2yr Treasury Yields and A Mature Fed Easing Cycle

The outlook for 2yr yields is still dominated by the scale of expected Fed cuts and this remains fluid and most influenced by whether data continues to show momentum or whether the soft v hard landing debate reignites. However, other financial markets should also watch how expectations of the maturity of the easing cycle develops, as normally towards the end of an easing cycle the 2yr moves to a yield premium versus 10yr yields.

Though it seems premature to look at 2yr and the end of Fed easing, if the easing cycle turns out to be modest what would be the impact on 2yrs?

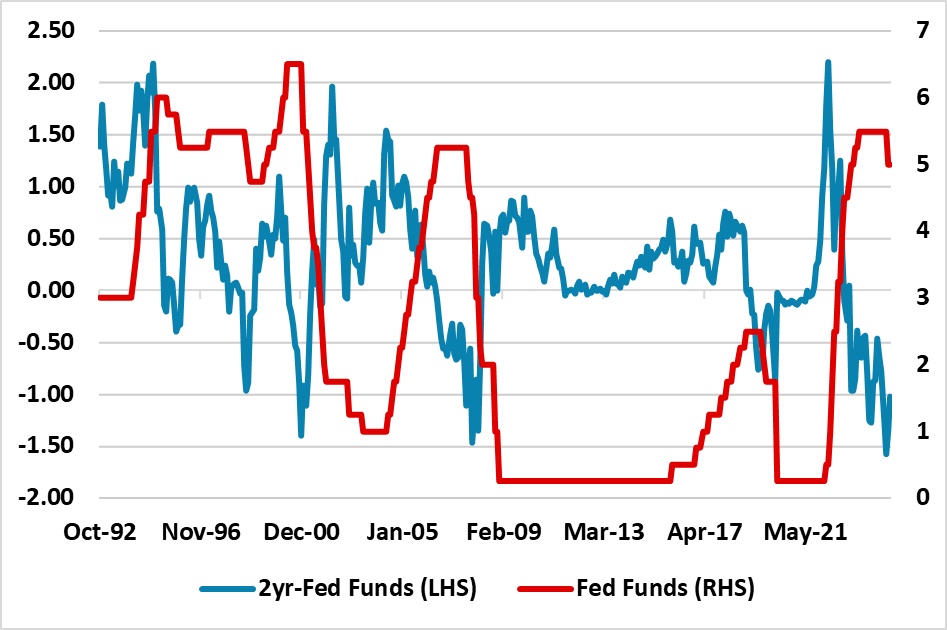

Figure 1: 2yr-Fed Funds Rate and Fed Funds Rate (%)

Source Datastream/Continuum Economics

Market expectations of the terminal policy rate in this Fed easing cycle have risen from 2.75% to 3.50% over the past month, as economic data has backed the soft landing idea and tempered fears of a harder landing in the U.S. economy. Indeed, the idea of rate cuts every meeting until June 2025 has been replaced by a more fluid expectations of four further 25bps cuts on this timescale. This has prompted an upward adjustment in yields across the U.S. Treasury curve, but what happens next?

· Data drives the market. It could be that the relative economic resilience continues or that the lagged feedthrough of previous tightening causes some weak figures and reignites the soft v hard landing debate. U.S. Treasury yields could move either way on the broader range of data outcomes, with next week GDP, PCE inflation and Employment reports being key before the Nov 7 FOMC announcement – we will review our Fed projections after these events.

· Fed Nov cut or hold? Expectations remain widespread that the Fed will cut by 25bps on November 7 to take further insurance out against a hard landing. However, a move is not 100% discounted and some hawkish FOMC officials have questioned the need to cut in November and December. If the Fed did not cut, the market could wonder whether easing stops at say 4.0% or above?

· Trump elected. We previously highlighted that if Donald Trump is elected (here), that the scale of policy action could be greater with a Republican clean sweep than a divided Congress – we attach a 25% probability to Trump victory and congressional clean sweep. This could be corporate tax cuts for example, which Trump could decide to partially fund with tariff increases. The policy stance would not be clear until H1 2025, but this could cause the Fed to slowdown the easing cycle in H1 2025 and in turn this could get the market fearing that the Fed easing could end between 4.5% and 4.0%.

For 2yr yields the scale of Fed easing is the most important issue, but as an easing cycle gets mature the 2yr discount to the Fed Funds rate normally flips to a premium (Figure 1) as the market discounts that the next policy cycle could be tightening. In 1995 and 1998 the Fed had easing cycle without a harder landing, which amounted to 75bps of Fed Funds cuts. By March 1996, 2yr was at a 50bps premium versus Fed Funds and Feb 1999 a 40bps premium versus Fed funds – both were a couple of months after the Fed’s final cut. We are not saying this will happen soon, it just that market expectations on the terminal policy rate also need to be watched as well as the timing of the next cut.