Fed: Heavy Hints at 2024 Rate Cuts

The December FOMC provides heavy hints that the Fed is preparing for 2024 rate cuts. An implied 75bps of cuts in the 2024 median dot, plus Powell Q/A not pushing back against easing ideas and providing some focus on easing considerations. Powell also acknowledged that the dual mandate was coming down into focus, which makes the Fed more senstitive to the economic slowdown. We see the first 25bps in Q2 and then a further 100bps in H2 2024, as we see a weaker growth outlook than the Fed.

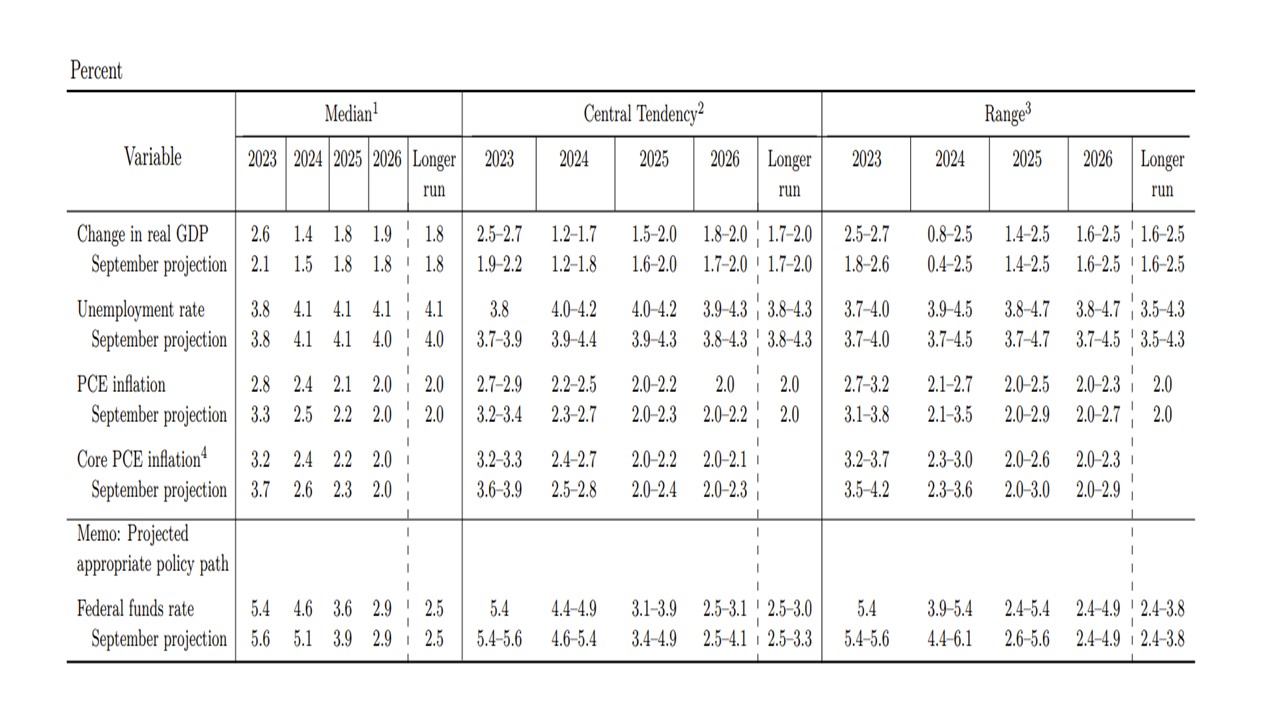

Figure 1: Fed December Summary of Economic Projections (SEP)

Source: Fed (December SEP)

Peak Rates Before 2024 Rate Cuts

The December FOMC statement and Fed Chair Powell Q/A provide a number of clues on prospective policy. Key points include

· Inflation/Growth Slowdown. Not much change in economic forecasts, but Fed officials are becoming more comfortable that core PCE inflation should come back to target. Though the median only hits 2.0% in 2026, the 2024 median at 2.4% is getting closer to target. The market also picked up on 2023 core PCE median moving to 3.2% v 3.7% in September. Fed chair Powell also highlighted the view that the labor market is rebalancing and expected to continue to do so. The FOMC statement also acknowledged softening of the economy and better inflation trajectory and Powell did note that non housing service inflation is improving.

