CBRT Keeps Its End-Year Inflation Forecast Unchanged at 38%

Bottom Line: Central Bank of Turkiye (CBRT) released its third quarterly inflation report of the year on August 8, and did not change its inflation forecasts and policy guidance. CBRT projects that inflation will fall to 38% at the end of 2024, and kept its forecasts for 2025 and 2026 unchanged at 14% and 9%, respectively, emphasizing that the disinflation process has started. We envisage CPI to cool off to 50%’s in August on base effects coupled with tightened monetary and fiscal policies, additional macro prudential measures, and relative TRY stability while our forecasts for the annual average inflation remain at 58.8% and 35.3% in 2024 and 2025, respectively.

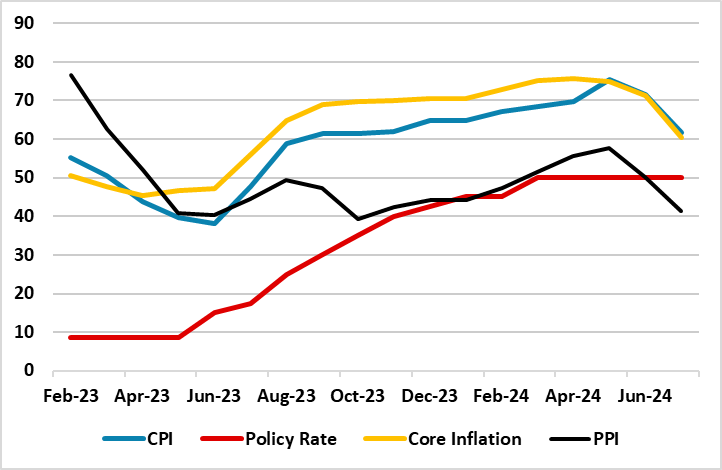

Figure 1: CPI, PPI, Core Inflation (YoY, % Change) and Policy Rate (%), February 2023 – July 2024

Source: Continuum Economics

CBRT released the third quarterly inflation report of the year on August 8, and held its year-end inflation forecast unchanged at 38%. CBRT’s forecast for end-2025 is still at 14%, while inflation is seen falling to 9% by the end of 2026.

According to third quarterly inflation report, inflation saw a temporary increase in July due to transient effects, while the underlying trend indicates a slow but steady disinflation process. (Note: After easing to 71.6% annually and 1.6% monthly in June, down from 75.5% in May, CPI cooled further down to 61.8% y/y in July backed by favourable base effects). The CBRT sees a slowdown in domestic demand in the third quarter in addition to the decrease in the current account deficit and an improvement in external trade, said the report. The report highlighted that the slowdown in credit growth has become more pronounced as a result of monetary policy decisions and other steps supporting the monetary tightening process while the decline in inflation expectations was less than anticipated.

Speaking about the course of inflation, CBRT Governor Karahan stated at the press conference on August 8 that "As we approach the year's end, the forecast range corresponding to 2024 should have narrowed down mechanically. However, given the mounting uncertainties amid recent geopolitical developments and global financial volatility, we kept the forecast range between 34% and 42%."

According to a survey by the CBRT released on July 22, annual inflation rate is projected to drop to 42.95% by the end of 2024, down from the earlier estimate that stood at 43.52%. Our forecast for the annual average inflation remain 58.8% and 35.3% in 2024 and 2025, respectively.

We are of the view that there are signs that inflation will continue to stay high in Q3/Q4. Despite aggressive monetary tightening, lagged impacts of the tightening cycle are still feeding through and we still see upside risks to the inflation outlook such as recent hikes in taxes along with 38% surge in electricity and natural gas prices, and 25% hike in minimum monthly pension in July. We think hikes in administrative prices, geopolitical risks, stickiness in services inflation, and deterioration in pricing behaviour continue to pressurize general level of prices.

Despite CBRT’s aggressive monetary tightening, we still think the road to bringing inflation back down to single-digit levels will be very bumpy, and the inflation getting there before 2027 remains unlikely, as opposed to what CBRT indicated in its third quarterly inflation report.