EUR, JPY, AUD, GBP flows: General USD correction, AUD favoured

USD corrects lower as equities rally

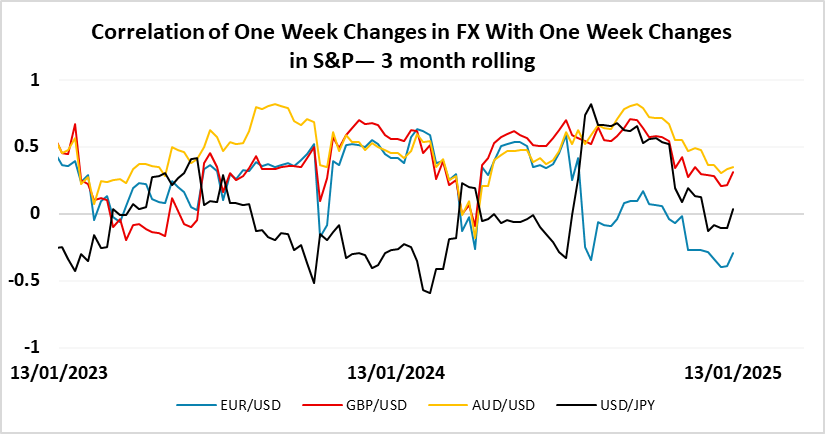

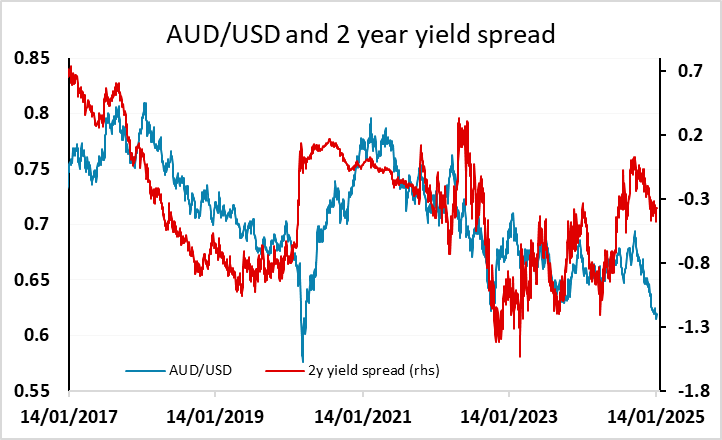

It’s a quiet European calendar this morning with not much other than the ZEW survey to look forward to. Overnight we have seen a USD and JPY dip as equity markets have rallied, with the antipodeans leading the way. The AUD continues to look to provide the best value, provided that equity markets hold up, with yield spreads remaining favourable. AUD/USD and GBP/USD both retain some positive correlation with equity markets, although this has diminished in recent months. There is less of a case for GBP to benefit from positive equity market performance as UK growth expectations are still weak and the current market hawkish take on BoE policy, with less than two 25bp rate cuts priced in this year, seems unlikely to persist.

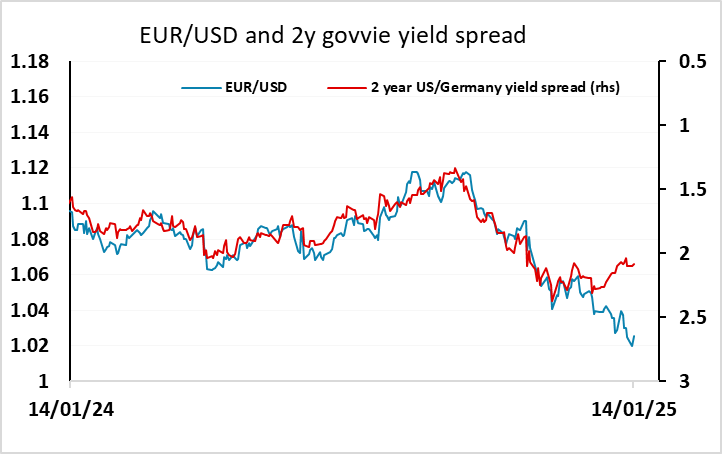

EUR/USD has lost its positive correlation with equities in recent months. The correlation has now turned negative. This change is to some extent to be expected due to the ECB rate cuts and the perception of weak growth in Europe. While EUR/USD still has potential to recover based on the recent underperformance relative to yield spreads, this itself may not last as the recent rise in front end EUR yields has little support from recent data or ECB policy comments. However, there is scope for a general USD correlation lower based on recent yield spread moves, and the EUR should hold its own against the JPY and GBP.