FOMC Pauses With Risks Seen Diminished

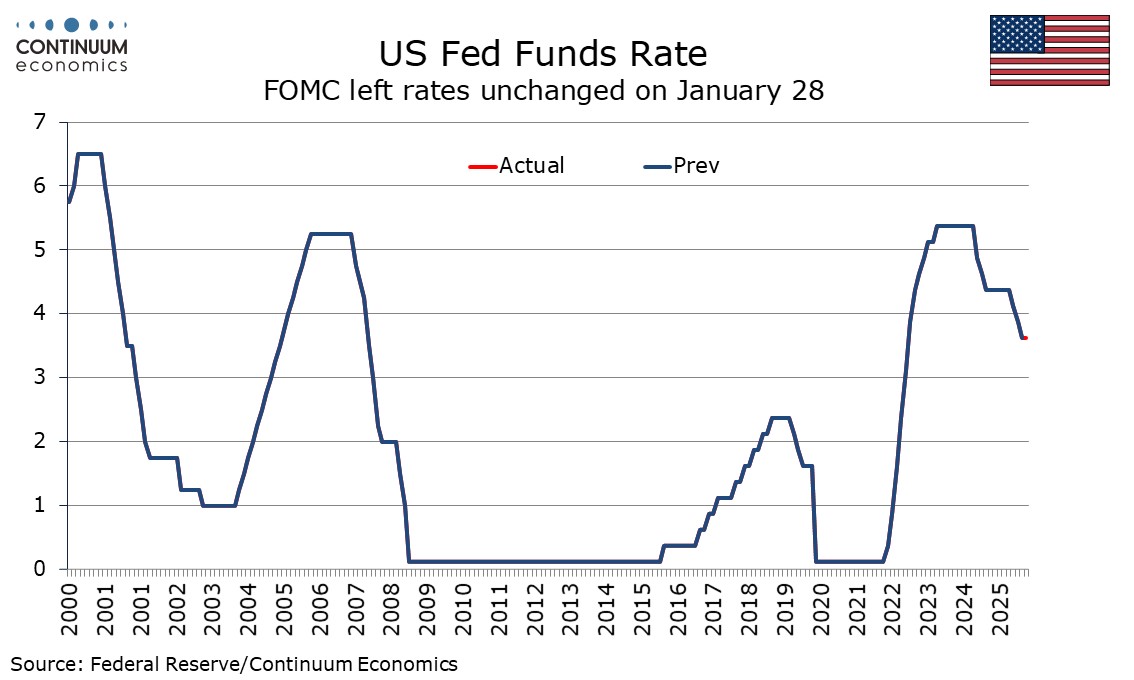

The FOMC has left rates unchanged at 3.5-3.75% as expected, with two dissents for a 25bps easing. The statement takes a slightly more optimistic view of the economy than the last one in December. We continue to expect two 25bps easings this year, coming in June and September.

Economic activity is now seen as expanding at a solid pace rather than a moderate one, reflecting an upside surprise in Q3 GDP. the release of which came after December’s meeting, as well as positive signals for Q4. The unemployment rate, previously seen as edging up, is now seen as showing signs of stabilization, and a reference to downside risks to the labor market having risen is removed. They do however state that job gains have remined low, rather than having slowed. On inflation, a reference to it having moved up since earlier in the year is removed but it is still described as somewhat elevated. The change is likely to reflect softer CPI outcomes in Q4 as well as the start of a new year.

A dovish dissent from Stephen Miran was to be expected and it is notable that this time he only called for 25bps, with his previous dissents having been for 50bps. A similar dissent from Christopher Waller was less expected but not a major surprise given that he had shifted in a dovish direction in 2025. What is notable is that while Waller did dissent Michelle Bowman did not. We had felt that Bowman had taken a somewhat more dovish stance than Waller in 2025. Both had been seen as contenders for Fed Chair. It may be that Waller is still in the running, but Bowman is not.