· Guidance on Interest rates. The December SEP (Figure 1) has a median of 75bps of cuts penciled in for 2024. Though the market was already discounting 100bps of cuts, this will be seen as a signal that momentum within the Fed is building towards a series of rate reductions in 2024 not just a solitary 25bps cut. The 100bps median of cut for 2025 and 70bps for 2026 will also be regarded as something that the market needs to consider, especially as some of this could be brought into 2024 if the economy stalls. The 2.9% end 2026 median also shows that the Fed expects to eventually get down to 3% in the coming easing cycle. Fed Powell Q/A left the impression that the Fed easing would be a topic going forward, with the Fed dots showing easing expected by Fed officials in 2024. He also noted that the Fed was aware of the risk that waiting too long before easing could leave policy too restrictive, now that the dual mandate is coming back into focus. Additionally, the push back from Powell to dampen rate cut talk was weak, which suggests that the Fed is moving towards 2024 easing. The FOMC statement was also tweaked to effectively signal that the tightening cycle is expected to be done, which will also help to shift the focus to 2024 easing.

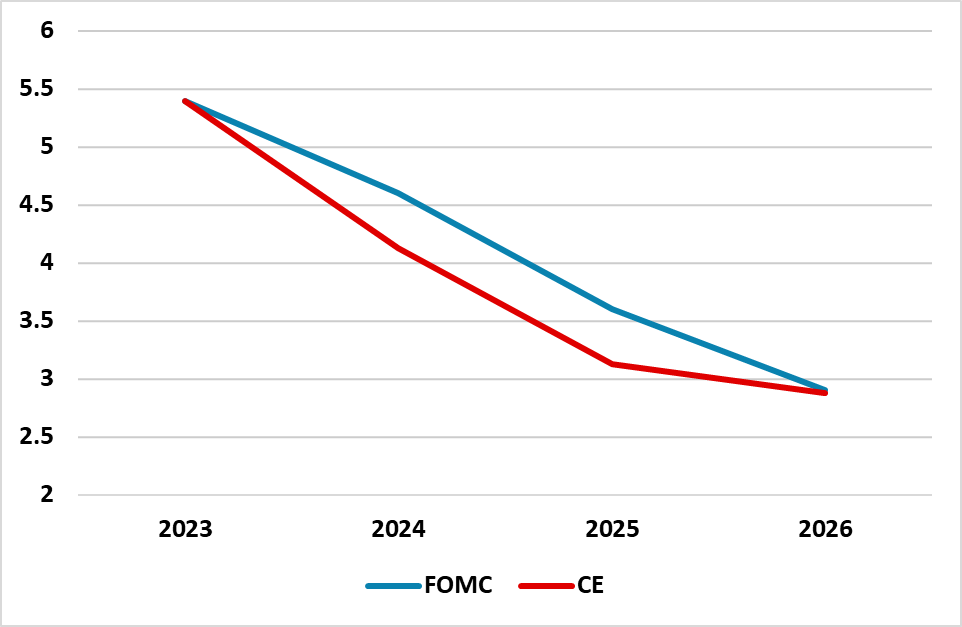

· 2024 rate cuts. We have penciled in the 1cut of 25bps to be delivered in Q2 2024, which is based on our macro view of the economy slowing more than the Fed thinks and this brings forward tightening. The dots and Powell Q/A is consistent with this timing. Additionally, a sub 1% trend in growth will likely worry the Fed that policy is too restrictive. In H2 this will likely mean that the Fed delivers 25bps at all four meetings for a cumulative 125bps in 2024 (Figure 2). Real sector/inflation data and financial conditions will be crucial, with Powell downplaying ideas that the Fed would cut rates mechanically to avoid real rates rising.

Figure 2: Fed Median v CE Fed Funds Projections (%))

Source: Fed/Continuum Economics