Preview: Due November 1 - U.S. October Employment (Non-Farm Payrolls) - Hurricanes and strike to deliver below trend month

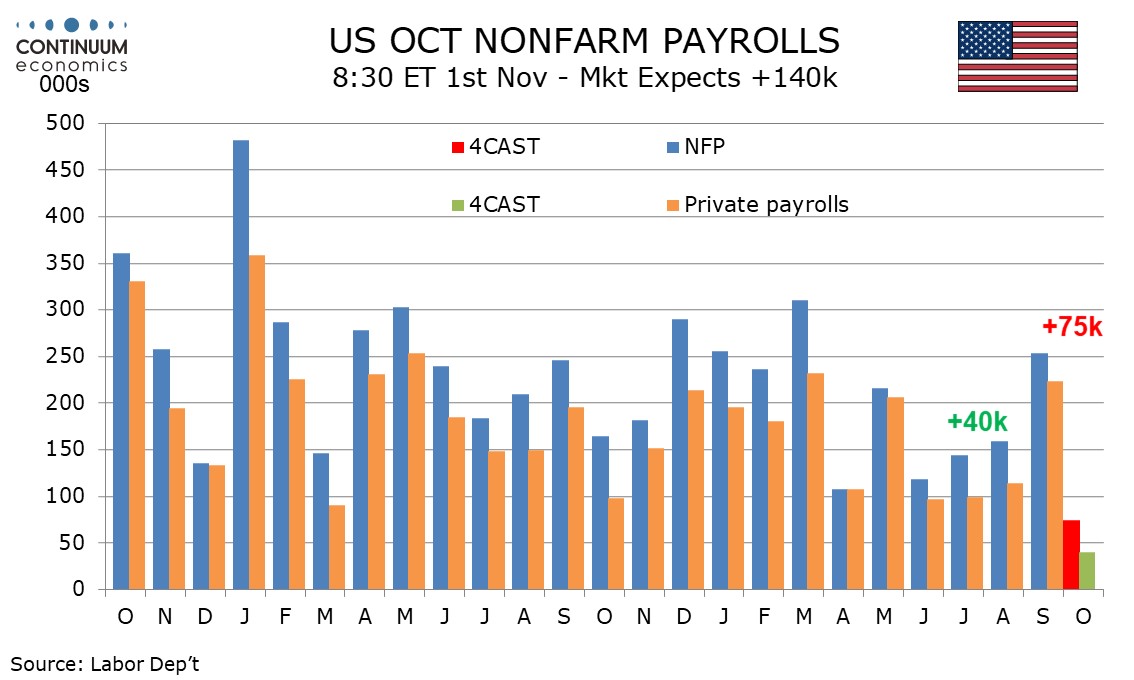

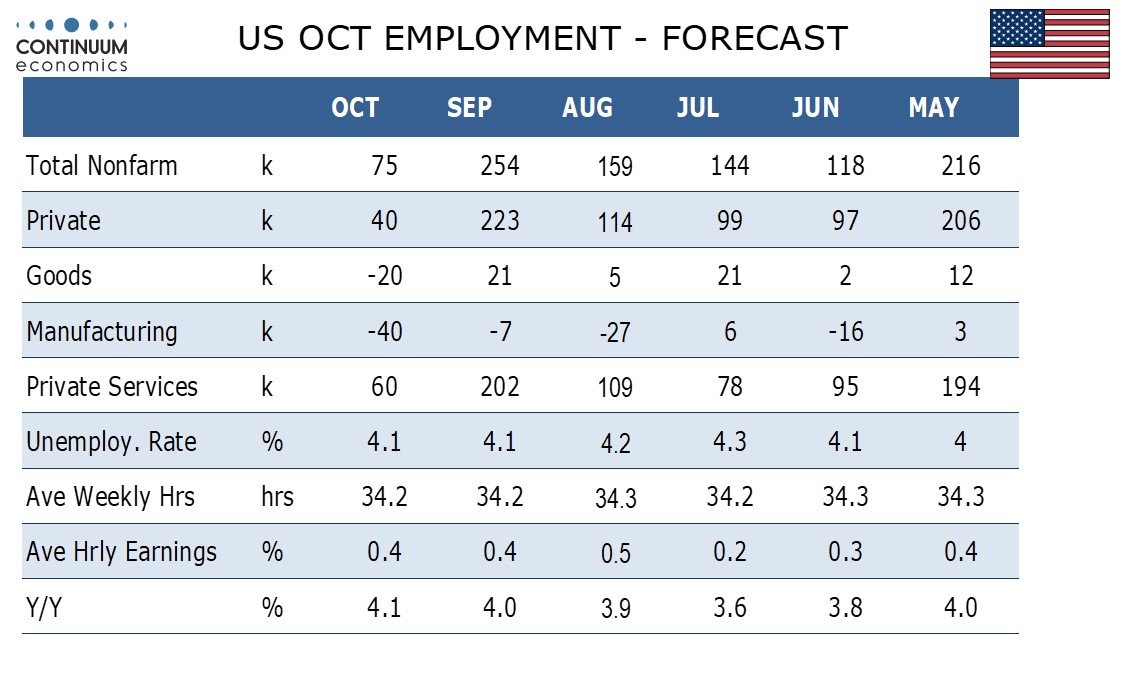

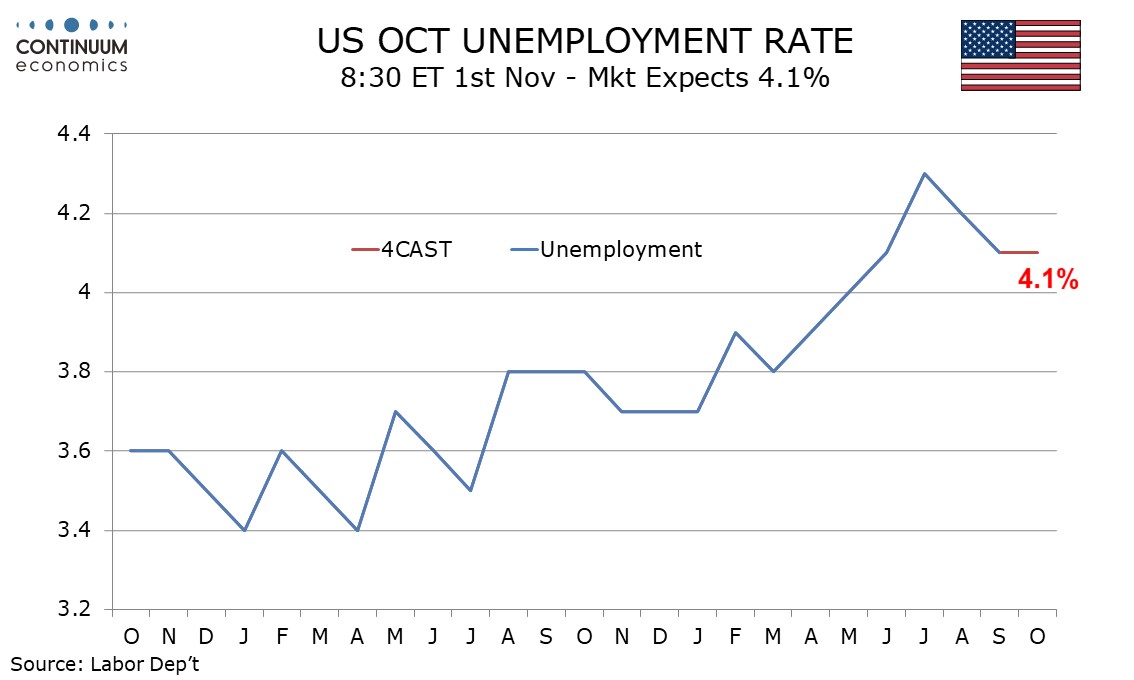

We expect a below trend 75k non-farm payroll increase in October, with only 40k in the private sector. This would follow above trend gains of 254k and 223k respectively in September, depressed by a strike at Boeing and Hurricanes Helene and Milton. While payrolls will be below trend, we expect unemployment to be unchanged at 4.1% and average hourly earnings to be on the firm side of trend with a rise of 0.4%.

Initial claims have moved higher after falling in September. September’s strong non-farm payroll was surveyed before the arrival of Hurricane Helene in late September while Hurricane Milton hit Florida in the October non-farm payroll survey week. This caused the largest evacuation in Florida since Hurricane Irma in September 2017, which followed Hurricane Harvey in late August of 2017. Hurricane Harvey caused severe flooding in Texas and Louisiana, and can be seen as comparable to the recent Hurricane Helene, where the flood damage was also severe, most notably in North Carolina.

The September 2017 non-farm payroll was originally reported as a 33k decline, but has since been revised to a 92k increase, still well below trend which was running around 170k at that time. Leisure and hospitality was particularly sharply below trend. We do not feel that there has been much change in underlying trend this month, but the hurricanes clearly provide downside risk, while a strike at Boeing is likely to explain most of what we expect will be a 40k decline in manufacturing.