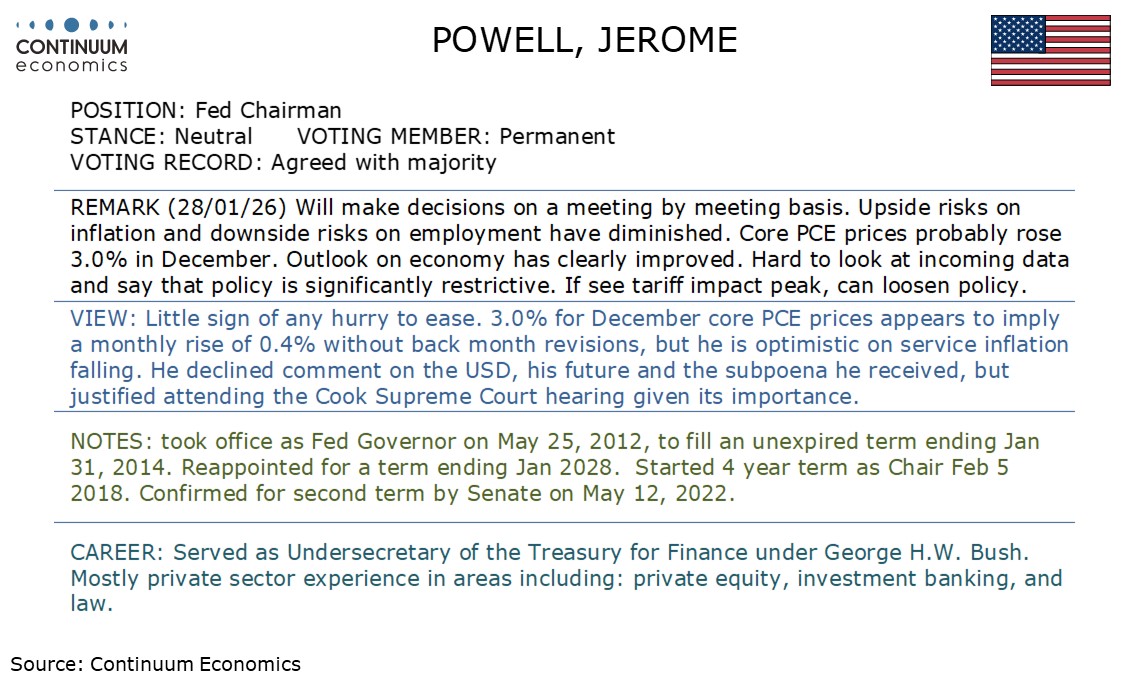

In his press conference Powell was unwilling to comment on the subpoena that was issued against him or whether he would remain on the FOMC once his term as Chair ends. However he did justify attending the Supreme Court hearing on the attempt to dismiss Governor Lisa Cook, given its importance. His remarks on the economy supported the more optimistic tone of the statement, noting that the economic outlook had clearly improved since December’s meeting and stating incoming data made it hard to make the case that policy was significantly restrictive. However he balanced that by suggesting that risks on inflation had also diminished, and that easing could be seen once the impact of tariffs on inflation peaks.

There are many uncertainties in the near term with the Fed probably wanting a good handle of Q1 data before it considers renewed easing. Factors to watch are a recent tendency for Q1 inflation data to be on the firm side as new year pricing decisions are made, and also the prospect of fiscal support from tax refunds. Employment and CPI data for January and February are scheduled before next meeting on March 18 so easing then cannot be ruled out, but it will have to be clearly soft to prompt a move. If the government enters another shutdown starting at the end of this week, which is a significant risk, CPI and employment data would again face delays, further diminishing the chances of a March easing. We are still confirmable with a view that the Fed will ease twice this year, in June and September, taking the target range to a near neutral 3.0-3.25%. A Powell comment that the tariff impact will drop out of inflation in mid-2026 is consistent with that.