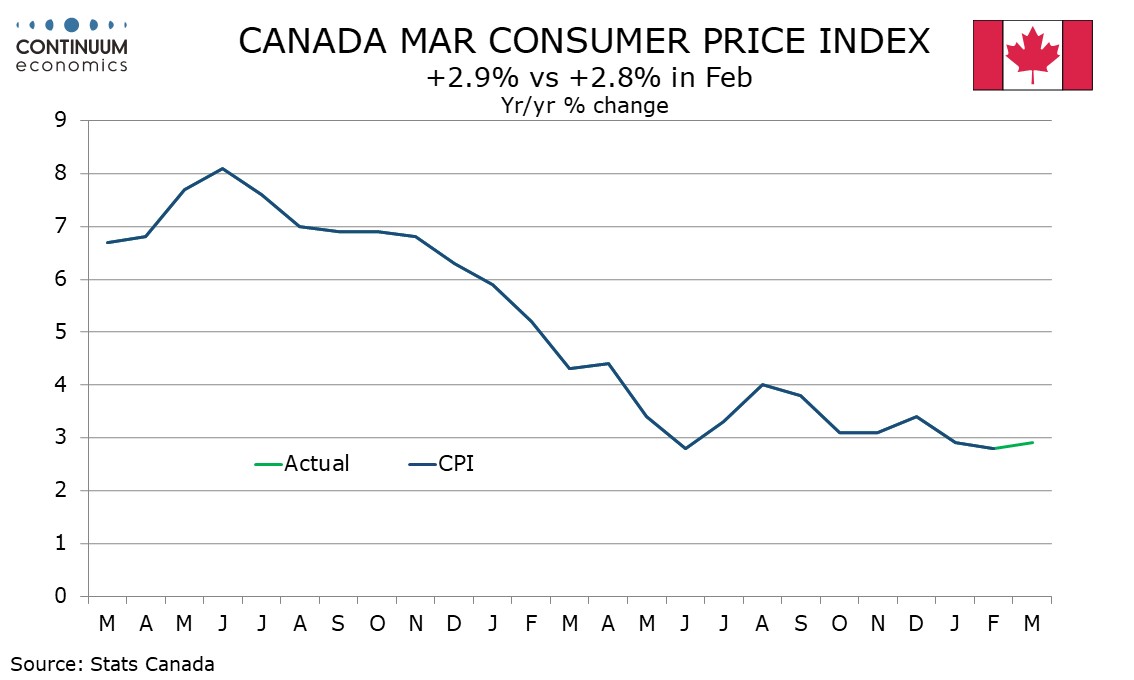

Canada March CPI a little firmer after two soft months, but BoC core rates continue to fall

