Eurozone: What Services Inflation?

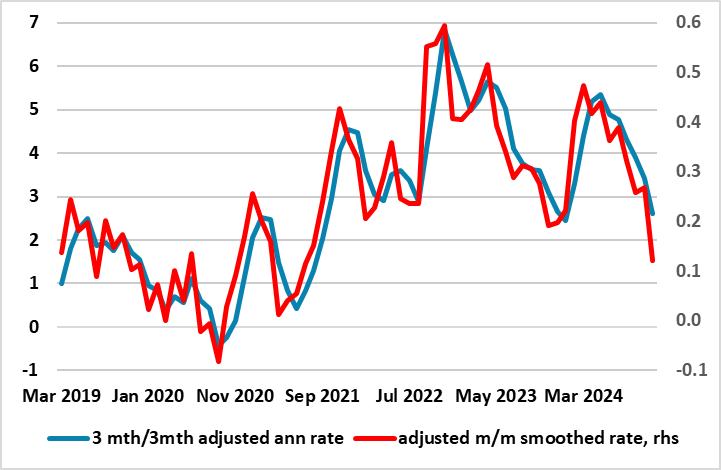

While real economy considerations seem to have taken over as the policy focus for the ECB majority, there are still some mutterings about apparent resilient services inflation. The latter is certainly the case when such inflation is measured on the conventional but possibly untimely y/y basis. However, while services inflation in the just-released flash was little changed at 3.9%, more up-to-date (ie short-term) measures show a completely different story with adjusted m/m figures not only consistent with being below target but also back to a pre-pandemic pace (Figure 1). Most of this is base effects related to indexation waning. But amid signs elsewhere of softening activity, now encompassing services too, the ECB this month has to ask itself whether soft inflation is not just the target being met early and durably but is as much a further symptom of economic weakness.

Figure 1: Services Inflation Slumping?

Source: Eurostat, ECB, CE

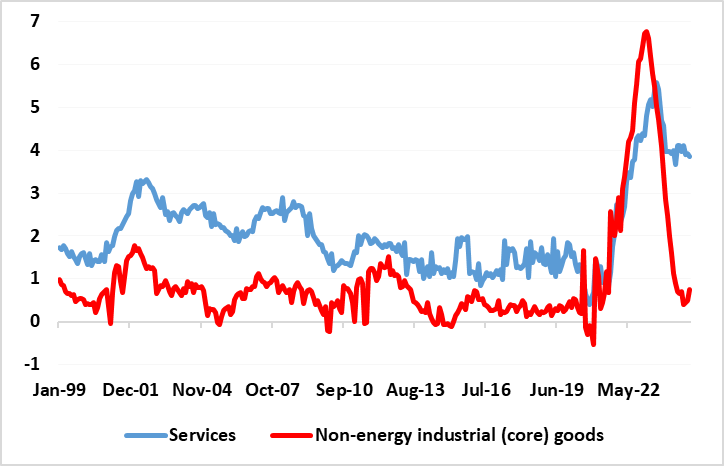

The ECB’s repeated focus on services inflation was understandable to some degree given that it had relatedly exceeded expectations and still does seemingly given that the y/y rate is running at just under 4%. In this regard, the ECB was wary of courting upside risks to overall inflation. But amid an apparent symmetric inflation target, it is puzzling why the ECB chose to focus on relatively high services inflation as opposed to very low, below-target and falling non-energy goods inflation. This is especially so given that a juxtaposition of services inflation persistently exceeding goods inflation was very much the pre-pandemic norm (Figure 2), with the former having run at pace well above the 2% overall target while goods undershot.

Regardless, services inflation has fallen, albeit slowly and unevenly. But there are increasing signs that services disinflation has picked up. This is not dramatically apparent when looking at the conventional y/y measure that many in the ECB still seem to think is the only way to assess price trends. But given what seems to be increasingly reliable seasonally adjusted measures, it is now possible, if not beneficial, to assess price swings using much more short-term dynamics. Indeed, the ECB has been computing and using seasonally adjusted HICP (and breakdown) data for time. With this in mind, it is notably that the November adjusted measure saw the first m/m drop since early in the pandemic. Admittedly, little should be taken from one month’s reading, however, divergent it may be from previous trends. But smoothing out the last three such m/m readings (ie averaging) shows inflation on this basis at a pace of just over 0.1%, ie consistent with an undershoot of target (Figure 1). This is less but still evident on a 3mth/3mth annualized basis that the ECB prefers but which suffers comparatively by being less up-to-date.

Figure 2: Services Inflation Historically Above That if Goods

Source: Eurostat, CE

Thus, ECB worries about upside inflation risks have dissipated very clearly of late, with worries now surfacing about a possible undershoot that may even requite the monetary stance to return to being expansionary as opposed to the clearly restrictive position currently. Indeed, mid signs elsewhere of softening activity, now encompassing hitherto solid-to strong services, the ECB this month has to ask itself whether soft inflation is not just the target being met early but is as much a further symptom of economic weakness.