U.S. Election Scenarios and Post-Election Policy Risks

The U.S. election remains very close though a win for former President Donald Trump appears slightly more likely than one for Vice President Kamala Harris. The race for control of the House is also close, though here a Democrat majority looks marginally more likely. For the Senate, a Republican majority is clearly the more likely outcome, but far from assured. This means a large number of possible outcomes, though Trump’s tariff proposals look to be by far the biggest risk for post-election policy, and uncertainty on this issue is likely to persist for some time if Trump wins the election.

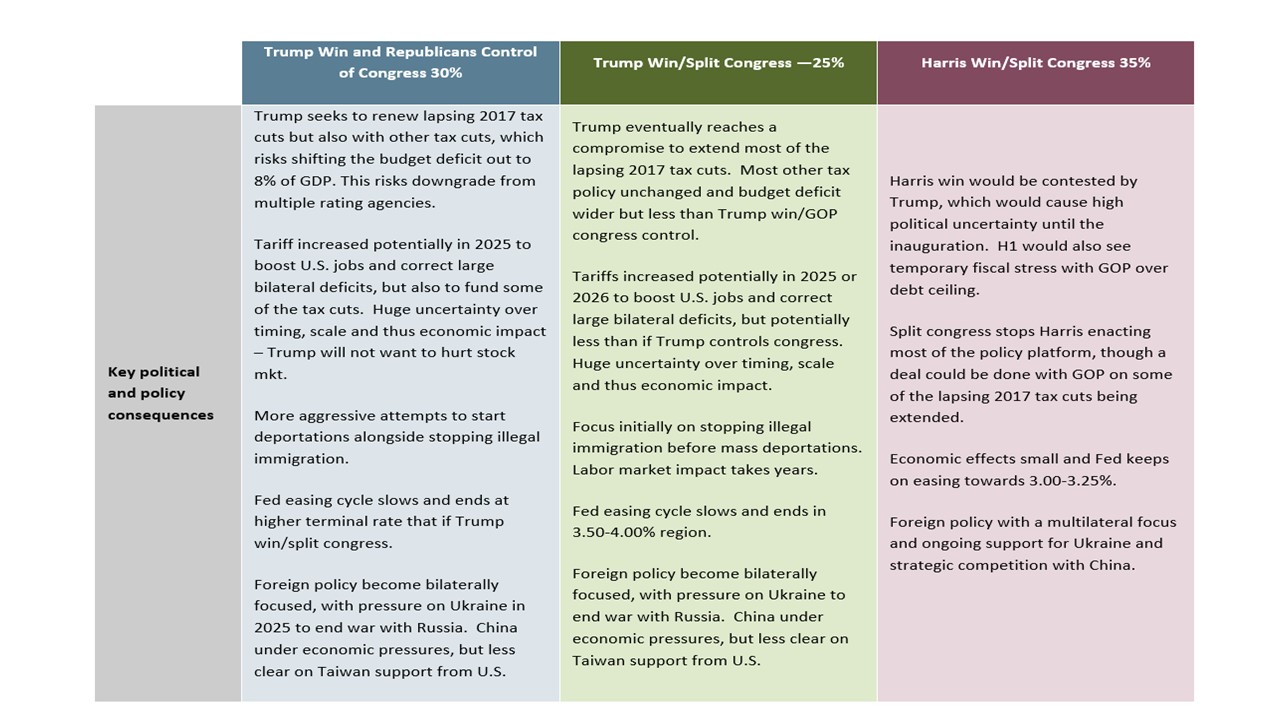

Figure 1: Main U.S. Election Scenarios

Source: Continuum Economics. A 10% probability also exists of a Harris victory and clean sweep for the Democrats in Congress.

The race for President – Trump the marginal favorite

Betting odds show a Trump win as roughly a 60% probability, though polls suggest Harris ahead in more national polls than Trump, and polls in the swing states are very close. There are suggestions that the betting markets have been influenced by large bets for Trump. Trump did outperform the suggestions of opinion polls in both 2016 and 2020, but since then Democrats have generally outperformed expectations in special elections and in the 2022 midterms. Polling is a tough science with response rates generally low, forcing pollsters to ask large number of questions such as race, income and education in order to get a sample in line with the overall electorate. Smaller polls, and that includes most in the swing states, are not reliable. That either candidate gets a surprisingly decisive victory cannot be ruled out.

