USD flows: Repeat of reciprocal tariff sell off?

USD generally weaker as Greenland spat revives memories of USD sell off on reciprocal tariff announcement last April

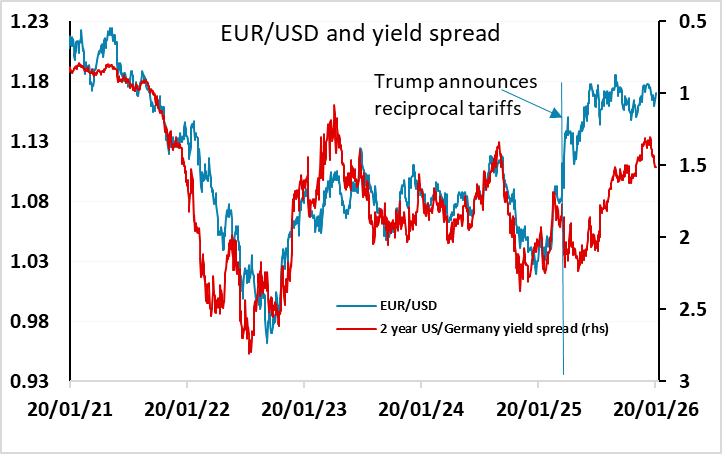

The USD is generally weaker in early European trade, except against the JPY, with the market apparently reprising the post-reciprocal tariff sell off seen last April in response to the Greenland situation. It’s early days – the move in April last year was much more violent, with EUR/USD gaining 7 big figures in the first 3 weeks of April despite yield spreads moving in the USD’s favour. The threat of tariffs over Greenland has nevertheless reignited the discussion about international investors potentially reducing their weightings in US assets due to concerns about the unpredictability of US policy. This was reported to be a factor in the April sell off, and although there is little evidence of any significant divestment, there may have been some more hedging of USD exposure. Either way, the market may be looking for a repeat performance, with the USD down and US yields up overnight.

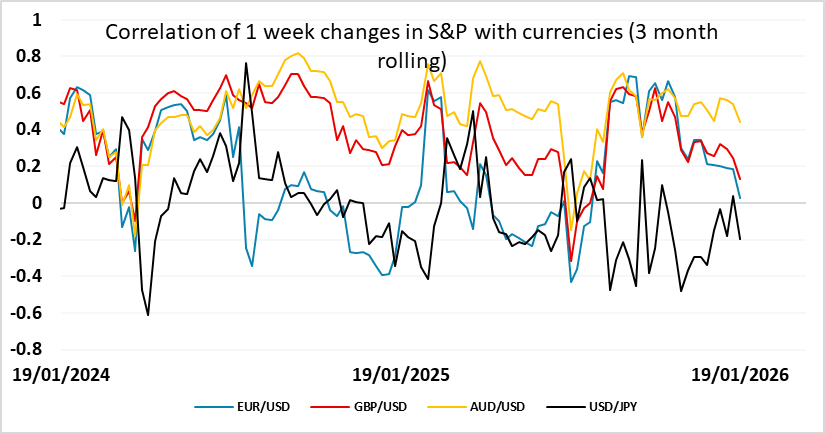

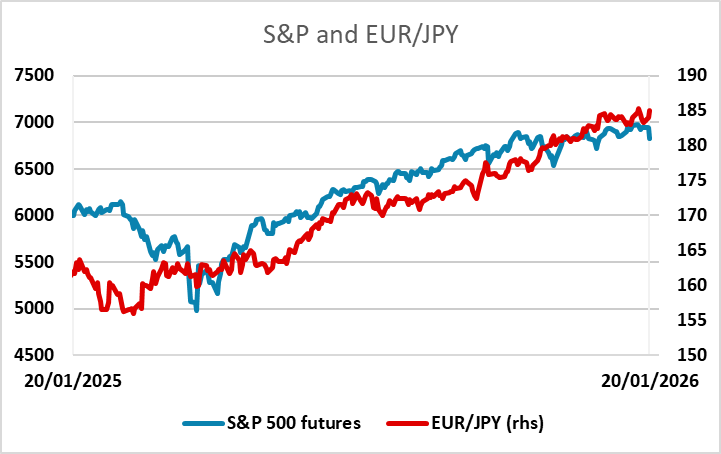

In April, the USD decline came across the board, with the JPY also initially benefiting, and only declining when equities broke to new highs in June. This time around, the JPY is hampered by speculation around the Japanese election, but with the JPY at significantly lower levels and with equities still falling, we would expect USD/JPY to reverse the latest gains. Scope for USD losses elsewhere may be less substantial than before if equities weaken significantly, as the USD remains significantly negatively correlated to equity indices against the riskier currencies.