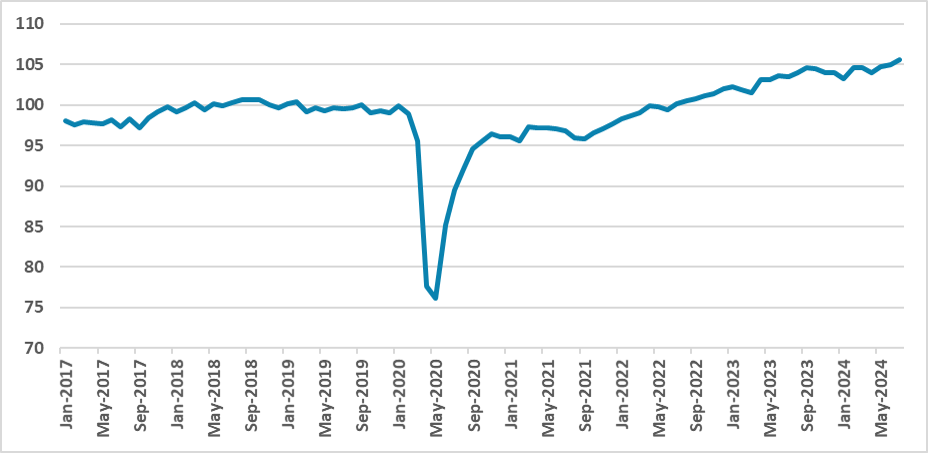

Figure 1: Mexico’s Economic Activity Index (Seasonally Adjusted)

Source: INEGI

After Morena successfully elected President Claudia Sheinbaum and its coalition secured a qualified majority in the Chamber of Deputies, falling just one vote short of doing the same in the Senate, the political landscape has changed considerably from the six-year term of López Obrador. In the past, López Obrador was unable to make drastic changes to the Constitution because he lacked the necessary two-thirds majority in Congress to approve them. Moreover, anti-market laws passed during his government were deemed unconstitutional by the Supreme Court.

However, the situation has now changed. Morena demonstrated that overturning a single vote in the Senate was not so difficult when they managed to pass the controversial judicial reform. Under this reform, Supreme Court justices will be elected by popular vote, and with Morena enjoying a 60% approval rating in Mexico, it is highly likely that most of the newly elected members of the Supreme Court will be sympathetic to the reforms Morena seeks to implement, reducing the risk that their laws will be ruled unconstitutional.

Currently, Morena holds a favorable position to use Mexican institutions to their advantage and potentially prosecute political opponents if they choose to. So far, Claudia Sheinbaum has aligned herself with a more democratic approach, and she will likely step down from the presidency as required by the Constitution. However, a door could be left open for any future Morena leader to enact abrupt changes to Mexican democracy.

Morena will likely pursue López Obrador's earlier goal of ensuring that Mexico's energy sector remains under state control, which could conflict with some clauses of the USMCA deal. Furthermore, Morena’s ability to swiftly change the rules of the game may alarm foreign investors, though we believe profit opportunities will ultimately prevail.

The timing of these reforms, expected to occur in 2025, is not ideal. The Mexican economy is clearly decelerating, and although Banxico is easing monetary policy, the Mexican economy is unlikely to replicate the 3% growth seen in 2022 and 2023. Most investments are likely to remain on hold until investors can better understand the direction of the Mexican economy. However, we see a Trump victory in the U.S. as one of the biggest risks, as he could view Mexico as harmful to the U.S. economy, potentially causing the current enthusiasm around nearshoring to fade by 2025.