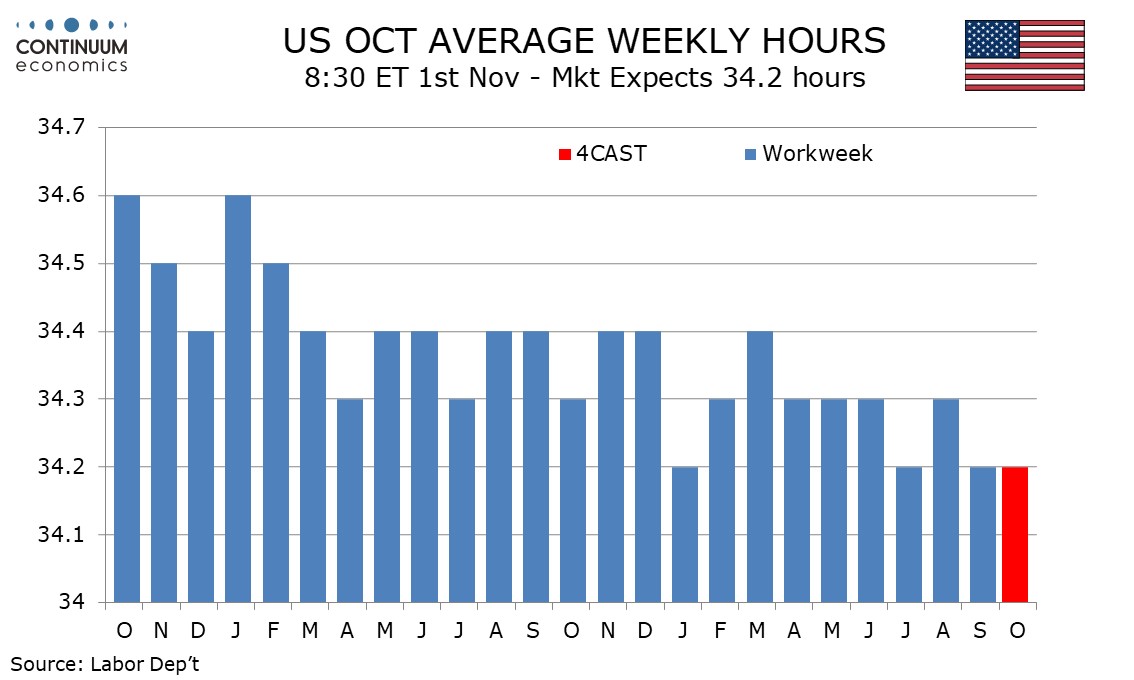

Adding to downside risk is the fact that September’s data was above trend, perhaps in part because seasonal adjustments are supportive in September. Seasonal adjustments are negative in October. If September saw fewer seasonal layoffs than usual October may see fewer seasonal hirings than usual, even without the likely impact of bad weather. Bad weather usually impacts the workweek, but with September’s workweek already below trend at 34.2 hours we look for no change in October, though a dip is more likely than a rise.

We expect the unemployment rate to be unchanged at 4.1%, with hurricane likely to restrain growth in the labor force as well as employment. September’s dip in unemployment saw the rate slip to 4.052% before rounding. If the household survey’s estimate of employment growth matches the 75k we expect from non-farm payrolls then the labor force would have to rise by more than 250k to see unemployment round up to 4.2%. We expect the labor force to rise by 150k, leaving the rate at 4.1%.

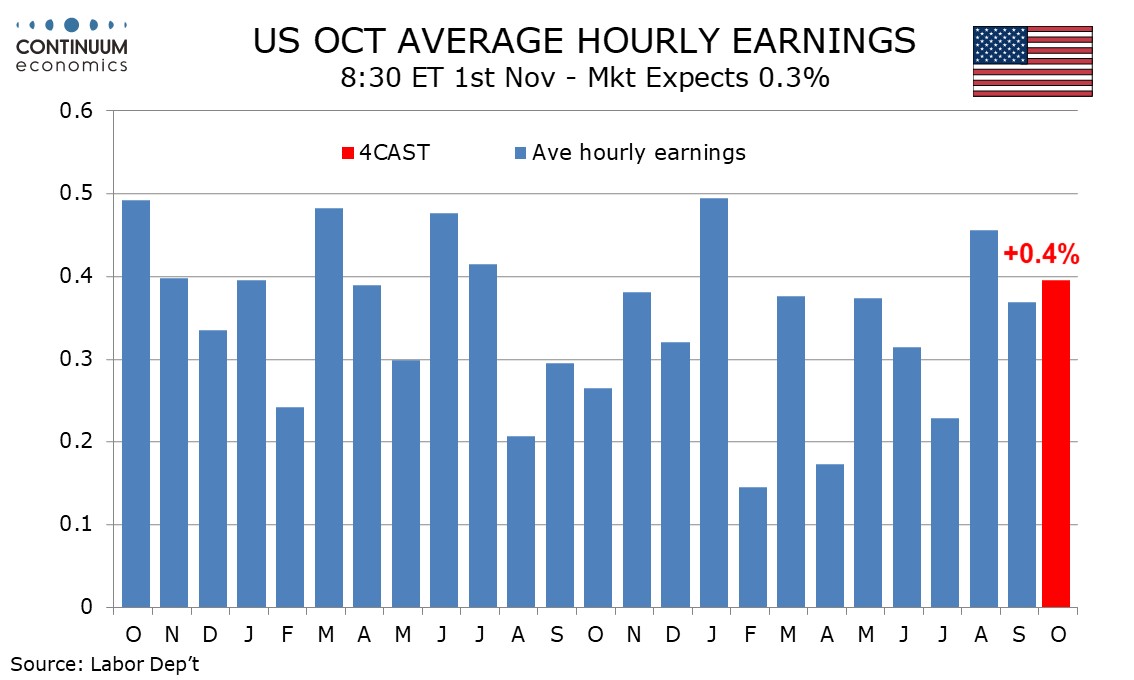

If employment growth is restrained by job loss concentrated in the low paying leisure and hospitality sector, this could bias average hourly earnings upwards, as could any weakness in the workweek. This leads us to expect a second straight 0.4% increase in average hourly earnings, on the firm side of trend, lifting yr/yr growth to a seven month high of 4.1%, from 4.0% in September.