Coalition’s Determination will be Key for Narrowing South Africa’s Current Account Deficit

Bottom Line: Current account deficits (CAD) continue to be a major headwind for South African economy ignited by logistical constraints, power cuts (load shedding), and weaker external demand especially from China and the EU. We think CA will be still bolstered by a trade surplus in H2 2024, supported by ECB easing and likely start of Fed easing in September, which can help strengthen exports. The coalition’s determination will be key, as the government would need additional reforms in the medium term in the energy and transportation sectors to address long-standing impediments in closing CAD.

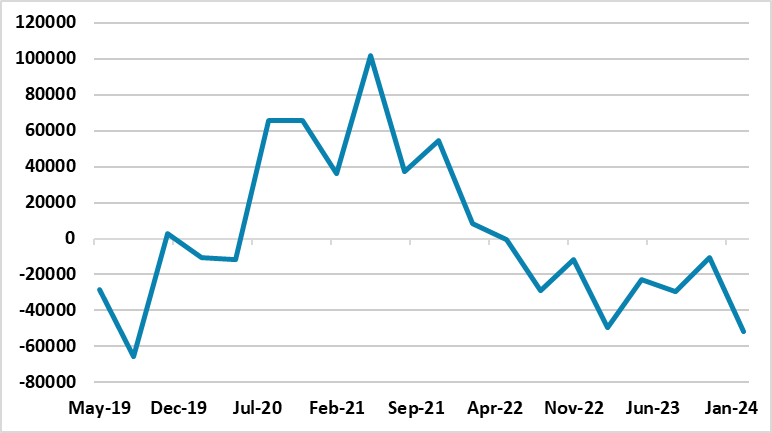

Figure 1: Current Account Balance (Million Rand), May 2019 – February 2024

Source: Continuum Economics

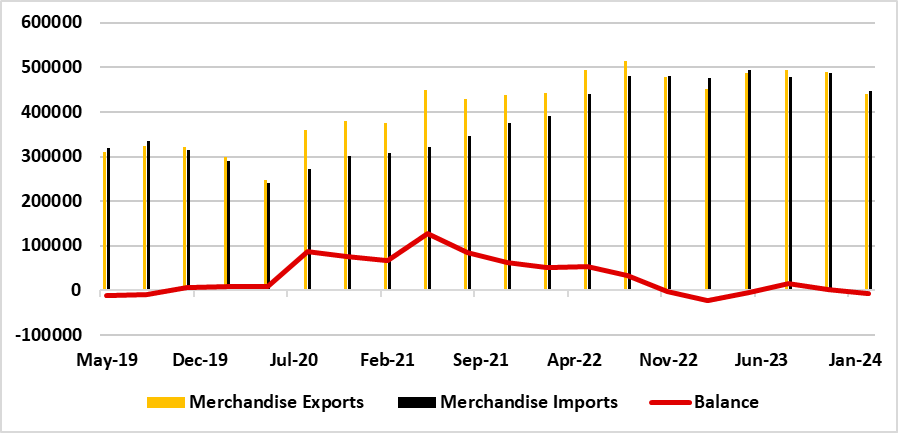

Figure 2: Foreign Trade (Million Rand), May 2019 – February 2024

Source: Continuum Economics

South Africa recorded a remarkable current account (CA) surplus worth 3.7% of its GDP in 2021 thanks to high commodity prices, and exports out grew imports triggered from recovering global demand, but things did not go well afterwards. CA fell into a small deficit in 2022 mostly due to a declining trade surplus driven by imports growing fast. CAD widened to R112.5 billion (1.6% of GDP) in 2023 from R30 billion (0.5% of GDP) in 2022 as transportation bottlenecks got worsen negatively impacting exports, commodity prices declined, and import demand remained strong. For the year 2023, the trade surplus narrowed to R103.5 billion (1.5% of GDP) from R224.2 billion (3.4% of GDP) in 2022. (Note: IMF expects CAD will further widen to 1.8% of GDP in 2024, and 1.9% of GDP in 2025).

According to South African Reserve Bank’s (SARB) latest current account report released on June 6, SA’s CAD narrowed to R84.6 billion in Q1 2024 from R162.9 billion in Q4 2023. The CAD as a ratio of GDP narrowed to 1.2% in Q1 2024 from 2.3% in Q4 2023. Trade surplus widened from R90.9 billion in Q4 2023 to R183.4 billion in the Q1 2024 as the value of goods exports increased marginally while that of merchandise imports decreased. As mentioned, the decline in CAD in Q1 2024 was ignited by the accelerating foreign trade surplus coupled with “improved terms of trade (including gold) in Q1 2024 as the rand price of exported goods and services increased more than that of imports,” SARB indicated.

SARB’s international investment figures, which was published on June 28, demonstrated that the country’s positive net international investment position (IIP) increased from a revised R2,028 billion at the end of December 2023 to R2,537 billion at the end of March 2024. The increase in the positive net IIP in Q1 2024 was due to a significant increase in foreign assets, mainly emanating from strong growth in foreign share market indices, while foreign liabilities decreased during the period.

We think there are moderate risks to CAB in H2 2024 such as weaker external demand especially from China, whose recovery remains faltering, coupled with higher energy related capital imports, logistical constraints and load shedding. (Note: Despite load shedding hurt the domestic economy particularly in Q1 as stages 3-6 of load shedding was implemented, Eskom recently announced that load shedding remained suspended for 79 consecutive days, reflecting an improvement in the reliability and stability of the generation coal fleet). We feel CA will be still bolstered by a trade surplus in H2 2024, supported by ECB easing and likely start of Fed easing in September, which can help strengthen exports.

Most importantly, the coalition’s determination will be key to fight against CAD. We envisage the coalition will be weaker at least for some time, and less able to undertake necessary fiscal reform policies abruptly and deal with power cuts and logistical problems in the near future, since the focus is currently on the new cabinet, and power sharing.

We feel the new coalition government would need additional reforms in the medium term in the energy and transportation sectors to address long-standing impediments in closing CAD.