Indonesia CPI Review: Food Prices to Maintain Pressure

Easing food inflation saw headline CPI decline to 2.8% yr/yr in May. Nonetheless, price pressures from a weakening IDR persist. Bank Indonesia will likely hold rates till Q4-2024.

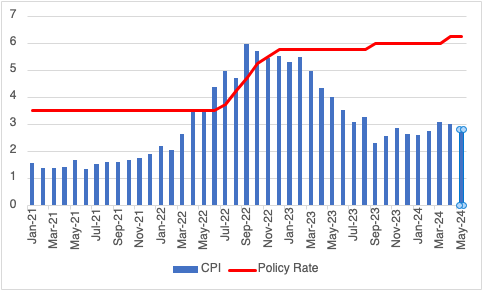

Figure 1: Indonesia Consumer Price Inflation and Main Policy Rate (%)

Source: Continuum Economics

Indonesia's Consumer Price Index (CPI) inflation rate fell to 2.84% yr/yr in May, according to data released by Indonesia’s Statistics Bureau. This marks a decrease from April’s 3% and is below our expectation of 3% price growth. On a monthly basis, headline inflation slowed to 0.03%.

May's inflation rate remains within Bank Indonesia’s (BI) target range of 1.5-3.5% for the year. Core inflation, which excludes volatile items such as fuel, edged up to 1.93% yr/yr from 1.82% yr/yr in April. The decline in headline inflation comes on the back of easing food price following the holiday season around Eid al-Fitr. As the effects of Eid al-Fitr wane, we anticipate continued downward pressure on inflation in the coming months.

However, for Indonesia’s central bank, Bank Indonesia, challenges persist. Despite the dip in inflation, the BI is unlikely to cut rates in the near term. Given the uncertainties around the Federal Reserve’s stance on interest rate cuts, BI would choose to remain cautious. Indonesia recorded a 5.1% yr/yr growth in Q1-2024, which would provide BI sufficient room to not head into a rate cutting cycle just yet. We believe BI will prioritise exchange rate stability over Q3 2024, and hold the policy rate steady at 6.25% till Q4. BI, in our view, could also opt for another rate hike, should the IDR come under excessive pressure. The probability for this remains slim. BI's forex reserves have been declining since the start of 2024. Foreign exchange reserves fell 3% m/m to US$ 136.2bn as at end April.

Looking ahead, CPI inflation is expected to remain broadly stable within BI's target range. We anticipate inflation to trend downward over Q3. However, external pressures on the rupiah could cause some inflationary upticks. Nonetheless, the impact of imported inflation remains limited so far.