Dovish Tone from the Bank of Canada

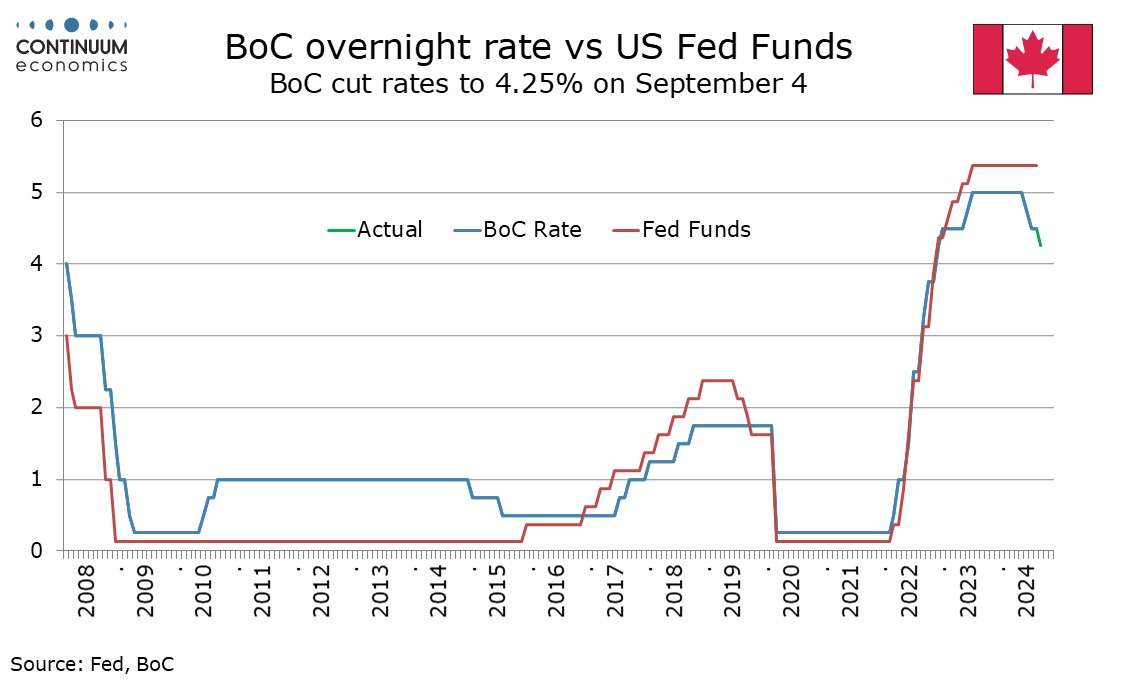

The Bank of Canada eased rates by 25bps for a third straight meeting as expected, taking the rate to 4.25%. The tone of the statement and press conference was dovish, expressing concern that growth may fall short of their expectations while seeing some progress in still resilient shelter inflation. This suggests that the pace of easing could be accelerated by early 2025.

The statement saw global growth as in line with projections in July’s Monetary Policy report, and 2.1% annualized Canadian GDP growth in Q2 was above forecast. However the statement also noted soft activity in June and July and continued slowing in the labor market. Inflation slowing to 2.5% in July was seen as expected. While the statement stated the BoC continues to weigh the opposing forces of excess supply reducing inflation and price increases in shelter and other services holding inflation up, the tone of Governor Tiff Macklem’s opening press statement was dovish. He saw the sources of upside pressure from shelter and some other services as having eased slightly but the downward pressure from excess supply remaining. He also noted that July’s economic projection had growth strengthening further in the second half of the year but recent indicators suggested some downside risk to this. He stated the share of CPI components growing above 3% was now around the historical norm but shelter inflation was still too high, despite early signs of easing.

In responding to questions Macklem stated there was a strong consensus for a 25bps cut and that a slower and faster pace of easing were both considered. He added that the BoC was prepared to take a bigger step if needed. If GDP growth does not improve as expected, leaving the upward trend in unemployment, now at 6.4% after starting 2023 at 5.0%, intact, and inflation gets close to target, the BoC may consider accelerating the pace of easing. The neutral range is currently estimated as 2.25-3.25% and the BoC may want to move more rapidly to neutral, or even a little below. We continue to expect 25bps moves in the remaining two meetings this year, on October 23 and December 11. Risk is however for more, increasingly so for December, if, as we expect, GDP does not gain momentum.

We now expect that this easing cycle will deliver at least one 50bps move, most likely in Q1 2025, and that rates will be moved down to 2.5%, in the lower half of the neutral range, by mid-2025, by when inflation should be near the 2% target. We expect GDP growth will move above 2% in the second half of 2025, though it may not be until 2026 when a return to full employment is achieved. Then we would expect the BoC to nudge rates up to 2.75%, the midpoint of the neutral range.