There are state where the race is seen as close, three in the north (Pennsylvania, Michigan and Wisconsin) and four in the south (North Carolina, Georgia, Arizona and Nevada). The northern swing states are slightly more favorable to Harris than the southern ones. If Harris wins the three Northern states and Trump wins the four southern states then Harris (barring shocks elsewhere) would receive the narrowest of Electoral College wins, 270 to 268. However if Trump wins one of the northern three, it would be tough for Harris to win. A Trump win in Pennsylvania would require Harris to win at least two southern swing states, and even if Trump gains only Wisconsin, the smallest of the northern swing states, Nevada, probably Harris’ most likely southern swing state, would not be enough. This suggest an advantage for Trump. Voting closes in Georgia at 7pm Eastern Time (12am GMT) at 7:30 in North Carolina, 8 in Michigan, 9 in Wisconsin and Arizona and 10 (3am GMT) in Nevada. Exit polls will appear after voting ends. It will be a major surprise if networks are willing to call a swing state until well into the night.

Senate leaning Republican, House leaning only marginally to the Democrats

All major Senate races see significant opinion polling. The Democrats currently have a 51-49 majority but West Virginia is almost certain to turn Republican, Montana looks likely to and a race in Ohio looks close to an even bet for a Republican gain. Democrats have several more incumbents is tight races which are leaning towards a Democrat hold. The most vulnerable Republican seat is in Nebraska, where the challenger in a close race is an independent populist, who has stated he would not align with either party. There are no races where a Democrat is expected to defeat an incumbent Republican, though they have some hope of an upset in Texas. In the event of a 50-50 Senate split the Vice-President has the casting vote. If Trump is elected President he would need two upsets to lose the Senate, while if Harris is the winner she would need one upset to keep the Senate.

The 2022 House elections brought a Republican majority of only nine (out of 435 seats), meaning that the Democrats needed only five more seats to win a majority, and that Harris now has stronger approval ratings than President Biden did in 2022 we expect Democrats are more likely than not to achieve a narrow House majority. However it is a close race and it will probably be a few days before a number of close races in California in particular see a winner declared. The race for President is likely to see recounts requested in at least one close state (either party would ask for a recount if the margin is within the required limits). However a clear victory for Trump would be conceded relatively quickly by Harris. Any victory for Harris would however be aggressively contested by Trump until inauguration.

Our overall probabilities

We attach a 55% probability to a Trump win, with a 30% probability that he will also have Republican control of Congress, with a 25% probability of a Trump Presidency and the Democrats holding at least one chamber of Congress. If Harris is the president, the probability of the Democrats having control of Congress is no more than 10%, leaving a 35% probability of Harris as President but without control of Congress.

Not much change to the economic view if Harris wins

If Harris is elected we doubt we would revise our economic forecasts by much. Given that Democratic control of Congress is a low probability scenario she would have limited ability to implement any aggressive new spending plans, though the budget deficit would increase from an already large 6.4% of GDP. Should the Democrats gain control of Congress, the extra spending could be significant but it would largely be financed by tax increases. Without any major changes in policy, prospects for the US economy look reasonably bright, with GDP growth still having some momentum and inflation low enough to allow the Fed to support the economy if growth falters. A Harris presidency and Republican control of at least one chamber of Congress would however guarantee a showdown over the debt ceiling, with risks of brinkmanship leading to a default larger in the case of a Republican House. While a deal would probably be done, the risks should not be dismissed. Harris’ negotiating abilities may fall short of Biden’s, given the latter’s much lengthier service in the Senate.

