USD, EUR, JPY flows: USD soft as equities rally, JPY reverses losses after BoJ

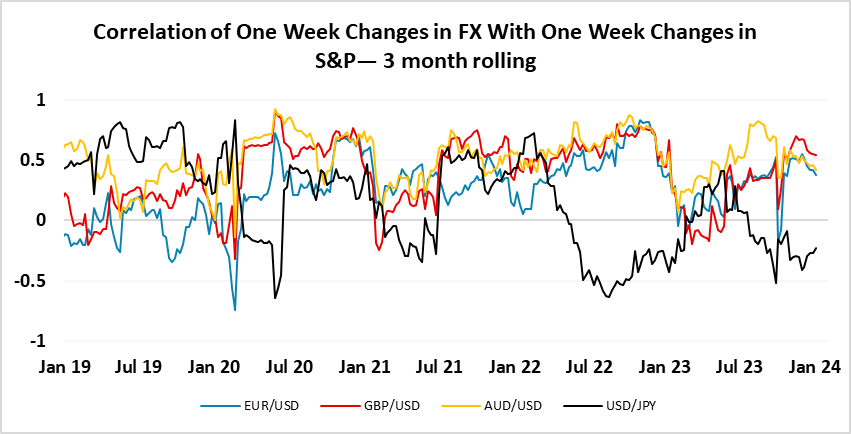

Better regional equity performance led to some USD losses overnight, JPY weakness post-BoJ was quickly reversed, but JPY upside scope still looks limited while risk sentiment stays positive and BoJ stays on hold.

The USD has generally traded softer overnight, supported by generally more positive equity sentiment, notably in China. The main event of the overnight session, the BoJ meeting, was something of a non-event, with no change in policy and just a downward revision in the CPI forecast for 2024 to interest the market. In practice this had no real impact, with a small knee-jerk JPY decline quickly reversed. While the JPY was a little softer on the crosses through the Asian session, as the USD fell against the riskier currencies on the back of the better regional equity market performance, it has rallied strongly in early Europe and now stands better on the day across the board.

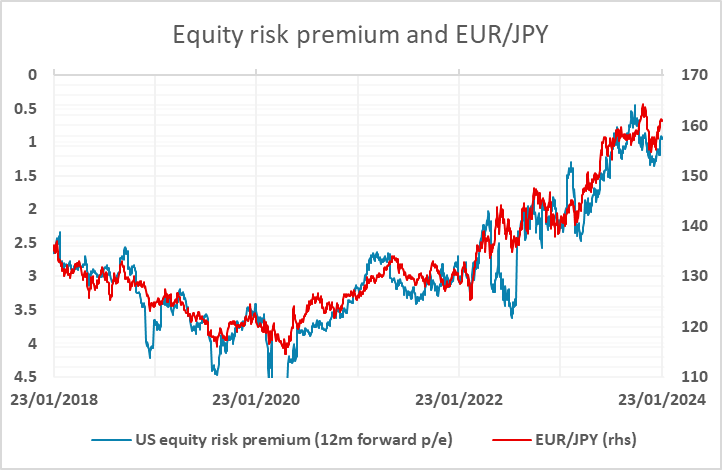

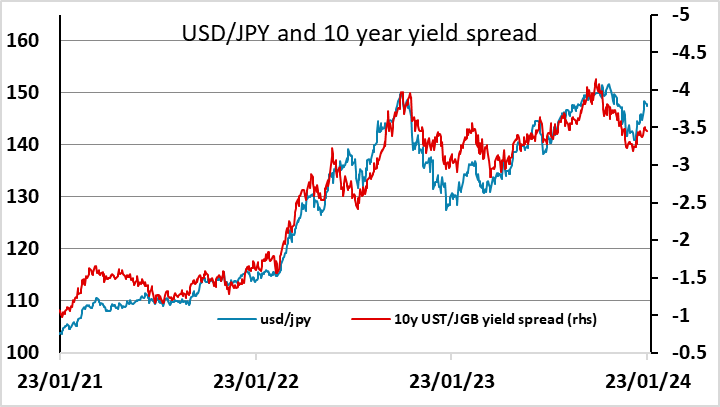

There isn’t a lot else on today’s calendar for the market to get its teeth into, with only the ECB Q4 bank lending survey having some potential to impact the market. While the JPY’s rally in early trading looks encouraging for the longer term JPY bulls (like ourselves), we doubt we will see any real extension of this strength unless the equity markets reverse some of the strength seen overnight. JPY crosses continue to be guided mostly by US equity risk premia, and the general strength of US equities so far this year combined with mildly firmer bond yields has meant an implied decline in risk premia that has weighed on the JPY. Lower bond yields, or lower equities, or both, are likely to be required to trigger a JPY recovery, in the absence of any imminent change in BoJ policy.