UK CPI Review: Inflation Stays at Target and Services Stay Resilient?

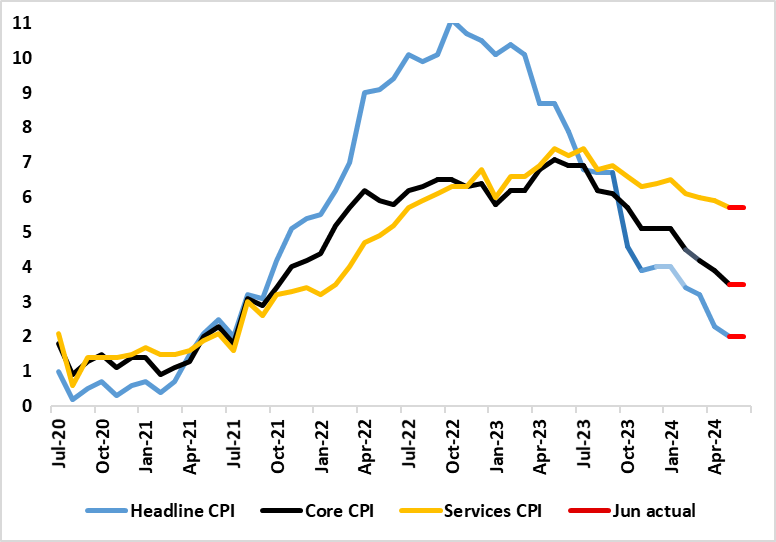

As has been made clear by policy-makers, labor market and particularly CPI data are crucial to BoE thinking about the timing and even the existence of any start to an easing cycle. In this regard the fact that headline CPI inflation dropped back to the 2% target in May is important but far from definitive. Indeed, largely meeting expectations, CPI headline inflation fell from 2.3% to 2.0% and thus back in line with the target for the first time in just over three years. But apparent service sector resilience is troubling the BoE (certainly the hawks) and will continue to do so. As we expected, headline CPI inflation stayed at 2.0% in the June numbers and with a stable core rate of 3.5%, but with services failing to ease by remaining at 5.7% (Figure 1) and thus some 0.6 ppt above BoE thinking.

Figure 1: Headline and Core Inflation Steady But Services Resilient?

Source: ONS, Continuum Economics

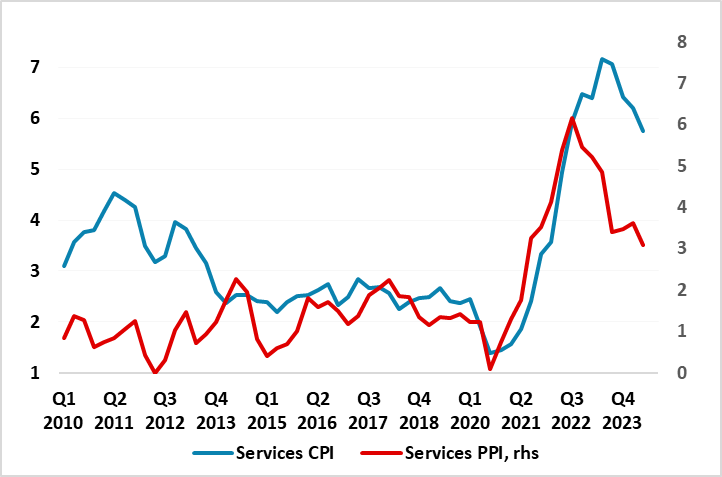

Thus, the data alone is not going to give a green light to a rate cut as soon as August, especially as GDP data may suggest another solid gain in Q2 is in store. But we are still pencilling in a cut next month, at least until we see the next set of labor market numbers, given the manner in which the thrust of inflation news has evolved of late and with it therefore highly likely that the August Monetary Policy Report will continue to point to a substantial inflation undershoot ahead. Indeed, despite apparently resilient services CPI inflation that for services PPI fell further, this a solid lead indicator for the former. Indeed, services producer prices rose by 3.1% y/y in Q2 (Apr to June) 2024, down from a revised increase of 3.7% in Q1 (Figure 2). Moreover, in spite of services price resilience (which is relatively widespread and included a fresh rise in restaurant inflation), overall CPI inflation has fallen faster that it rose, averaging a drop of 0.48% per month since its peak in Oct 22.

Figure 2: Services Producer Price Pressures Falling Further

Source: ONS, % chg y/y

Indeed, some of this services resilience partly due to strong, if not record, rental inflation. This is contributing some 0.5 ppt at present with it notable that rental prices had been a clear factor suppressing services inflation prior to the start of the BoE hiking cycle raising the question as to what extent they are proactively linked to Bank Rate. Regardless, there were some reassuring aspects to the June CPI data, where petrol costs added to the headline rate (as may industrial goods) but be offset by lower food inflation. Overall, this meant no change in the core rate, this stuck at 3.5%, but where this is still being held up by base effects. Indeed, this anticipated outcome implies a m/m adjusted reading still above a rate consistent with target but with some fresh slowing evident, either on smoothed monthly basis or even the 3-month annualized rate that some at the BoE favour.