Eurozone: Labor Market Faltering

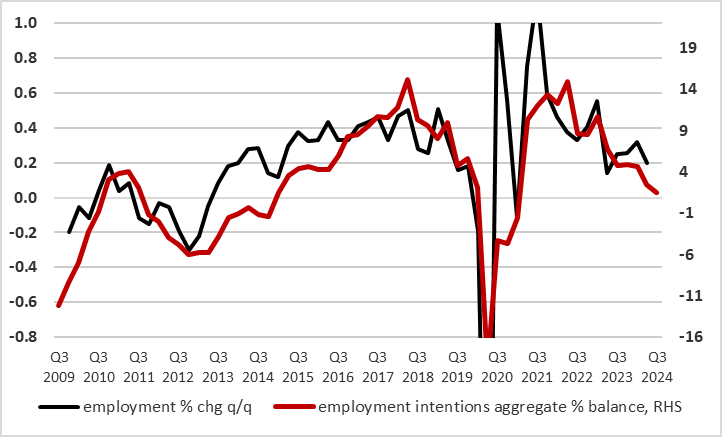

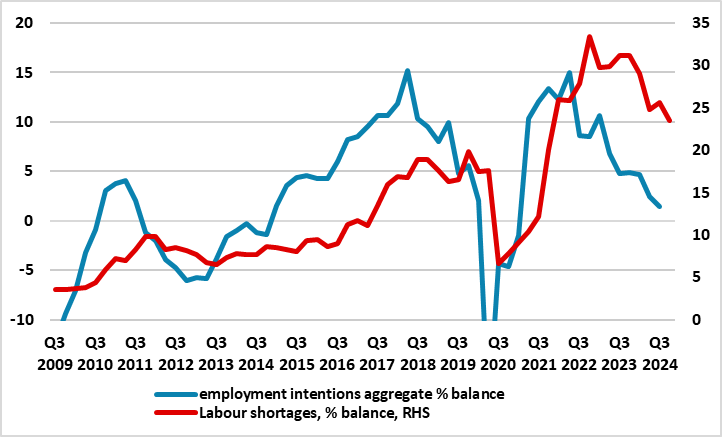

There are suggestions that worries about weaker growth are now reverberating within the ECB, albeit with the hawks still more mindful of service price resilience. But the former worries chime with our long-standing concern of downside risk to what we still see is a below-consensus growth outlook, emanating not least from tight financial conditions and weaker global activity. Perhaps more notable are now signs that some of these downside risks may now be materializing, with business survey data possibly puncturing what has been solid service sector activity and the labor market in particular. Indeed, such survey data has seen a distinct drop in employment intentions that bodes ill for jobs growth (Figure 1) and where this seems to be more a reflection of company caution given what still seems to be a general labor shortage (Figure 2).

Figure 1; Employment Intentions Suggest Jobs Growth to Reverse?

Source: European Commission, Eurostat; aggregate computed by CE

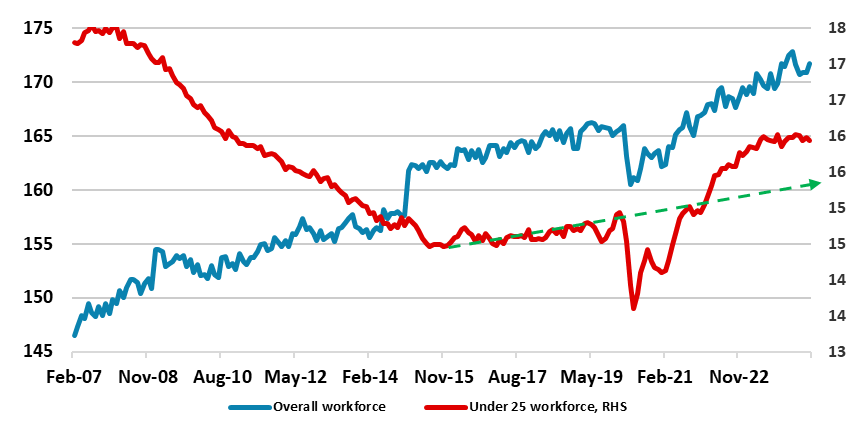

Low Jobless Rate Not the Main Story

Growth worries, let alone labor market concerns, seem puzzling given a record-low jobless rate of 6.4%. But as we have repeatedly highlighted this is not apparent labor market tightness, the very opposite as it reflects an ever larger workforce (Figure 3). Indeed, this record-low jobless rate continues to mask something unique to the EZ, at least amid the DM world, that is not only an increase in labor supply and to levels that has exceeded pre-pandemic rates. Moreover, the increase in the workforce has perhaps been most manifest among the young (under 25), they more likely than older workers to consider looking for better paid work (ie labour churning). This will surely diminish what may already be slowing wage pressures, especially given that these younger potential works also seem to have a much lower perception and expectation of overall inflation according to the ECB’s consumer expectations survey.

Labor Supply Growing

Of course that is not the whole labor market story as employment has grown every quarter since mid-2021, something that has reflected a need for companies to address labor shortages and where employment levels have probably been bolstered by labor hoarding. Simple labor hoarding, where companies hold on to more workers than necessary resulting in under-utilization of labour can manifest itself in various forms, such as reduced effort or hours worked, and the shift of labour to other uses, such as training. From the company’s point of view, some labour hoarding may be optimal given the fixed costs associated with adjusting staff numbers. These costs include costs of recruitment, screening and training of new workers, as well as costs related to the termination of contracts such as severance pay.

Figure 2; Employment Intentions Drop Despite Labor Shortages

Source: European Commission; aggregate computed by CE

Company Labor Demand Falling

Regardless, there are now signs that this is changing. Amid softer business survey data seen of late, particularly that compiled by the European Commission are clear(er) signs that company intentions to hire new workers has been falling (Figure 1) and this is evident construction, manufacturing and even services. Indeed, aggregate sector employment intentions are at a decade-low and well under the levels that preceded the pandemic. It could be argued that this may reflect companies needing fewer works having hoarded labor during the recent near recession (see above) a factor that may explain the weaker employment projections embedded in ECB forecasts (ie just 0.1% q/q out to 2026). But this does not seem to be the case given that the same surveys also suggest that companies are still reporting labor shortages as a key factor hindering output (Figure 2), admittedly less acutely of late. Instead, it seems more likely that diminishing confidence, demand and financial constraints may be affecting labor demand more. The old adage suggests there are two sides to every story; the EZ labor market is no exception!

Figure 3: Labor Supply on Firm Upward Trend

Source: Eurostat, Continuum Economics; millions, dashed lines are pre-COVID trends