USD, JPY, AUD, EUR flows: JPY slightly offered as risk recovers

A better equity performance overnight has allowed some correction to recent JPY strength, but JPY still looks well supported

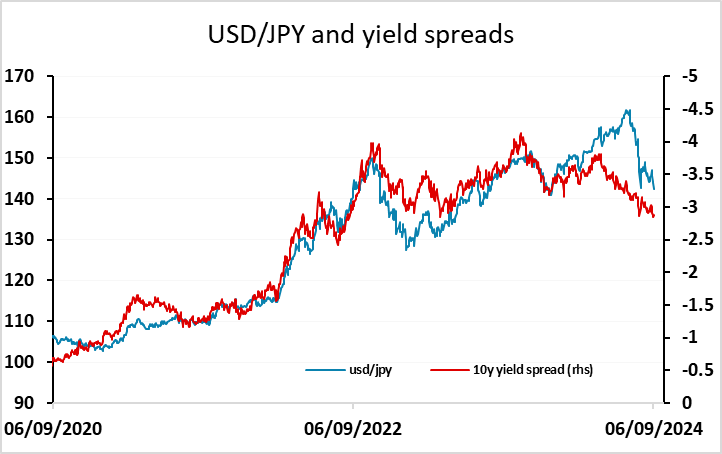

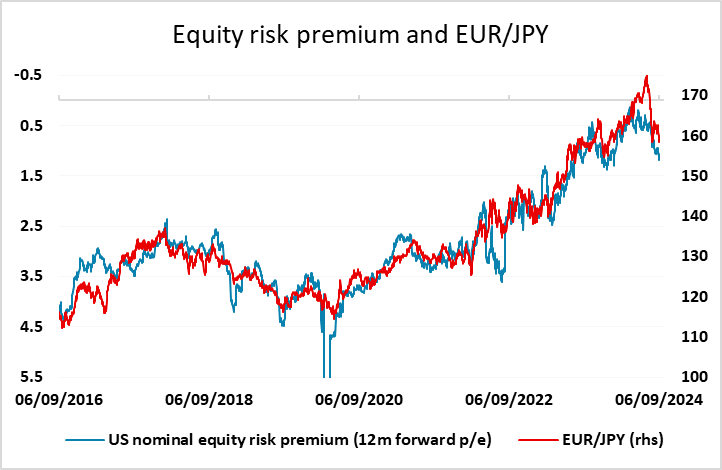

After a week of equity market weakness the week has started with a more risk friendly tone, with global equities generally firmer, and the riskier currencies consequently managing a modest recovery against the JPY overnight. There isn’t a great deal on the calendar today, with the Japanese GDP data overnight having come in slightly on the soft side, but comments from chief cabinet secretary Hayashi citing BOJ's Governor Ueda saying there are more rate hikes ahead have helped to limit JPY losses. As it stands, the JPY still looks to be slightly on the cheap side relative to yield spreads and equity risk premia against the USD and EUR respectively, so we doubt this JPY dip will extend far given the deterioration in the US employment trend supported by last week’s employment report. While this is not too severe, it looks quite clear after the downward revision to the June and July payroll data.

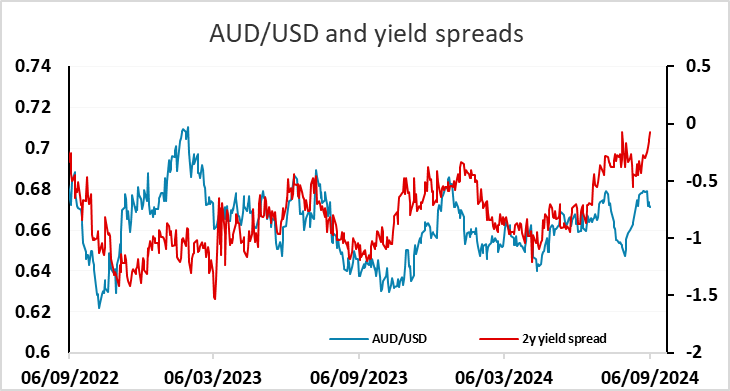

Elsewhere, the stabilisation in risk sentiment should allow some bounce n the riskier currencies against the USD, with AUD/USD looking cheap relative to recent yield spread moves. While there is some scope for US short term yields to edge higher if the market starts to price out the risk of a 50bp cut from the Fed next week, there has already been enough spread movement in recent weeks to justify AUD/USD moving back towards the top of the year’s range above 0.68.