Preview: Due February 11 (government shutdown may delay) - U.S. January CPI - A stronger month but slower yr/yr

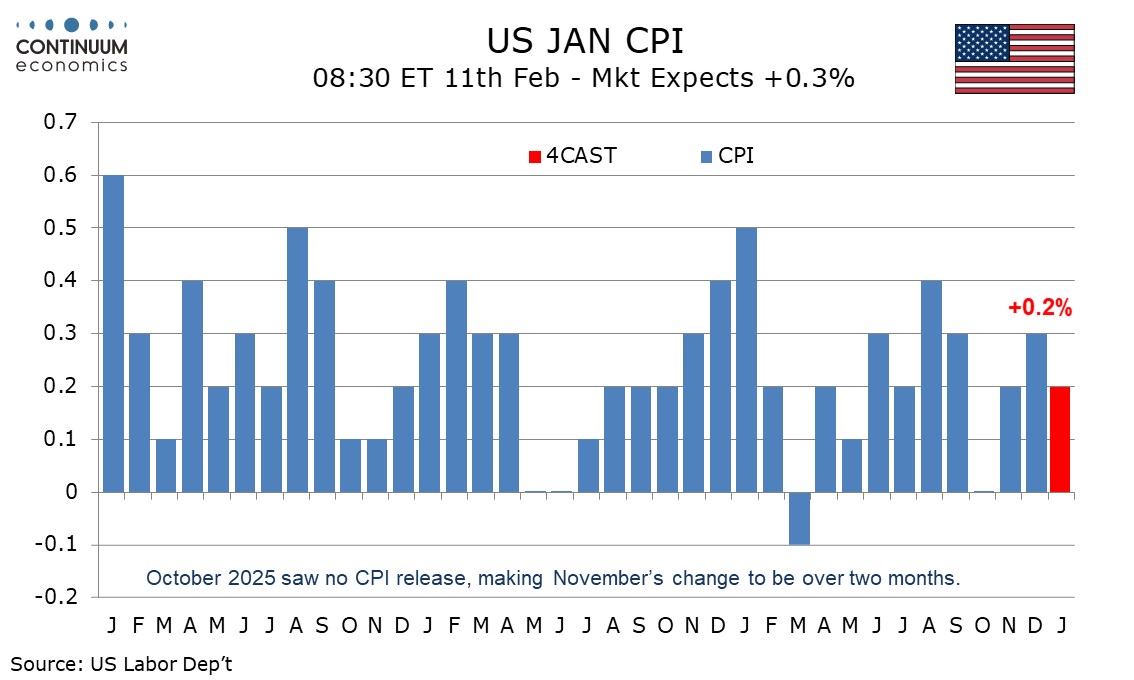

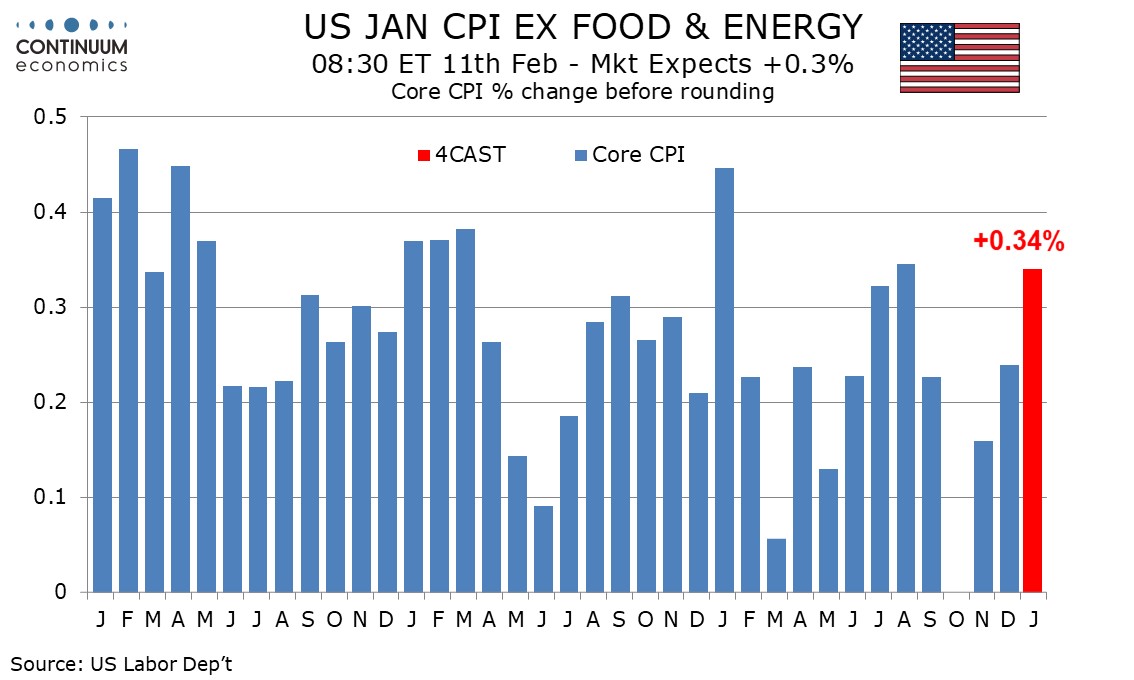

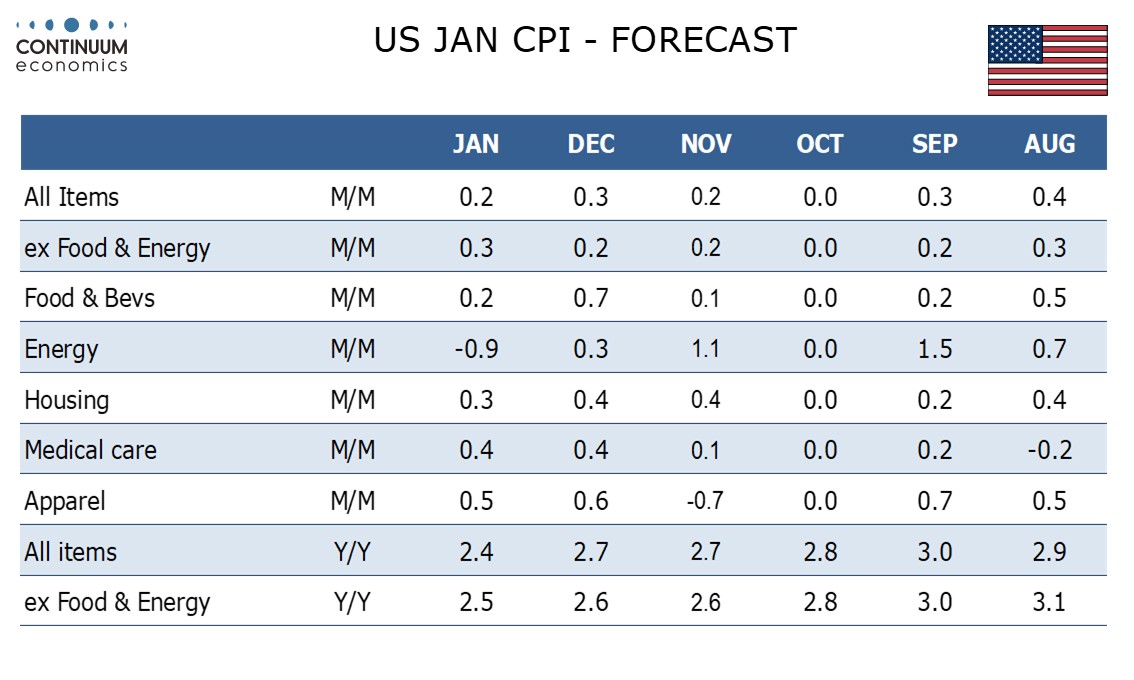

We expect a 0.2% increase in January’s CPI, with a 0.3% rise ex food and energy, though risks are to the upside with our forecasts before rounding being for gains of 0.24% overall and 0.34% ex food and energy. The latter would be the strongest since August.

Pricing decisions are often made at the start of the year and January data in recent years has tended to be quite strong, with ex food and energy gains of 0.4% in January of 2025, 2024 and 2023 and 0.6% in 2022, though only the January 2025 gain was clearly above the trend seen at the time.

Reasons to expect a bounce this year include the January 14 Fed Beige Book stating that several contacts that initially absorbed tariff increases were starting to pass them on, and also that Q4 CPI data slowed more than did most other inflationary indicators, suggesting scope for a correction. However gasoline prices look weaker and we expect food to moderate after a strong 0.7% increase in December.

December core CPI rose by only 0.24% before rounding despite strong gains in two of the most volatile components of services, air fares and lodging away from home, the latter part of housing which is expected to gradually lose momentum. Against this, autos, one of the more volatile components of goods, have scope to correct from a weak December. Upside risks appear more pronounced in goods, particularly if there is some tariff feed-though. We expect a 0.5% increase in commodities less food and energy but only a 0.3% rise in services less energy. We expect supercore CPI, excluding food, energy and housing, to rise by 0.3% in January, with housing converging towards the core.

We expect yr/yr CPI to slow to 2.4% from 2.7%, which would be the slowest since May, and the yr/yr rate ex food and energy to slow to 2.5% from 2.6%. The latter would be the slowest since March 2021. Seasonal adjustments will see an annual update with this release, which adds to the uncertainty that is higher than usual in January CPI releases, with potential for some modest back month revisions.