Under Trump tariffs will be the key decision, and the outcome is highly uncertain

A win for Trump would inject a large degree of extra uncertainty to the picture. This is particularly so in the case if Republicans control Congress, but substantial even if they do not. On the campaign trail, Trumps promises for tax cuts are getting increasingly more aggressive. Some, such as making his 2017 cuts permanent would clearly be a priority while others, such as excluding Social Security benefits from taxation, look less likely to be. However Trump is clearly looking to cut taxes significantly more than Harris (who would only partially extend the 2017 tax cuts), and has few serious proposals to reduce spending. With Harris unlikely to able to add much to spending and willing to raise taxes to pay for much of anything she can do there is little doubt that budget deficits would be higher under Trump than Harris. Deficits of 8% of GDP look plausible if the Republicans also have a clean sweep, enough to cause concern in the Treasury market and for the rating agencies. Without tariffs, GDP and inflation would probably be slightly higher under Trump than Harris, equities better supported and UST yields higher, but the differences would be modest.

However, as Trump escalates his tax cut proposals, he is increasingly pushing tariffs as a means to pay for them, now suggesting 20% across the board rather than his original 10% suggestion with rates of 60% on China. A large increase in tariffs could, even with a reduction in imports, raise over 2% of GDP in revenues, but much of this would be a passed onto prices. A one-time adjustment to the price level may be acceptable but the Fed would need to be on guard for second round effects, particularly if reduced immigration lifts wages without boosting productivity. Tariffs, which would surely see retaliation against US exports, would probably be a net negative on GDP. While the economy appears to have enough underlying strength to stay out of recession, Trump’s tariff proposals carry large risks.

Whether Trump would go ahead is highly uncertain. He has the authority to do so if he invokes national security concerns. Some Republicans will warn him that aggressive tariffs would weigh on equities, which Trump cares about, and would boost inflation, a rise in which was very damaging to Biden. If Trump inherits a growing economy with falling interest rates he may simply decide to take the credit for a healthy economy and avoid major policy actions. Aggressive or limited action on tariffs are both possible. Compromise options could involve taking action against a few countries, China and Mexico being particularly vulnerable.

If Trump has to govern with the Democrats in control of one of the Chambers of Congress (most likely the House) he will be unable to fully implement his tax cut plans, and will have to compromise even on the extension of his 2017 tax cuts. Still, there will be more Democrats willing to vote for tax cuts than Republicans willing to vote for tax-funded spending increases so taxes are likely to be lower and budget deficits higher than would be the case under Harris with a Republican Congress. Trump would still have the authority to raise tariffs, though without the aggressive tax cuts a Republican Congress would be willing to authorize he would have less fiscal incentive to do so, and the arguments against tariffs outlined above will remain relevant. Still, Trump’s case for tariffs is not confined to the need for revenues. Even without the support of Congress, aggressive tariff increases from Trump cannot be ruled out.

Fed policy and foreign policy

Our current central forecast for an end 2025 Fed Funds target of 3-3.25%, 175bps lower than currently, assumes little change in fiscal policy and can thus be sees as consistent with the scenario that Harris as president without the support of Congress (we shall review our Fed call after the Nov 7 FOMC and the election outcome). Even here the risks are on the upside given recent resilience in economic data.

Under a Trump presidency with limited action on tariffs easing would probably be a little more cautious than under Harris, perhaps by 50bps, but if a sharp tariff increase was seen the Fed would be likely to keep policy restrictive until it was clear that there were few second round effects. If the Fed eases significantly before tariffs are raised, we may see some of that easing reversed. Jerome Powell looks unlikely to be reappointed as Fed Chairman when his term expires in May 2026 in any case. Trump will try and appoint supportive individuals to any vacant Fed positions, but he is unlikely to be able to appoint enough to bring the Fed under his control in a four year term.

On foreign policy the primary issue to watch is Ukraine, even if Harris decides to reduce support for Israel. Trump would probably be willing to settle for a deal which gave Russia a significant part of Ukraine, either what Russia already controls or the whole of what it has officially annexed, while agreeing to keep Ukraine out of NATO. Trump would however probably not want to make a deal that delivered images of Russia taking control of the Ukrainian capital Kyiv.