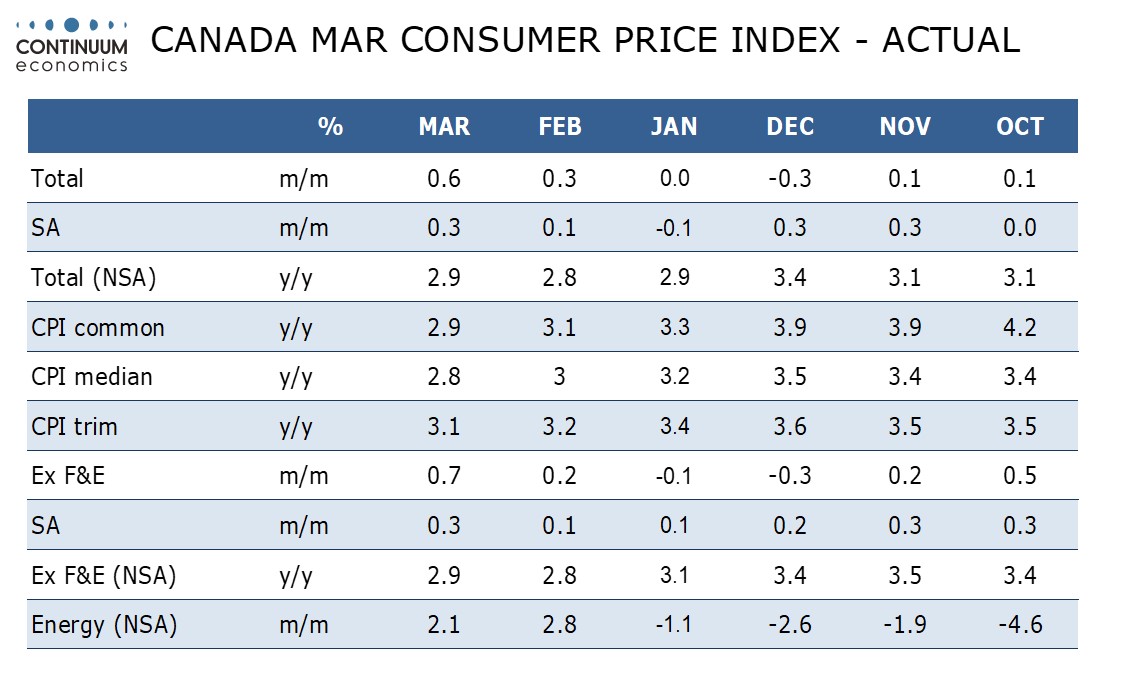

March’s Canadian CPI has seen an as expected increase to 2.9% yr/yr from February’s unexpectedly softer 2.8%. On the month the seasonally adjusted data is a little firmer after two soft months but the Bank of Canada’s core rates continue to fall.

On the month CPI rose by 0.6% overall and 0.7% ex food and energy, and though some of this strength is seasonal we saw seasonally adjusted gains of 0.3% both overall and ex food and energy. The seasonally adjusted ex food and energy gain comes after two straight gains of only 0.1%. The Bank of Canada can still see this as representing progress in Q1 though more soft data is likely to be needed before it feels ready to ease policy.

The relative strength of March’s data relative to January and February comes to a large extent from clothing and footwear seeing a 1.4% seasonally adjusted increase after two straight sharp declines. Shelter remains relatively firm with a 0.4% rise while recreation, education and reading rose by 0.6%. Household operations, furnishing and equipment however fell by 0.5%. Each of the latter three components were similar to their February outcomes, illustrating the importance of the swings in clothing.

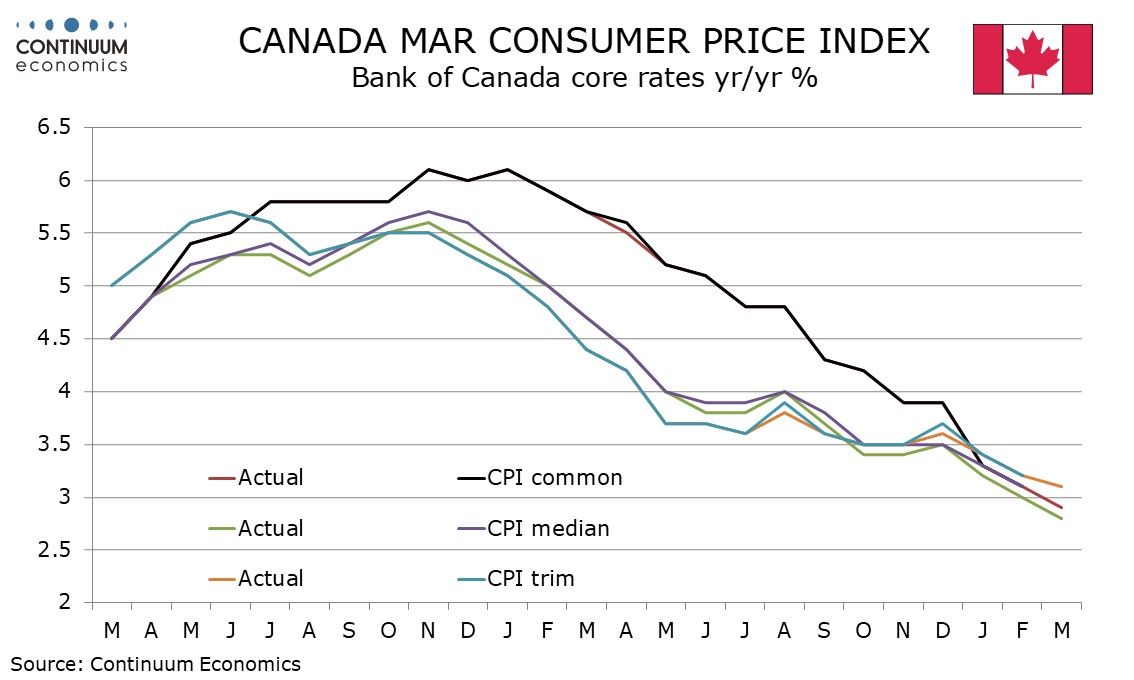

The ex food and energy rate is not one of the BoC’s three core rates, which all continued to slip, CPI-common to 2.9% from 3.1%, CPI-median to 2.8% from 3.0% and CPI-trim to 3.1% from 3.2%, all measured yr/yr. These are all still above the 2.0% target but moving in the right direction. The average has fallen below 3% for the first time since July 2021.